Is the Santa Claus rally already over? Here’s what it means for your crypto investments

- The market noticed important declines up to now week.

- There’s nonetheless time within the yr for the market to push for one final rally.

The Santa Claus rally, a seasonal market pattern the place costs traditionally rise within the final week of December, has develop into a sizzling matter within the crypto world.

As we method the top of 2024, crypto traders are questioning whether or not this rally has already fizzled out or if it nonetheless has the potential to drive markets greater.

Present market overview

Bitcoin [BTC], the market chief, is at the moment buying and selling at roughly $95,00, reflecting a lower than 1% improve up to now 24 hours.

Ethereum [ETH] follows swimsuit with a lower than 1% improve, priced round $3,291. Solana [SOL] and Binance Coin [BNB] are additionally exhibiting slight good points, with the general crypto market capitalization hovering close to $3.5 trillion.

Regardless of the minor pullback, buying and selling volumes stay sturdy. Bitcoin’s dominance, now at 55.08%, underscores its pivotal position throughout this seasonal interval.

Supply: Coinglass

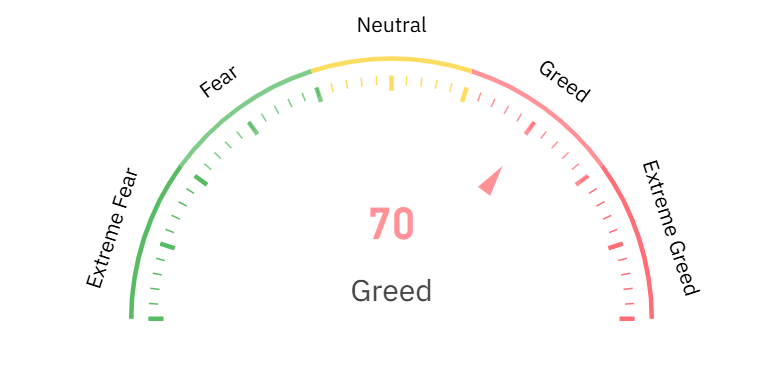

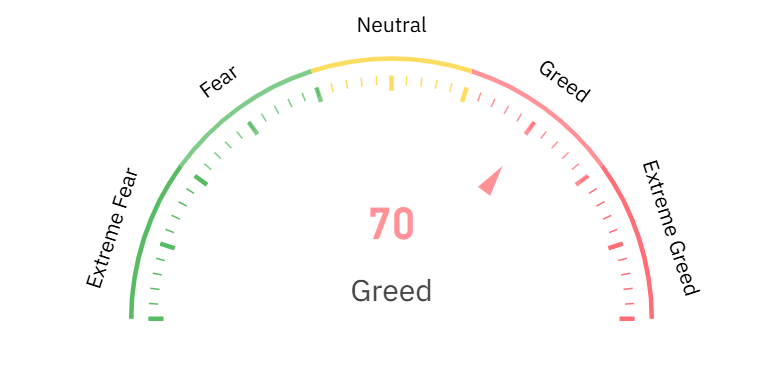

Moreover, the Concern & Greed Index, at the moment at 70 (Greed), suggests market sentiment stays bullish, albeit cautiously.

Has the Santa Claus rally misplaced steam?

The Santa Claus rally has traditionally been linked to bullish sentiment, tax-driven shopping for, and elevated retail participation. Nevertheless, current occasions have launched volatility, together with the expiration of over $2.6 billion in Bitcoin and Ethereum choices.

This options expiry typically creates worth swings as merchants alter their positions.

On-chain knowledge reveals blended alerts. Whale exercise has slowed, with fewer giant transactions recorded, whereas retail traders proceed accumulating.

In the meantime, technical indicators just like the Relative Energy Index (RSI) for BTC and ETH hover close to impartial ranges, suggesting a scarcity of clear directional momentum.

What this implies for traders

The rally’s efficiency within the coming days will largely rely upon key resistance ranges. Bitcoin faces a psychological barrier at $100,000, whereas Ethereum must reclaim $3,500 to regain bullish momentum.

Bollinger Bands point out diminished volatility, however any breakout could possibly be important.

For these navigating the present market, danger administration is essential. Traders ought to look ahead to momentum shifts, significantly within the MACD and RSI, whereas monitoring macroeconomic tendencies and regulatory updates that will impression sentiment.

Whereas the Santa Claus rally hasn’t delivered explosive good points, its potential isn’t fully diminished. The following week shall be pivotal because the market transitions into 2025.

Staying knowledgeable and adapting to market situations shall be key for crypto traders seeking to capitalize on year-end alternatives.