Is Solana the next Ethereum? A Swiss crypto bank says ‘Yes!’

- Solana and Ethereum have each held vital milestones whereas fostering a aggressive rivalry

- Nevertheless, a current occasion might exacerbate tensions between the 2

In its month-to-month report, Swiss crypto financial institution Sygnum highlighted Solana [SOL] as Ethereum’s [ETH] most important challenger within the finance sector and a viable different for quite a few rollouts and growth breakthroughs.

Sometimes called an “Ethereum killer,” Solana has steadily gained traction by leveraging Ethereum’s weaknesses to determine a aggressive edge.

Nevertheless, a big market cap hole exists – round $218 billion – as Ether continues to outpace Solana. And but, Solana’s value ratio to Ether has surged 300% year-on-year. What contributed to the surge?

Solana’s sturdy foothold within the finance sector

Two years in the past, an identical rivalry between SOL and ETH emerged when Solana partnered with Visa. On the time, SOL was built-in for USD Coin settlements, touting its excessive throughput and low prices.

Not too long ago, the upside was additional bolstered by asset supervisor Franklin Templeton’s announcement to launch a mutual fund on Solana.

Solana’s rising resourcefulness within the monetary sector has led the Swiss financial institution to acknowledge the blockchain as a “critical challenger” to Ethereum in the long term.

Whereas there’s no clear timeline for when this shift would possibly happen, Solana is undeniably closing the hole with Ethereum throughout numerous metrics.

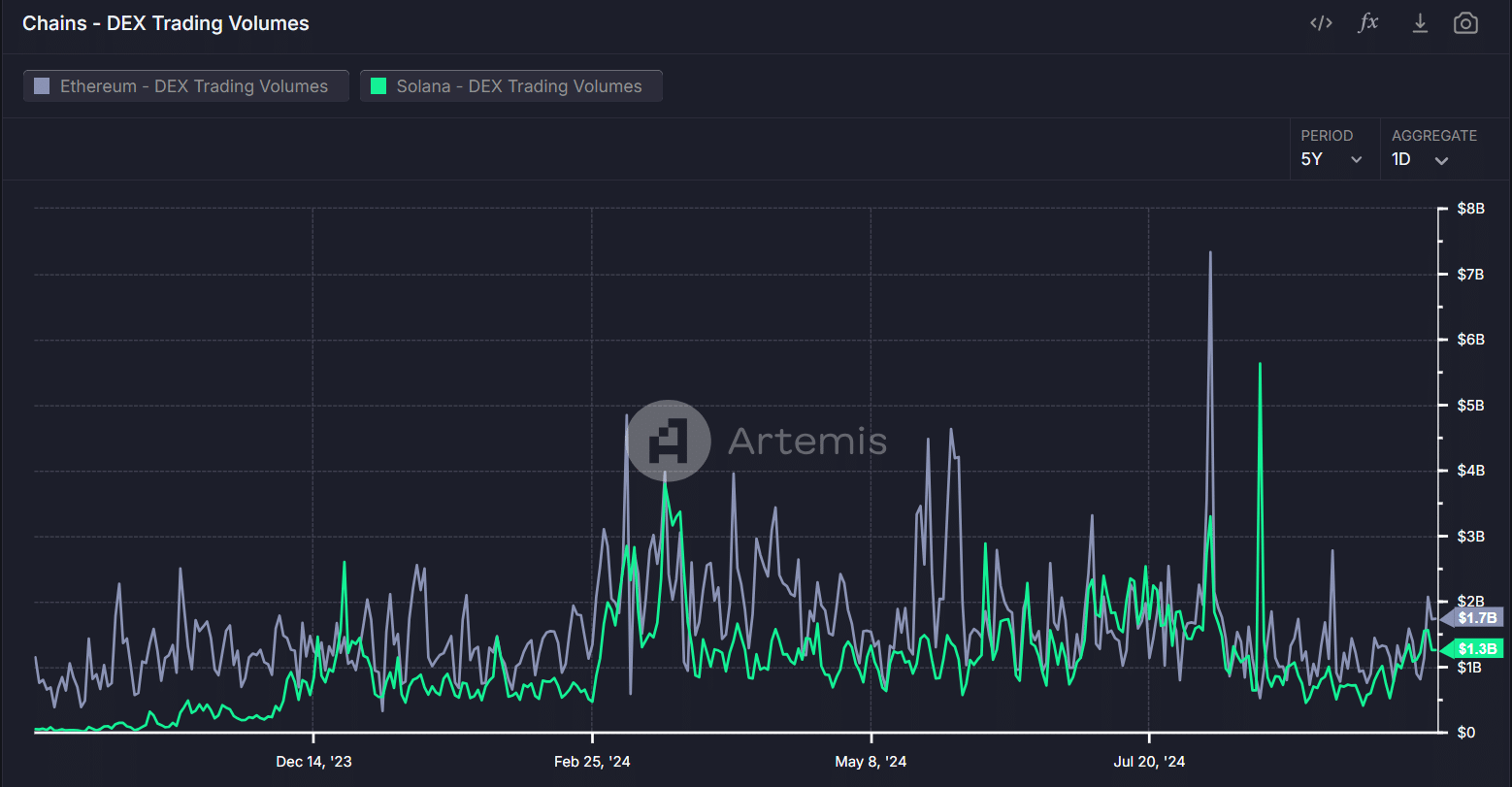

For starters, Ethereum’s DEX quantity had dropped from $2 billion in August to $1.7 billion at press time. Quite the opposite, Solana’s DEX quantity has remained secure, even enhancing over the identical interval.

Supply : Artemis Terminal

In brief, partnerships with main monetary establishments, resembling Visa, have enhanced Solana’s visibility, doubtlessly drawing in new buyers and difficult Ethereum’s dominance.

Past these collaborations, the continuing comparisons between Solana and Ethereum are supported by a well-crafted technique. One that’s geared toward overtaking the five-year-older Ethereum blockchain.

Solana capitalizes on Ethereum’s shortcomings

Solana’s structure helps excessive throughput and low transaction charges, making it engaging for customers and builders alike.

In distinction, Ethereum faces challenges with excessive fuel prices, which may deter customers from participating with its community.

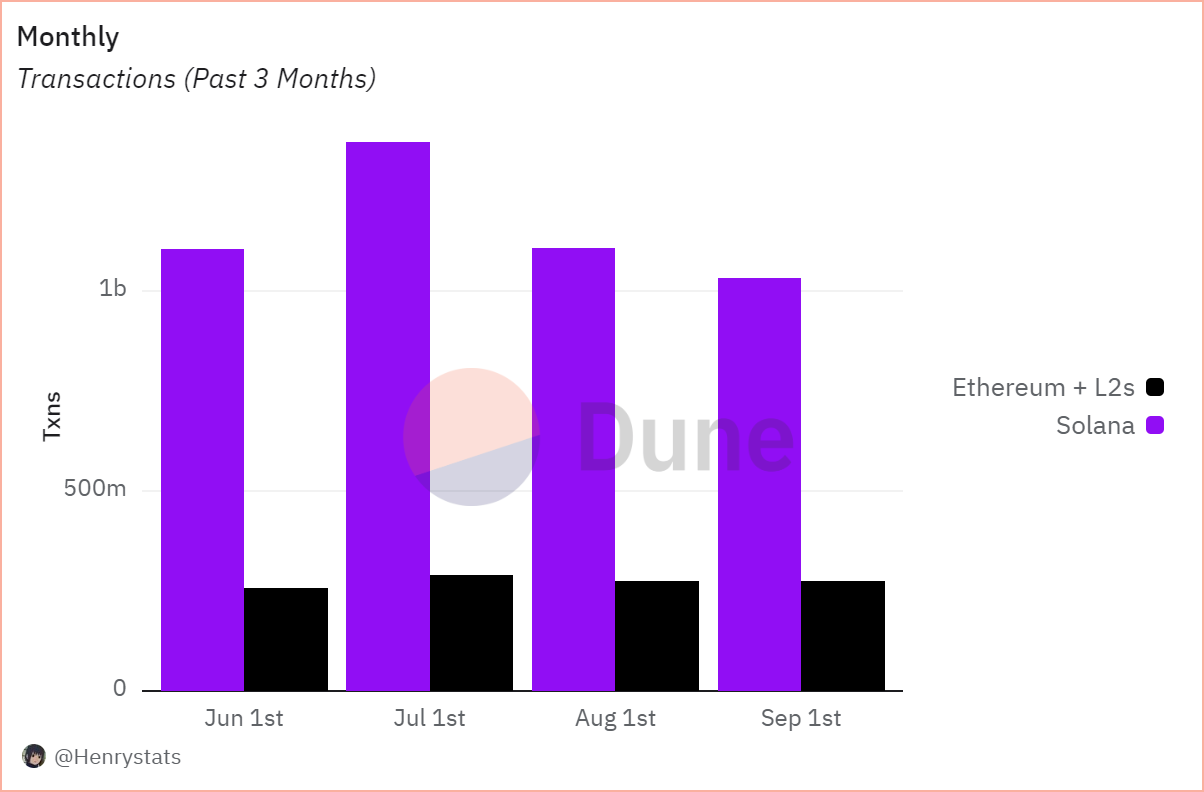

Supply : Dune

The impression of this disparity is obvious within the chart above. Month-to-month transactions on Solana have surpassed 1 billion, whereas Ethereum is experiencing low community exercise with solely 200 million in transactional quantity.

Clearly, excessive fuel charges on Ethereum have pushed customers to Solana for quicker transactions at decrease prices.

Learn Solana’s [SOL] Worth Prediction 2024–2025

In essence, Solana has achieved vital traction in simply 4 years since its launch. Nevertheless, whereas there are areas the place SOL excels, Ethereum stays dominant in others.

Total, for Solana to really rival Ethereum, it should develop revolutionary decentralized functions that promote widespread adoption – An space the place Ethereum at the moment guidelines.