Bitcoin’s mixed signals: Institutional sell-offs vs. whale accumulation

- U.S. retail buyers noticed a pointy drop in BTC shopping for exercise after the market opened, mirroring institutional developments.

- The broader market stays bullish, with billions of {dollars} price of BTC bought.

Bitcoin’s [BTC] worth motion stays unsure. The asset has dropped 12.42% over the previous month and struggled to keep up a bullish stance, up 0.26% within the final 24 hours till press time.

Present sentiment suggests BTC may see a serious worth rally, as notable shopping for exercise is noticed from retail buyers and whales. Nevertheless, low liquidity ranges threaten this rally.

U.S. buyers and establishments panic-sell BTC

There was a notable decline in curiosity from U.S. retail and institutional buyers over the previous 24 hours, in keeping with knowledge.

The Coinbase Premium Index (CPI), which tracks U.S. retail investor exercise on Coinbase relative to different exchanges, exhibits that promoting stress has intensified because the CPI dropped beneath zero.

Supply: CryptoQuant

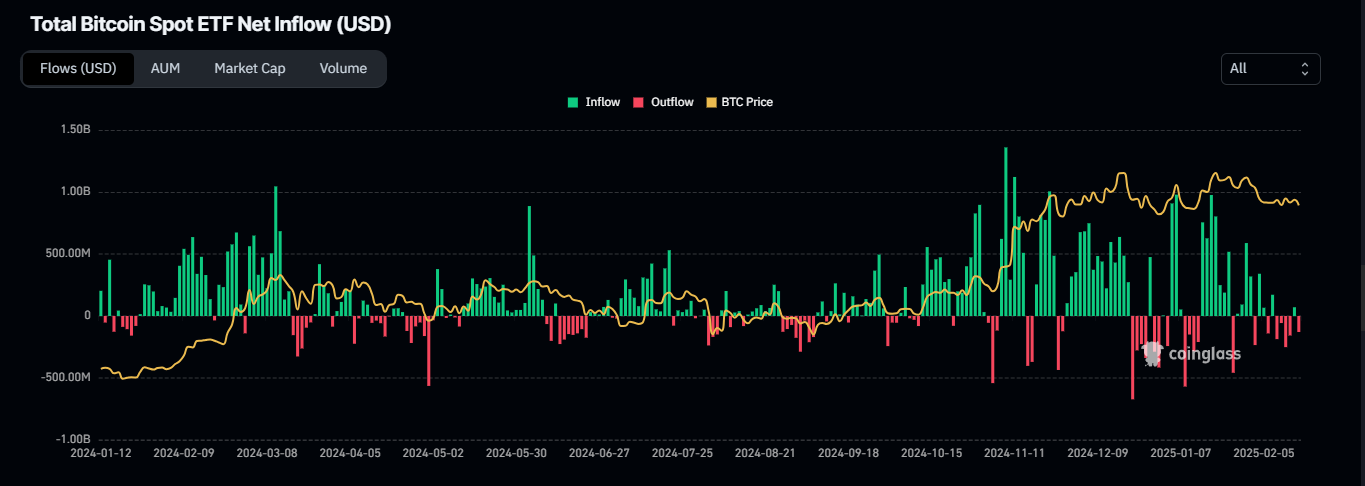

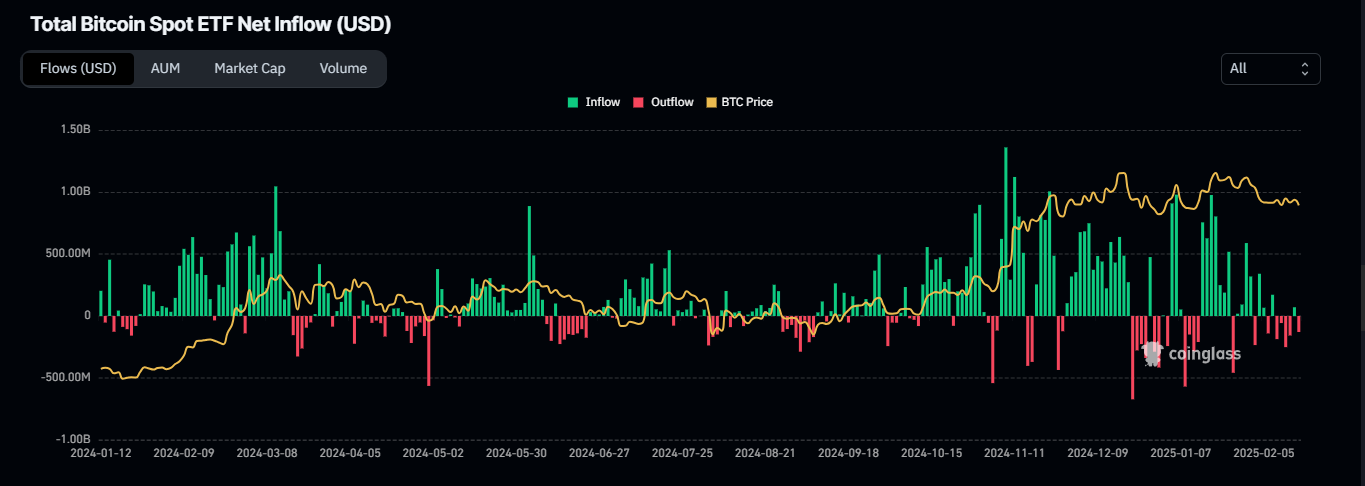

This shift follows bullish sentiment on the seventeenth of February, when the crypto market noticed a robust worth surge. Nevertheless, ETF exercise suggests a extra bearish outlook.

In February, spot BTC ETFs noticed an influx of $70.60 million, suggesting shopping for exercise. Nevertheless, on the 18th, a serious outflow of $129.10 million was recorded, which means extra BTC was withdrawn from these establishments.

Supply: Coinglass

This was a continuation of the market outflows that occurred from the tenth to the thirteenth of February, as institutional buyers continued promoting their BTC holdings.

Bullish sentiment stays robust

Regardless of latest promote stress, some bullish sentiment stays. Based on CryptoQuant, an handle linked to over-the-counter (OTC) trades for long-term holding has accrued a big quantity of BTC.

On the time of study, over 28,000 BTC—price greater than $2.6 billion—had been bought by these addresses. This might result in a provide squeeze, lowering circulating BTC.

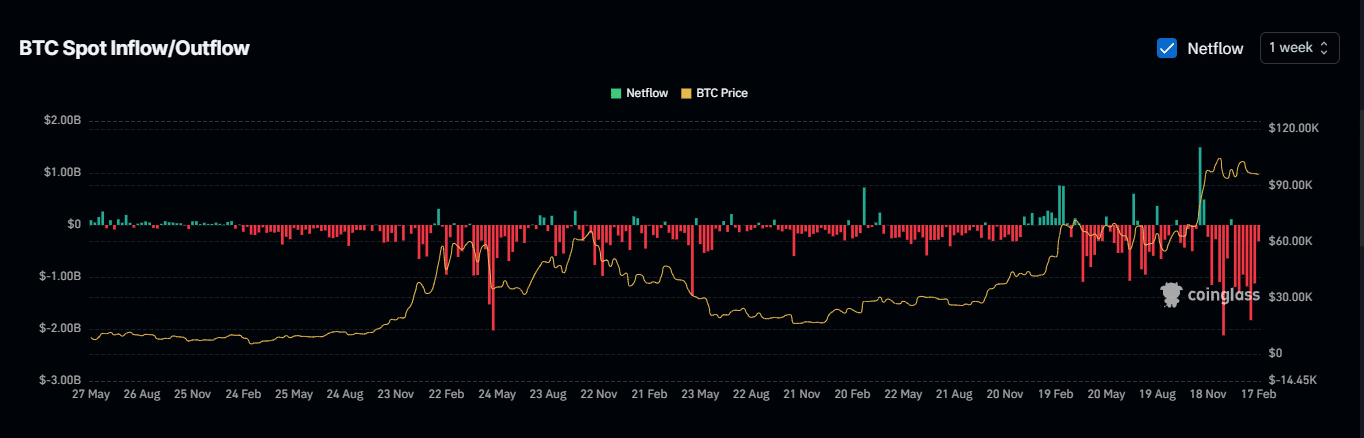

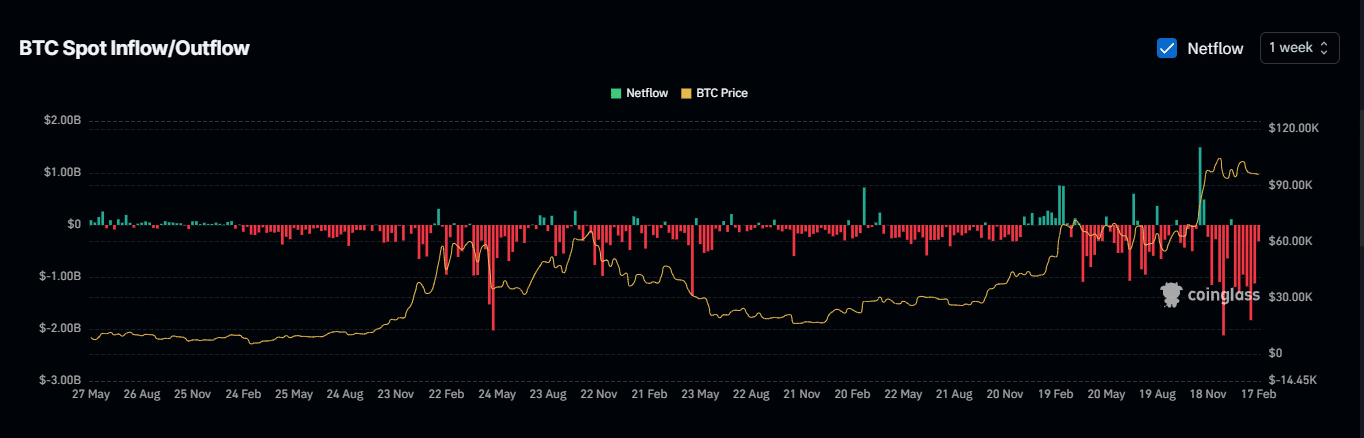

A better have a look at the spot market displays comparable shopping for developments. Up to now week alone, $314.70 million extra BTC was purchased than offered.

Asset netflow knowledge exhibits constant BTC accumulation since January 2025, additional supporting a bullish outlook.

Supply: Coinglass

Low liquidity ranges threaten an upward transfer

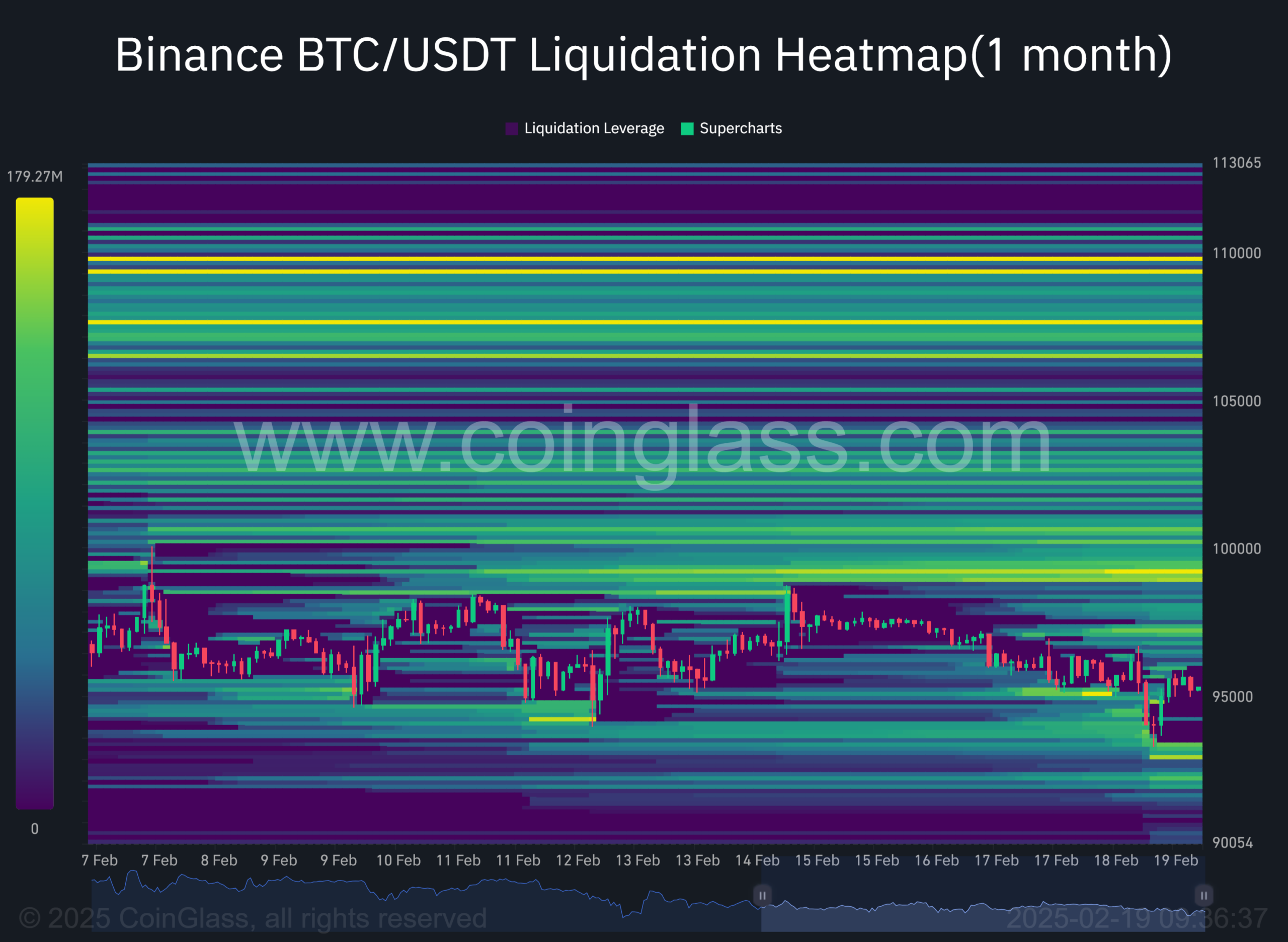

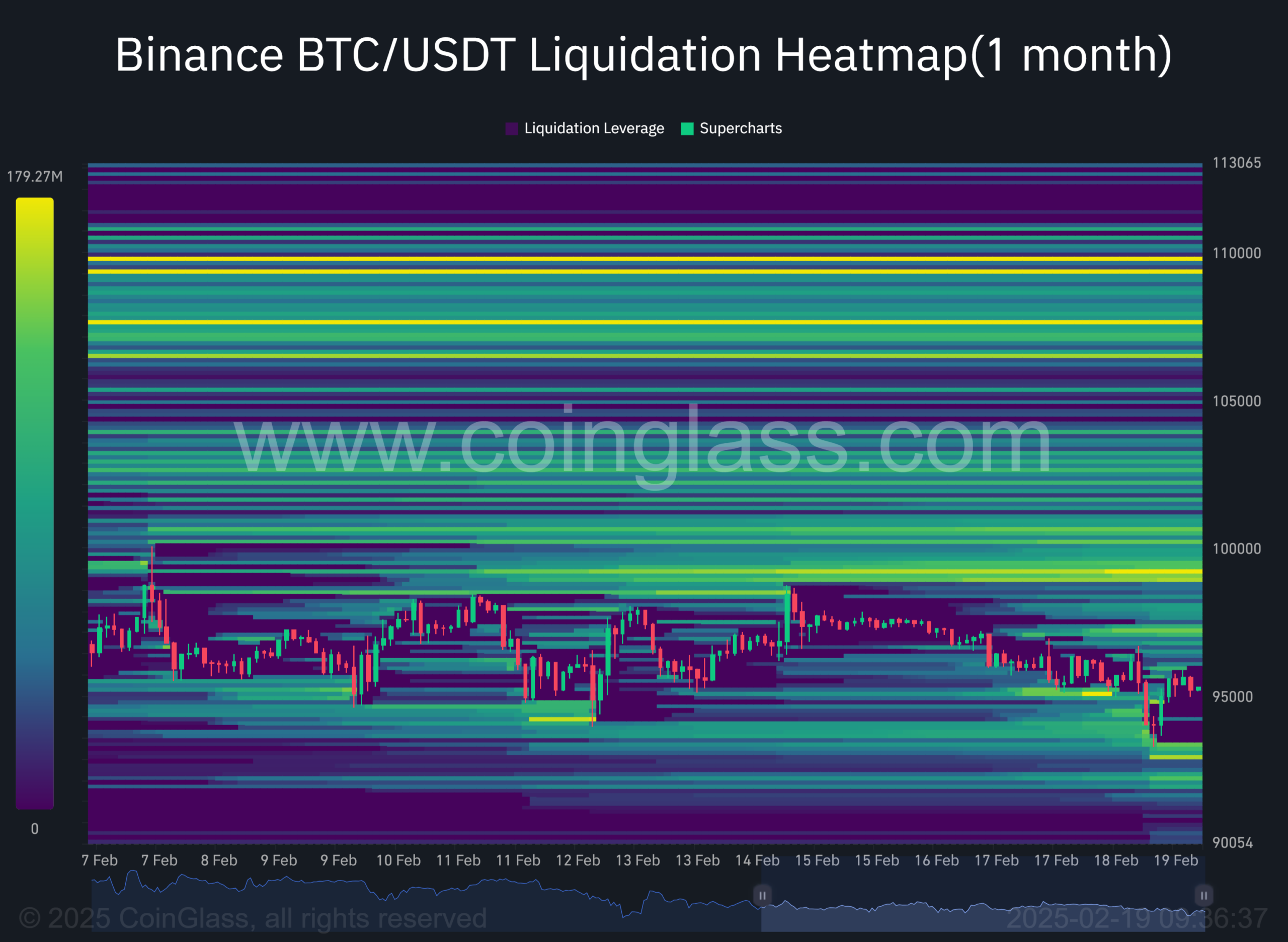

Based on Binance’s liquidation heatmap on the month-to-month timeframe, a serious liquidity degree is positioned at $92,930.28, the place $136.1 million price of BTC purchase orders have been positioned.

Supply: Coinglass

Sometimes, liquidation ranges act as magnets that pull the worth towards them. If this holds for BTC, it could drop to this degree earlier than shortly rebounding.

For now, market sentiment stays combined, and additional knowledge and on-chain exercise will present readability on BTC’s subsequent transfer.