Is PEPE’s consolidation an early sign of an October-style 100%+ breakout rally?

- PEPE’s October rally stays one among its most notable worth actions, representing a 227% hike in worth

- To find out if PEPE is positioned for the same rally, its present technical setup is value analyzing

In a latest market commentary, analysts hinted at the potential of a 100% upside in Pepe [PEPE], drawing parallels with its October breakout sample.

Notably, 2024 marked a breakout 12 months for the memecoin, after it posted exceptional 1,435% year-over-year features – Surging from its New 12 months opening worth of $0.0000013. By doing so, it closed the 12 months with exponential returns.

At press time, nonetheless, PEPE was buying and selling 61% under its Q1 2025 opening, reflecting broader market corrections. Nonetheless, its present 1-day chart construction carefully mirrors the late October consolidation vary, characterised by compressed worth motion.

Traditionally, this sample has preceded a pointy breakout, with the identical seeing PEPE skyrocket by 227%, peaking at $0.00002597 on 14 November.

Because of this, speculations are swirling round whether or not the memecoin may very well be prepared for the same breakout within the close to time period. A repeat rally, maybe?

Supply: TradingView (PEPE/USDT)

Breakdown of PEPE’s elementary setup

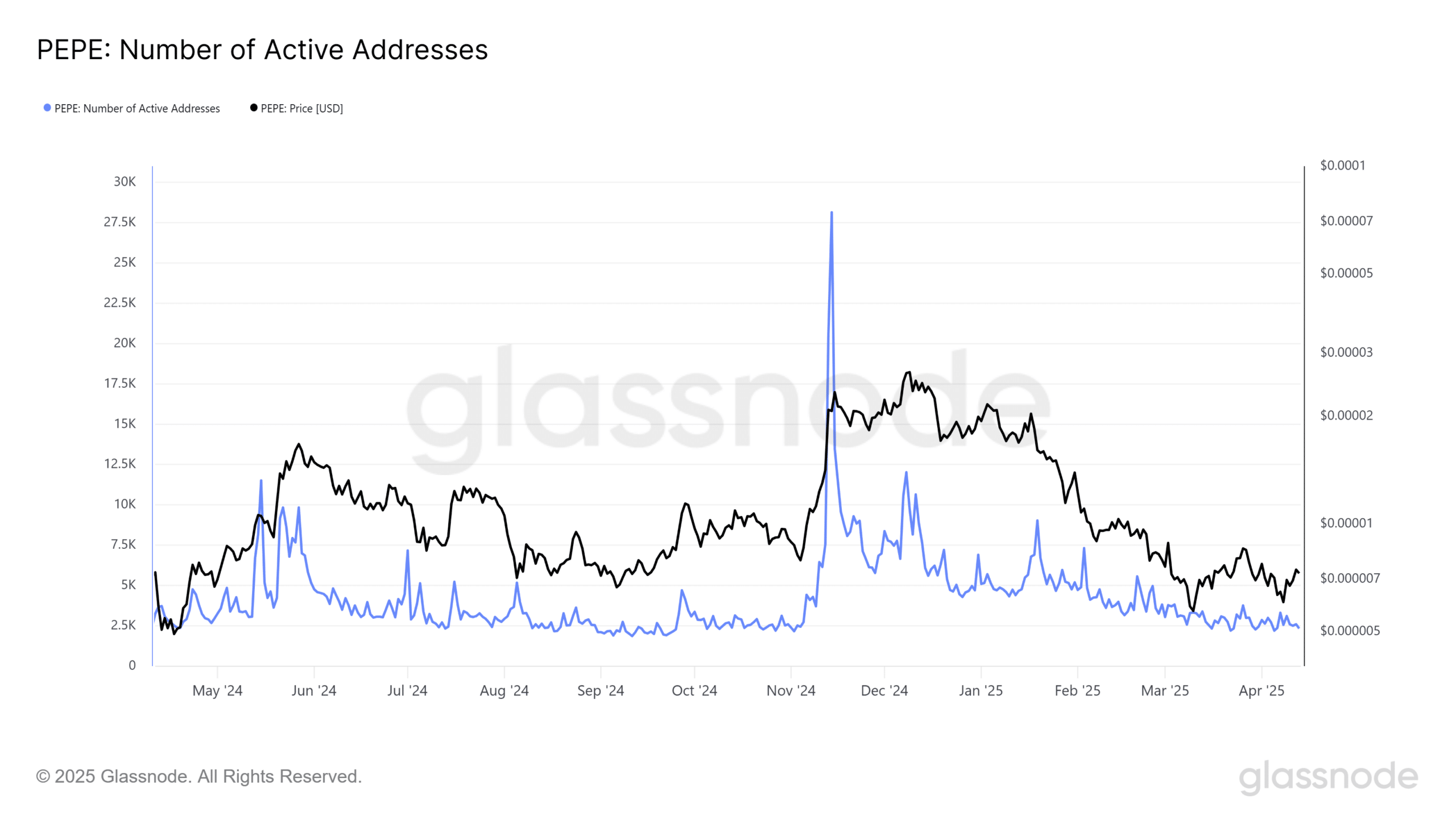

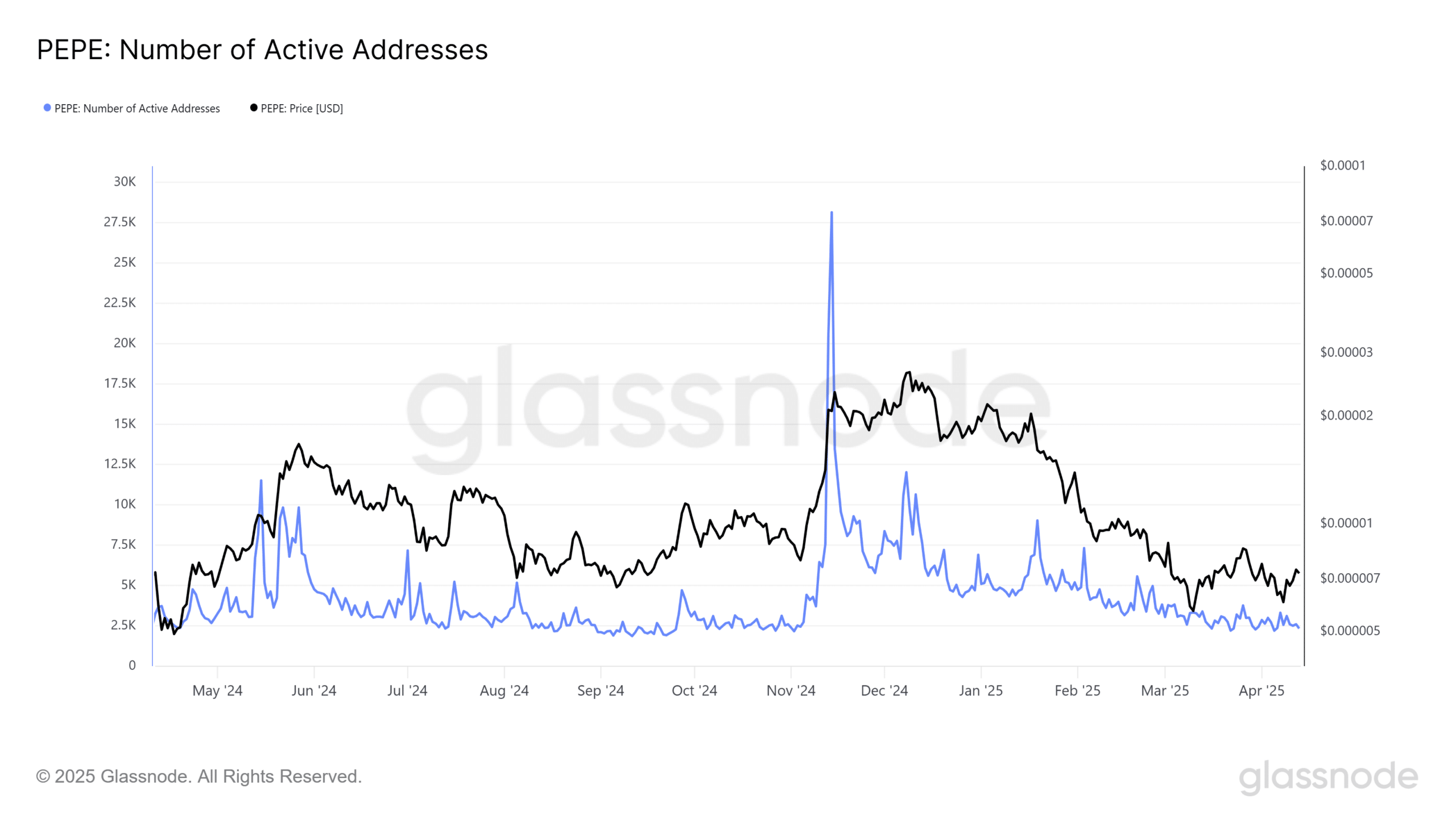

Apparently, energetic addresses on the PEPE community averaged 2,500 previous to a major surge to twenty,500 in mid-November, aligning with the token’s parabolic worth motion.

Traditionally, such an uptick in on-chain exercise has been a number one indicator of bullish momentum.

Nevertheless, present community metrics stay comparatively flat, with energetic addresses at 2,587 – Mirroring earlier consolidation phases earlier than breakout occasions.

In different phrases, this might imply an identical accumulation sample that preceded a major worth shift beforehand. .

Supply: Glassnode

Regardless of the shortage of concrete affirmation, PEPE’s speculative rally potential is perhaps a double-edged sword. Notably when contemplating spinoff market information.

As an illustration – Coinglass data indicated that regardless of muted on-chain exercise and a scarcity of clear accumulation indicators in spot market quantity, Open Curiosity (OI) on PEPE Futures has risen sharply.

In actual fact, it surpassed November’s ranges with a close to 5% uptick, with the identical pegged at $301.48 million at press time.

Consequently, PEPE’s 20% weekly features could also be vulnerable to triggering liquidation cascades, particularly on lengthy positions, because of the absence of dip-buying assist. This may put short-sellers in management, highlighting the necessity for cautious threat administration.

Whereas historic patterns appeared to trace at a possible breakout, the crypto market depends on onerous information, not coincidences. PEPE’s features have been pushed by leveraged liquidity somewhat than natural shopping for, making this rally susceptible to a pointy reversal.