Is this Bitcoin bull run different? Key indicators say…

- Bitcoin is anticipated to rally massively after the summer time’s halving occasion.

- Some anomalies recommend that this time could be vastly totally different.

Bitcoin [BTC] has been in a robust uptrend since late October 2023. Whereas this was evident from the worth motion, it’s unclear what would possibly comply with. AMBCrypto used a CryptoQuant Insights publish to grasp what the dynamics of this cycle may very well be.

There was a pertinent however uncomfortable query about whether or not the Bitcoin bull run was totally different this time. There may be an argument to be made that it was totally different, however ought to buyers be involved?

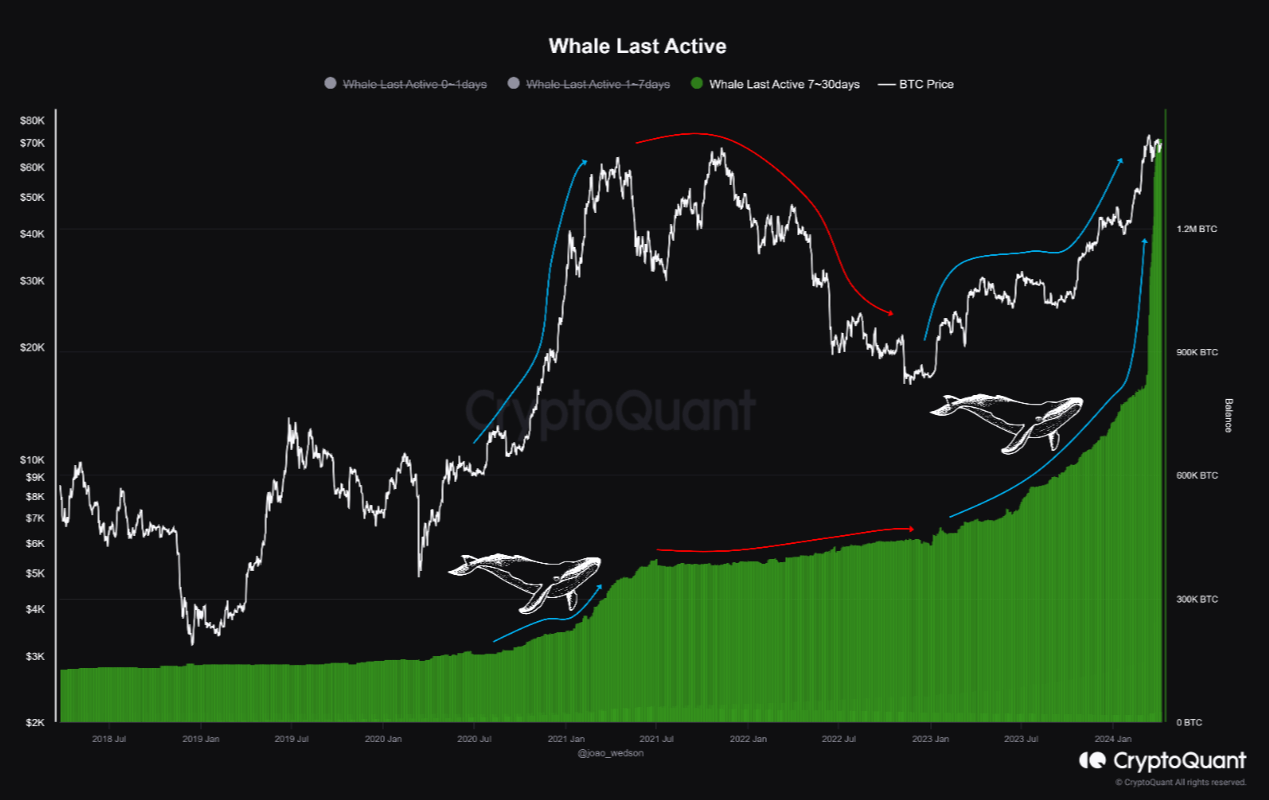

Has the present bull run been in place since March 2023?

Supply: CryptoQuant Insights

CryptoQuant person joaowedson identified that the Whale Final Energetic 7-30 days indicator started to development upward since March 2023. Through the earlier bull run, the rise in whale exercise in mid-2020 was accompanied by a fast Bitcoin rally.

The same scenario performed out over the previous 6-8 months when the indicator started pushing noticeably increased.

Alongside the worth motion, the whale indicator was one other signal that the present uptrend was a long-term bull run that started at $30k.

Inspecting miner conduct

The halving occasion is the speak of the city (after Bitcoin ETFs and their absurd inflows) and the miners have been at its crux. Their block rewards would drop from 6.25 BTC to three.125 BTC, which might drive lots of them to close up store if they’ll’t maintain until BTC costs climb increased.

An alternate is {that a} drop within the community hash charge and falling issue might ensue- however this was extraordinarily unlikely to happen.

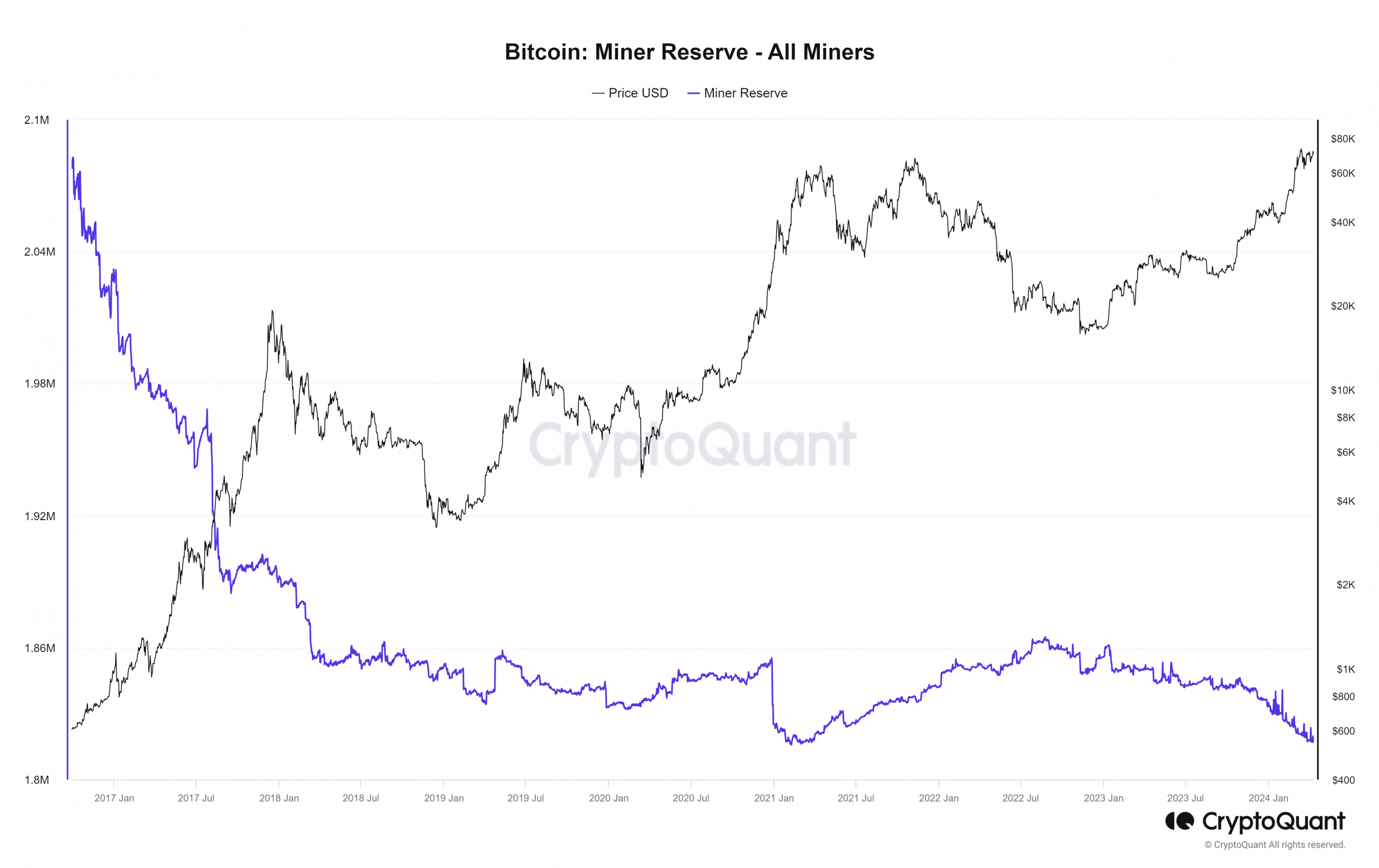

Supply: CryptoQuant

The miner reserve chart from CryptoQuant confirmed a decline since November 2023. Prior to now two cycles, a noticeable decline within the BTC miner reserve got here hand in hand with a bull run.

Therefore, it was one other metric which corroborated the concept that Bitcoin has begun to development increased properly prematurely of the halving occasion. Bitcoin additionally made an ATH earlier than the halving, which hasn’t occurred within the earlier cycles.

The significance of miners’ Bitcoin transactions was additionally one thing that has dwindled with successive cycles. This development was prone to proceed because the whales and institutional buyers turned the dominant gamers.

In that case, the halving occasion would possibly change into a “promote the information” kind of occasion.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

For the reason that whale exercise and miner reserve metrics, mixed with the worth motion, help the concept of an current bull run, the query of “when will the cycle finish” comes about.

Earlier cycle tops got here at 526 and 547 days after the halving occasion. Might this run’s size be severely curtailed as a result of we now have already been working over the previous 6-8 months? Solely time will inform.