KAIA crypto soars 101% in a week — But faces a key test at…

- KAIA’s sentiment was overwhelmingly optimistic, with its TVL reaching ranges final seen in 2023—its highest level this 12 months.

- On-chain metrics additional supported the bullish outlook.

Kaia’s [KAIA] development over the previous week has been extraordinary, with a 101% enhance. This builds on a rally that began a month in the past, leading to a cumulative 197.6% achieve—a efficiency matched by solely a handful of tokens available in the market.

The surge has attracted a wave of keen consumers, driving the value even greater and presenting a compelling alternative for buyers.

Collective curiosity in KAIA spikes

Curiosity in KAIA has surged, making it the fourth high earner on CoinMarketCap after a 35.05% value enhance. This was accompanied by a dramatic 281.63% rise in buying and selling quantity, as reported by Coinglass, with energetic consumers and sellers exchanging positions available in the market.

This heightened curiosity considerably impacted KAIA’s market efficiency. The token’s market capitalization, representing its whole worth, surged by 36.27% to $2.25 billion.

On the identical time, KAIA’s Total Value Locked (TVL)—a key indicator of investor exercise inside the blockchain protocol—rose to $128.49 million.

That is the best stage this 12 months, matching a peak final seen in December 2023 and displays rising investor confidence and dedication to the platform’s development.

Supply: DeFiLlama

If this momentum persists, KAIA’s value is prepared for additional good points as market curiosity continues to construct.

Warning signal: A possible drop in value

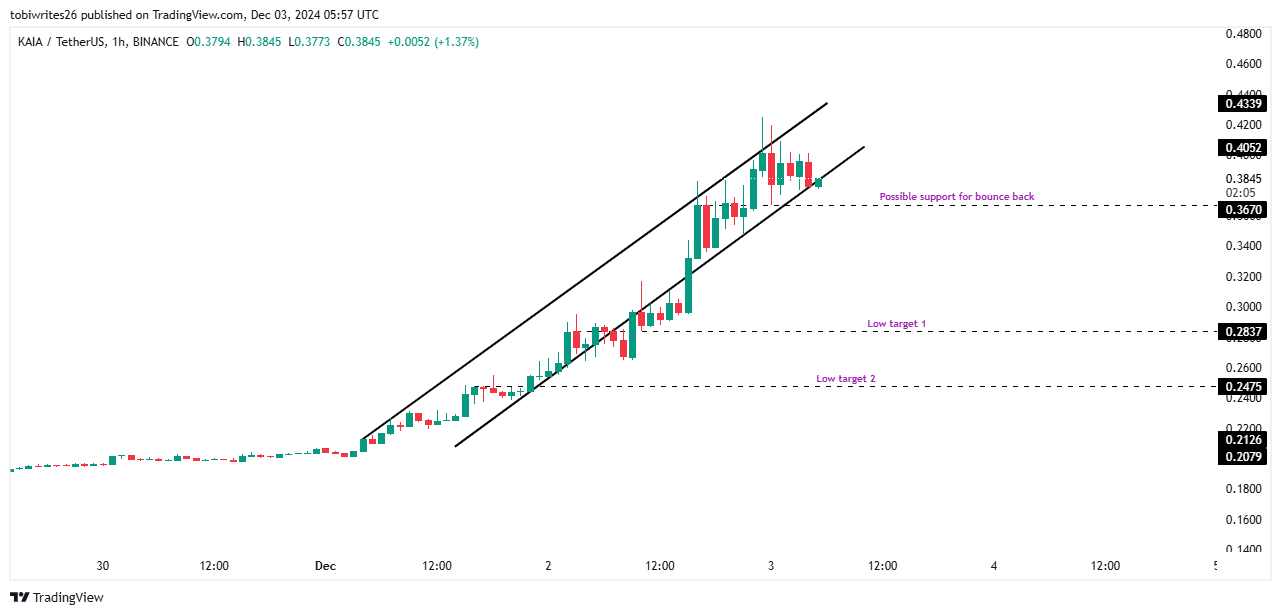

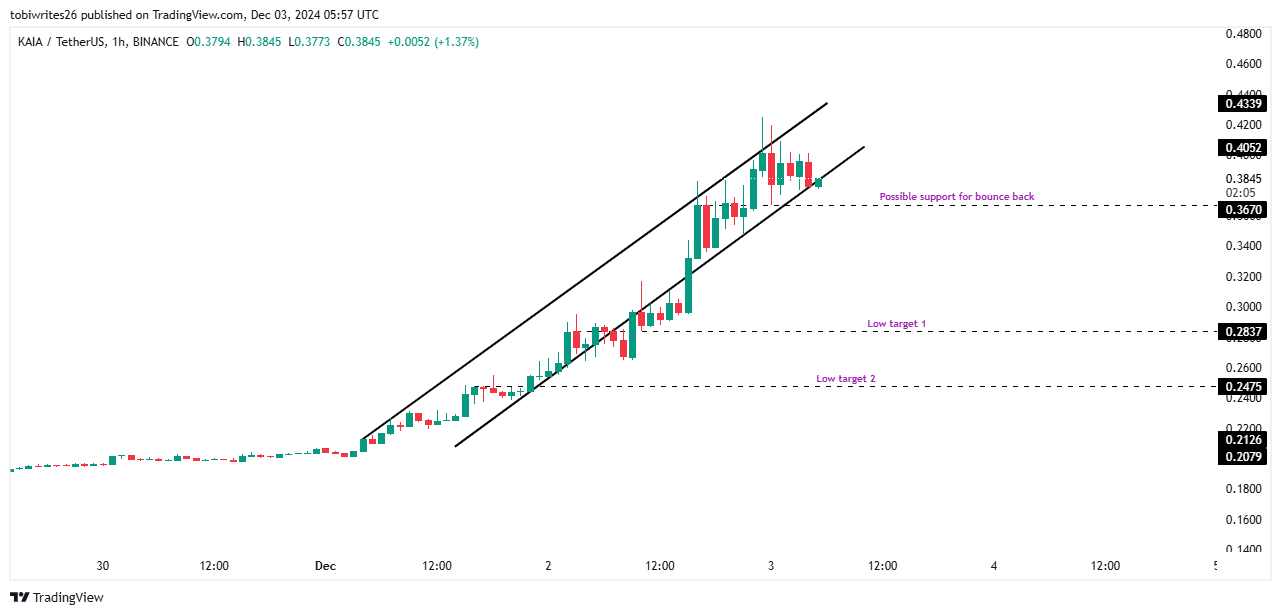

KAIA’s value would possibly face a downturn because it trades inside an ascending triangle sample. This sample, characterised by value actions between an upward-trending resistance and assist line, usually results in a breakdown and vital decline when the assist line is breached.

If this situation happens, KAIA’s value might retreat to the bottom of the channel. A rebound at $0.3670 might provide non permanent reduction, however failing to carry this stage might push the value to 2 decrease targets: $0.2837, and if no bounce happens, $0.2475.

Additional declines might observe, relying on on-chain sentiment.

Supply: Tradingview

Regardless of these dangers, AMBCrypto notes that present on-chain sentiment stays bullish, which can assist the value and even elevate it.

Bullish momentum sustained by on-chain exercise

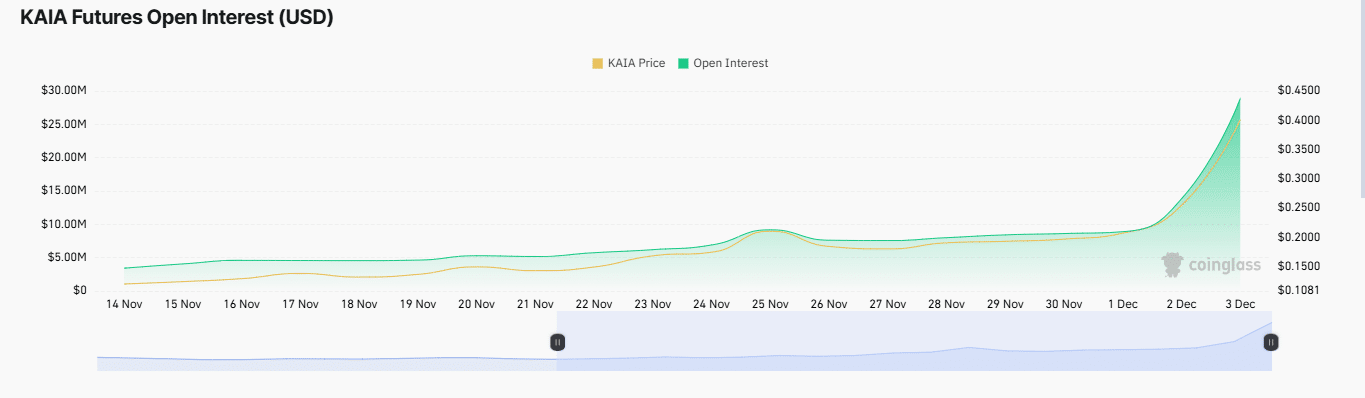

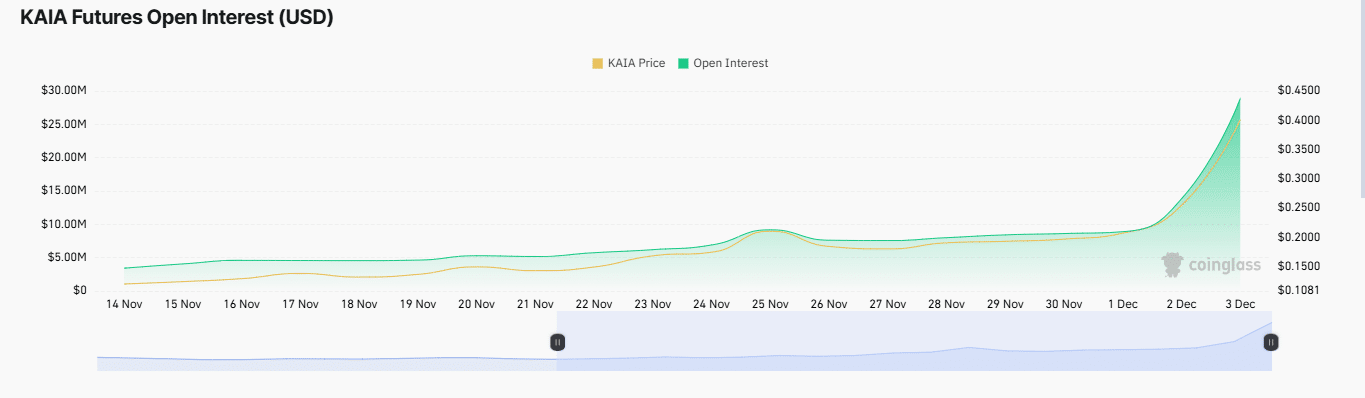

On the time of writing, Coinglass reported a bullish market sentiment for KAIA, with its Open Curiosity(OI) surging by 107% to succeed in $35.15 million.

A rise in OI usually alerts market confidence, suggesting that bullish merchants are dominating by opening or sustaining lengthy positions. This means optimism in KAIA’s value trajectory and reinforces the prevailing bullish outlook.

Supply: Coinglass

Learn Kaia’s [KAIA] Value Prediction 2024–2025

Moreover, the Funding Fee has been optimistic at 0.00254%. This means that lengthy merchants are paying to take care of a stability between the perpetual and spot markets, which helps guarantee value stability.

If these traits proceed, KAIA’s value is prone to maintain its upward momentum, additional boosting the continuing rally.