Is the crypto market running out of Bitcoin? What you should know

- Bitcoin’s alternate reserve dropped progressively throughout February.

- The variety of whale entities elevated by almost 4% over the previous month.

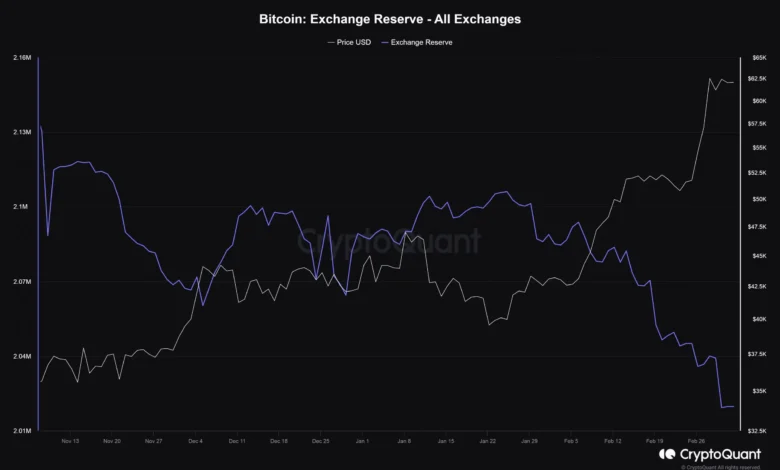

Almost 50,000 Bitcoins [BTC] have been withdrawn from centralized exchanges all through February, inflicting a pointy dip on the planet’s largest cryptocurrency’s “that can be purchased” provide.

As analyzed by AMBCrypto utilizing CryptoQuant’s knowledge, Bitcoin’s alternate reserve dropped progressively through the month, at the same time as its market worth spiked by 44% on the similar time.

Supply: CryptoQuant

Why this can be a bullish sign

Usually, a drop in alternate provide implies lowered promoting stress and a potential shift in direction of different actions, like changing into long-term holders.

Moreover, as extra Bitcoins have been gathered and locked away in self-custodial and chilly wallets, it created a shortage out there. As per the supply-demand dynamics, this was a significant bullish sign.

Bitcoin whales rise in quantity

One other important reflection of the broader hoarding mentality was the sharp enhance within the variety of institutional traders, additionally known as whales of the crypto market.

The variety of distinctive entities holding at the very least 1k Bitcoins elevated by 55 throughout February. This represented a virtually 4% bounce over the earlier month.

Supply: Glassnode

The launch of a number of exchange-traded funds (ETFs) tied to the spot worth of Bitcoin opened the gates of the crypto marketplace for TradFi traders within the U.S.

The sport-changing occasion led to bullish forecasts, with one analysis pegging Bitcoin to develop to $100,000 by the year-end, and near $200,000 by the tip of 2025.

It was possible that whale traders have been motivated by these optimistic predictions to stockpile Bitcoins.

The place is BTC headed to?

Over the past week, Bitcoin rallied as excessive as $64k. This raised hopes of an inevitable restoration to its all-time excessive (ATH). Revenue-taking pulled the king coin to $61.8k as of this writing.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Nonetheless, the asset was nonetheless about 20% larger on a weekly foundation, in accordance with CoinMarketCap.

The market was in a state of “Excessive Greed” as per the most recent studying of Bitcoin’s Concern and Greed Index. This recommended a good diploma of FOMO amongst market individuals, resulting in upsides within the days forward.

Supply: Bitcoin Concern and Greed Index