Is now the time to shift to Ethereum?

- Ethereum setting for a reversal on its BTC and USD pairs

- Market sentiment for ETH shifted to bullish too

Ethereum (ETH), second solely to Bitcoin (BTC) by market cap, continues its battle for dominance in opposition to BTC. Regardless of challenges in latest value motion, ETH’s scalability stays a key driver of its development.

On the time of writing, on the every day chart, ETH/BTC fashioned a Double Backside, often, a reversal sample. This instructed that ETH could quickly dominate the crypto markets.

Moreover, the ETH/USD chart highlighted a symmetrical triangle with a double backside on its decrease trendline, reinforcing a possible shift in market sentiment favoring Ethereum.

Supply: X

These alerts, collectively, counsel that now could be the best time to contemplate shifting focus in direction of Ethereum. This, in anticipation of a potential hike in its dominance. Well-liked analyst Michael van de Poppe additionally noted the identical on X,

“In principle, there’s one large bearish divergence on the Bitcoin dominance. This ought to be keen to interrupt downwards, wherein ETH carries the markets. I’ve not been this excited in regards to the markets for a very long time.”

Furthermore, the Supertrend indicator has been holding sturdy too, signaling a shopping for alternative. ETH’s on-balance quantity (OBV) steadily elevated not too long ago, additional supporting this potential shift.

Regardless of bearish sentiments throughout the market, these technical alerts have been exhibiting energy for Ethereum. Merely put, a shift in direction of ETH dominance could possibly be imminent quickly.

Supply: TradingView

A mixture of the indications, with the general market setup, instructed that Ethereum will cleared the path for altcoin season.

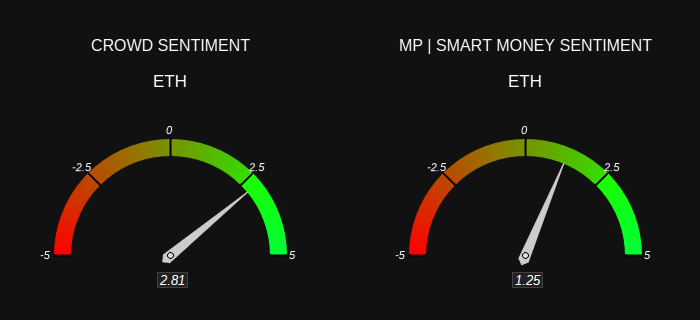

ETH sentiment and curiosity

Market sentiment can also be shifting now, with optimism constructing round ETH. The group is rising more and more optimistic too, aligning with the views of Sensible Cash, which instructed that ETH could possibly be set for a bullish breakout.

This shared optimism can strengthen the chance of ETH taking up the market, particularly after a protracted interval of Bitcoin’s dominance which has rejected off the 60% stage. Proper now, BTC’s dominance is across the 57% stage.

Supply: Market Prophit

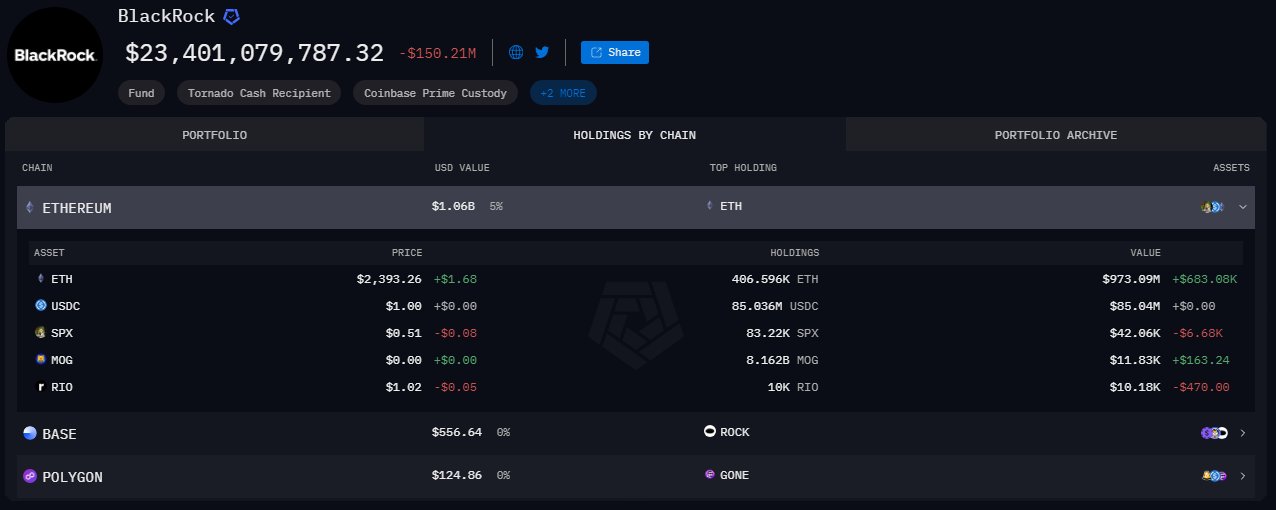

Institutional curiosity in Ethereum can also be rising quickly. In truth, Arkham’s knowledge revealed that Blackrock’s ETH holdings are nearing a $1 billion valuation, underscoring vital institutional confidence in ETH.

This fast accumulation by main monetary establishments additional validated the concept a shift to Ethereum could possibly be on the horizon.

Supply: Arkham

With this stage of institutional backing, mixed with optimistic market sentiment and technical indicators, Ethereum could also be poised for potential increased costs. Particularly because it goals to take over market management from Bitcoin.