Is the Bitcoin bull market finally here?

- BTC’s Web Unrealized Revenue and Loss metric confirmed the continuing bullish rally.

- At its present worth, BTC is likely to be overvalued and would possibly expertise a pullback.

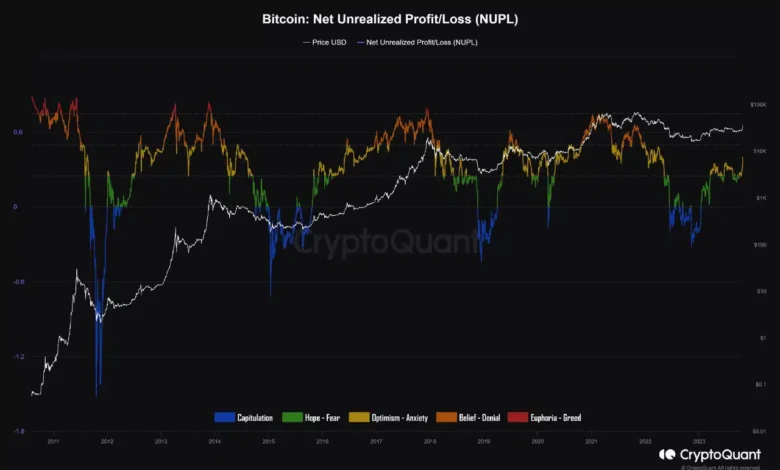

Bitcoin’s [BTC] Web Unrealized Revenue and Loss (NUPL) has reached its Optimistic section, indicating that the prevailing sentiment is extra bullish, pseudonymous CryptoQuant analyst Gaah famous in a current report.

Learn BTC’s Worth Prediction 2023-24

BTC’s NUPL metric capabilities as an excellent gauge of market sentiment because it measures the general profitability of coin holders. When the NUPL worth is above zero, it signifies that BTC holders are in revenue. Conversely, a worth under zero signifies that almost all holders are at a loss.

At 0.399 at press time, the main coin’s NUPL rallied above the zero line on 15 October, when BTC started its uptrend. Since then, the coin’s worth has elevated by 31%, information from CoinMarketCap confirmed.

With rising bullish sentiments, Gaah famous:

“The indicator is now approaching 0.5+ (Perception – Denial Section [Orange]), a degree that has traditionally indicated market tops.”

Supply: CryptoQuant

The analyst added that euphoria would possibly set in as soon as the U.S. Securities and Change Fee (SEC) approves BTC spot exchange-traded funds (ETFs). “If this occurs later this yr, the value might hit its final historic excessive once more,” Gaah opined.

The coin’s final historic excessive was $68,789.63, which was reached on 10 November 2021.

A retracement in sight?

At press time, the main crypto exchanged arms at $34,063. Worth actions assessed on a day by day chart hinted at the potential of a slight retracement within the coming days.

Firstly, the coin’s key momentum indicators have been positioned at overbought highs at press time. Its Relative Power Index (RSI) and Cash Move Index (MFI), which observe the coin’s buying and selling momentum, have been 82.63 and 84.36, respectively, as of this writing.

At these values, there’s a excessive chance of a pullback or reversal within the close to future. Moreso, an evaluation of the Spent Output Revenue Ratio for each brief and long-term BTC holders revealed that each cohorts of traders at the moment maintain at a revenue. They could turn out to be incentivized to promote their holdings to money in these earnings. This would possibly end in a worth downside.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

Likewise, BTC’s worth sat above the higher band of its Bollinger Bands indicator at press time.

When an asset’s worth trades on this method, it signifies that the asset is buying and selling above its common worth and that volatility is excessive. It typically alerts that the coin is overvalued and {that a} pullback is probably going.

Supply: BTC/USDT on TradingView