Lido dominates staked ETH market, but can it lift Ethereum’s price?

- Lido outperformed Ethereum by way of charges earned in the previous few days.

- Regardless of curiosity in staking rising, the worth of ETH declined.

Lido [LDO] has managed to outperform Ethereum [ETH] in the previous few days by way of charges earned.

Lido confirmed development

Within the final month, Lido Finance collected $20.8 million in charges in only one week, which was greater than the charges collected by Ethereum itself, which collected $19.8 million throughout the identical interval.

This spectacular efficiency positioned Lido Finance because the second-highest charge earner throughout the cryptocurrency house for that week, behind solely Tron [TRX], which had earned $33.7 million.

Lido Finance’s momentum continued all through the month. Over your entire month, Lido generated $98 million in charges, representing an 8% enhance in comparison with the earlier month.

This sturdy charge technology is probably going resulting from Lido’s dominance within the staked ETH market. At press time, Lido held over $33.4 billion in complete staked belongings, commanding a 29% market share in staked ETH.

Supply: X

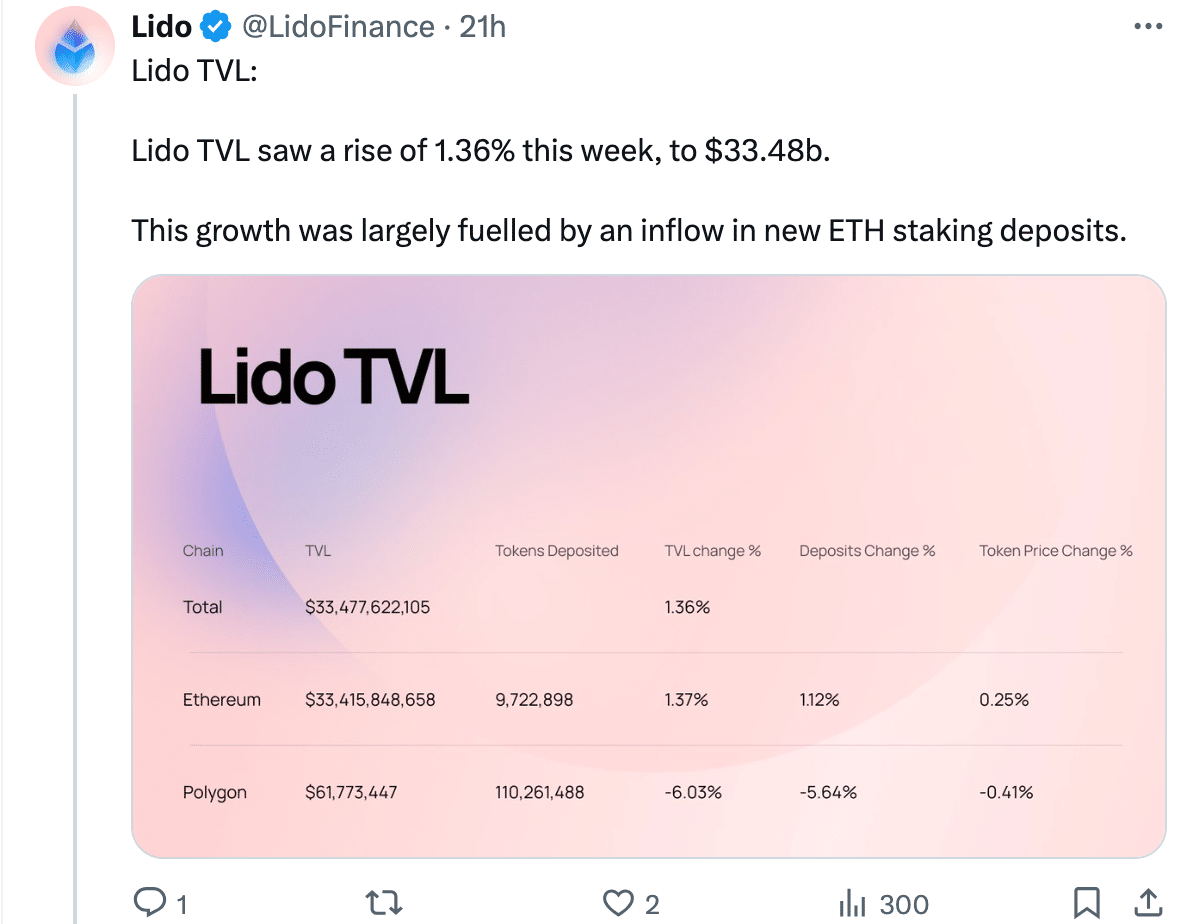

Lido’s complete worth locked (TVL) jumped 1.36% this week, reaching $33.48 billion. This surge was pushed by a wave of recent ETH staking deposits, with 95,616 web new ETH staked via Lido up to now seven days.

Whereas the 7-day stETH APR dipped barely by 0.04% to 2.96%, there have been optimistic indicators elsewhere.

Supply: X

Wrapped stETH (wstETH) bridged to Layer 2 networks noticed a big rise of seven.19%, bringing the overall to 141,586 wstETH.

Arbitrum [ARB] held the bulk with 65,290 wstETH, adopted by Optimism [OP] at 27,879 wstETH. Each networks skilled minor declines up to now week.

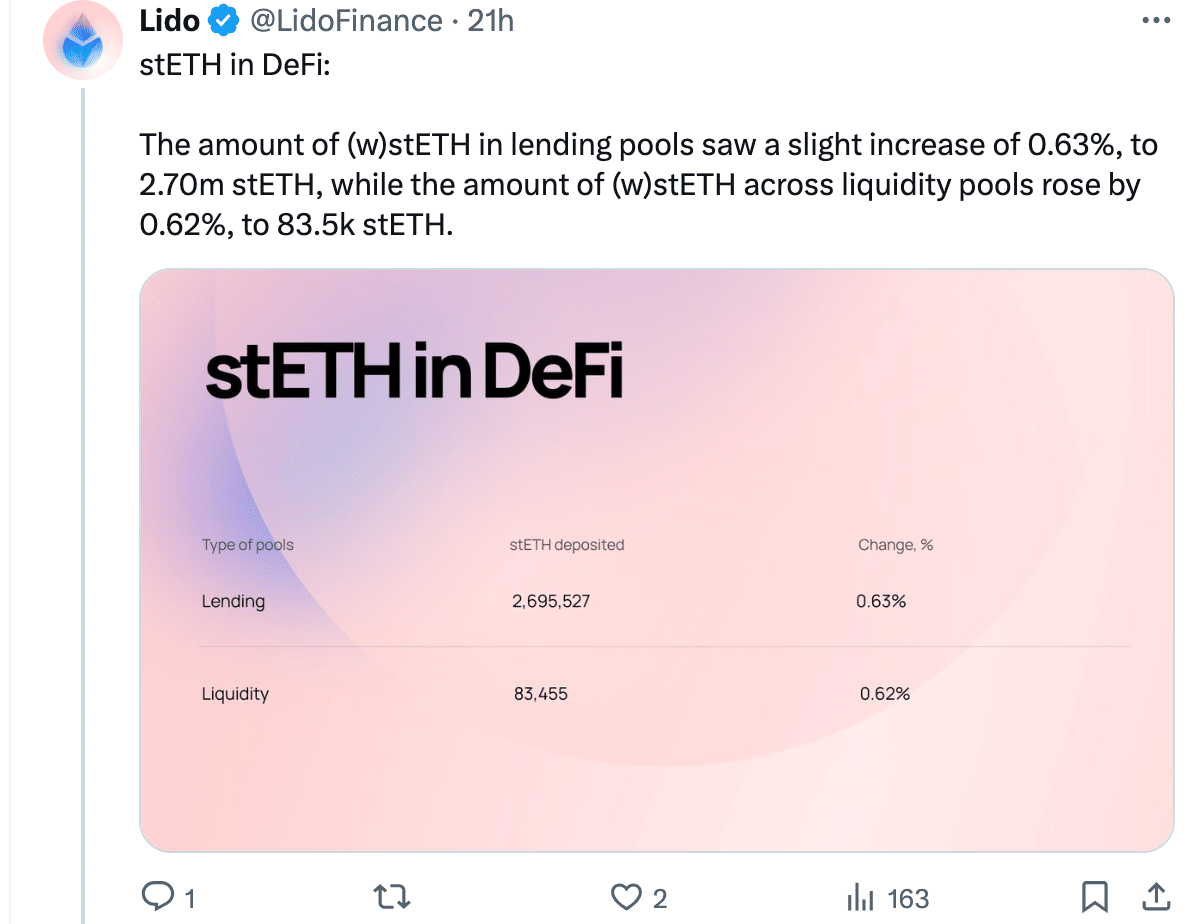

There was additionally a slight enhance in wstETH deposited in lending swimming pools and liquidity swimming pools, reaching 2.70 million stETH and 83.5k stETH respectively.

Supply: X

wstETH bridged to Cosmos networks additionally noticed a small uptick, reaching 1,788 wstETH up 2.12% up to now week.

Nonetheless, the 7-day buying and selling quantity for (w)stETH dipped 7.25% in comparison with the earlier week, totaling $1.23 billion.

Whereas Scroll noticed a big enhance in wstETH up 86.26%, different networks like Base, Polygon, Linea, and zkSync Period skilled minor declines.

What occurs subsequent for ETH?

The recognition and development of the Lido protocol hints at the truth that customers are more and more displaying their curiosity in staking ETH.

Lifelike or not, right here’s LDO’s market cap in BTC’s phrases

Although ETH’s value could also be stagnating on the time of writing, a surge in staking implies that current customers imagine within the long-term potential of ETH.

At press time, ETH was buying and selling at $3,336.23 and its value had declined by 3.15% within the final 24 hours.

Supply: Santiment