Ramp Network Integrates with GFAL to Simplify Onboarding for Web3 Gamers

Ramp Network, a fintech agency creating fee options that hyperlink cryptocurrency with the worldwide finance system, has introduced its integration with blockchain gaming developer Games for a Living (GFAL). This integration is about to simplify the onboarding course of for gamers in GFAL’s Web3 gaming ecosystem, enabling extra accessible purchases of native cryptocurrency tokens utilizing fiat currencies.

Ramp’s Integration in Decentralized Apps

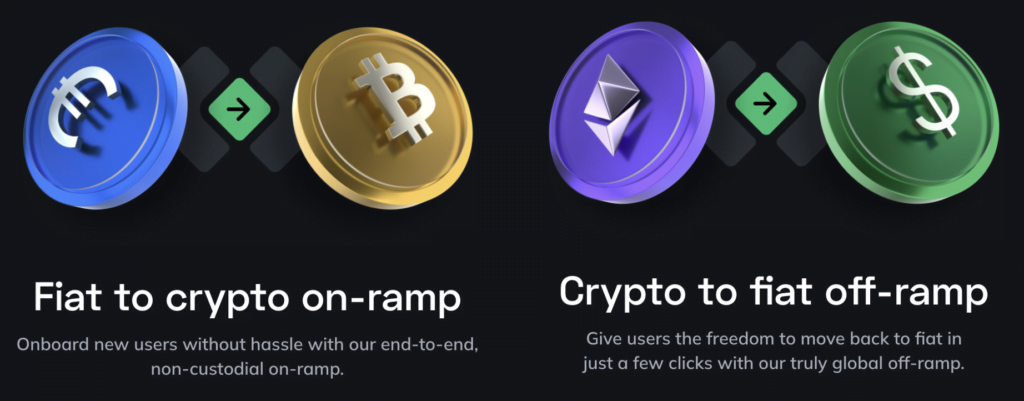

Geographically spanning 150+ nations and providing 100+ property, Ramp is extending the attain of the Web3 infrastructure to an enormous client base. It achieves this by on- and off-ramp merchandise that simplify digital asset buying and selling with API-based instruments. This allows decentralized software creators to include digital asset buying instantly into their merchandise.

With these merchandise, Ramp goals to enhance the consumer expertise and cut back the complexity for customers who now not should first go elsewhere to acquire their crypto. What’s extra, Ramp is registered with the U.S. Monetary Crimes Enforcement Community (FinCEN) and the U.Ok.’s Monetary Conduct Authority (FCA).

Ramp’s collaboration with GFAL is about to strengthen its place within the fast-evolving blockchain gaming sector. With blockchain video games, gamers can earn real-life rewards by crypto and in-game collectables. Nevertheless, customers should receive crypto to reap the benefits of these play-to-earn capabilities, one thing not all the time simply accessible to gamers, particularly newcomers to Web3 video games.

Streamlined Crypto Purchases in GFAL Video games

GFAL is a AAA-quality online game growth and publishing studio based by seasoned industry experts, together with the previous vice chairman of Activision Blizzard, Manel Kind, and the founding CEO of Digital Arts, Journey Hawkins.

Manel Kind, the CEO and co-founder of GFAL, shared his views on the collaboration, stating, “Ramp will assist GFAL make its imaginative and prescient come true, which is to advertise another blockchain video games strategy. We emphasize that incomes revenue naturally accompanies the enjoyment of the sport and contributes to a singular immersion. This stands in distinction to the prevailing pattern in Web3 video games, which frequently prioritize income technology as their principal focus.”

GFAL’s integration with Ramp makes its video games extra accessible to new players, permitting them to buy crypto with 100+ property accessible on-ramp and 40+ accessible off-ramp from anyplace on this planet. Customers will then see these property deposited instantly into their wallets, all with out having to depart the sport.

To make this integration work, Ramp will allow GFAL to supply customers the direct buy of $GFAL tokens. In a number of clicks, customers should purchase tokens utilizing fiat currencies with fee strategies akin to credit score/debit playing cards, financial institution transfers, Apple Pay, and extra. This user-friendly strategy opens GFAL’s doorways to a broader vary of players, not simply these already versed in crypto.