LayerAI crypto’s 81% surge – Here’s what’s driving LAI’s price now!

- LayerAI surged by 81.92%, supported by sturdy technicals and rising Open Curiosity

- On-chain exercise and brief liquidations hinted at rising market confidence in LayerAI’s momentum

The cryptocurrency market has seen its justifiable share of volatility currently, however LayerAI [LAI] is making an announcement. The token surged by a powerful 81.92% in simply at some point, buying and selling at $0.007600 at press time.

This sudden uptick in value has grabbed the eye of buyers and analysts alike. So, what’s driving this upward momentum, and may LayerAI maintain its progress?

Can LAI maintain its positive factors?

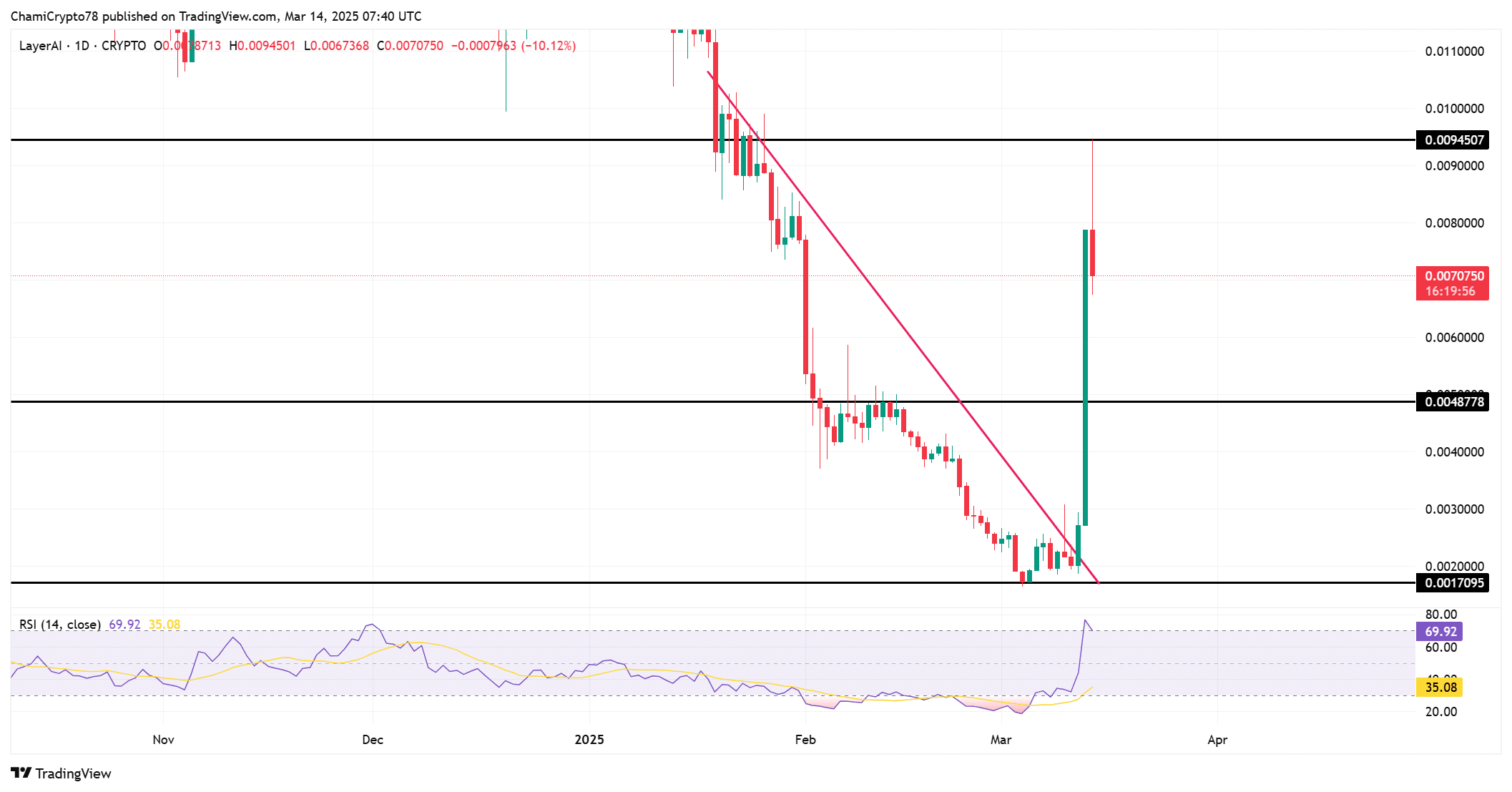

LayerAI’s value chart revealed a dramatic spike in March 2025, the place it broke by means of a number of resistance ranges, pushing the value above the $0.007-mark.

The RSI gave the impression to be flashing a bullish studying of 69.92 – An indication that the asset was in a robust momentum section. Nevertheless, the value correction seen after reaching the height alluded to potential consolidation earlier than its subsequent massive transfer.

Key help ranges to look at embrace $0.0048778 and $0.006000, whereas resistance has been forming close to the $0.0094507 area. If LayerAI continues to carry above the help, it might goal larger value ranges within the coming weeks.

Supply: TradingView

Open Curiosity surge – What does it inform us?

LayerAI’s Open curiosity surged by a staggering 143.39%, hitting $6.42 million. This sharp hike indicated that extra capital is being tied up in LAI Futures, signaling rising market confidence. It’s a transparent signal that buyers are betting on additional value motion.

Nevertheless, the numerous uptick in Open Curiosity might additionally sign larger market danger, particularly if the value information a reversal. With this in thoughts, merchants ought to intently monitor the Open Curiosity ranges to gauge the depth of market sentiment.

Moreover, LayerAI’s on-chain metrics highlighted a major spike in every day energetic addresses and transaction quantity. The variety of every day energetic addresses jumped dramatically, reaching 54 addresses at press time – Marking a rise in community exercise.

Moreover, this surge has been supported by a corresponding hike in transaction counts. Such a spike in on-chain exercise sometimes signifies that extra customers are partaking with the community. This might sign rising adoption and additional demand for LAI.

Supply: Santiment

LAI Lengthy vs. Brief liquidations – Who’s profitable?

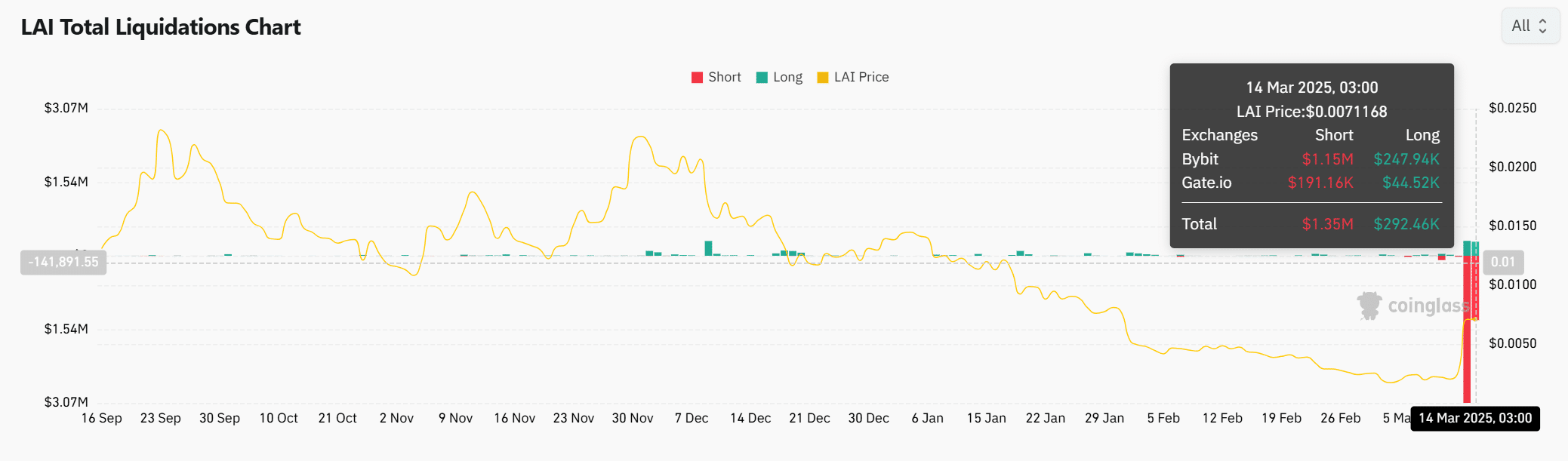

LayerAI has seen notable liquidations available in the market, with brief positions dealing with important stress. As of 14 March, brief liquidations amounted to $1.35 million throughout exchanges like Bybit and Gate.io.

The speedy value surge triggered many brief sellers to exit their positions, additional fueling the rally.

Now, lengthy positions additionally confronted some liquidations. Nevertheless, the overwhelming brief liquidations imply that bearish sentiment has been squeezed out for now.

Supply: Coinglass

Will LayerAI proceed to surge?

LayerAI’s dramatic value motion, bolstered by elevated Open Curiosity, rising on-chain exercise, and the dominance of lengthy liquidations, paints a bullish image. Nevertheless, the market might see volatility within the brief time period. Particularly because the RSI advised the token could also be nearing overbought situations.

Subsequently, whereas the surge has been promising, merchants ought to stay cautious and look ahead to any indicators of a correction. If LayerAI manages to carry above key help ranges, it might proceed its bullish trajectory.