Lido Finance [LDO] prepares for major V2 upgrade; how are ETH stakers affected

- Lido Finance is about to allow stETH:ETH withdrawals as soon as its V2 improve goes dwell.

- LDO’s worth has declined since Ethereum’s Shanghai Improve.

Following the implementation of Ethereum’s Shanghai Improve (Shapella) in April, main Ethereum [ETH] staking platform Lido Finance [LDO] has scheduled the ultimate on-chain vote for its V2 improve on 12 Might.

How a lot are 1,10,100 LDOs value at this time?

In keeping with the staking protocol, if the voting is profitable, the V2 improve would go dwell on 15 Might, and allow direct in-protocol stETH:ETH withdrawals and staking router structure.

A Lido V2 replace:

The ultimate on-chain vote for the V2 improve is scheduled for this Friday, Might twelfth.

If no last-minute findings are surfaced and the vote is profitable, Lido V2 can be dwell after the vote enactment on Might fifteenth 🏝️

— Lido (@LidoFinance) May 8, 2023

In an earlier announcement made in February, Lido acknowledged that its V2 improve could be composed of two foremost parts; the Staking Router, which is a modular infrastructure that enables the event of on-ramps for brand new Node Operators, and Withdrawals, which is able to allow stETH holders to withdraw from Lido at a 1:1 ratio.

Lido intends for its Staking Router to permit for a extra various validator ecosystem. Additionally, by enabling withdrawals, protocol customers can have the “freedom to stake and unstake at will.”

Lido since Shanghai

In a brand new report, on-chain analytics platform Glassnode famous:

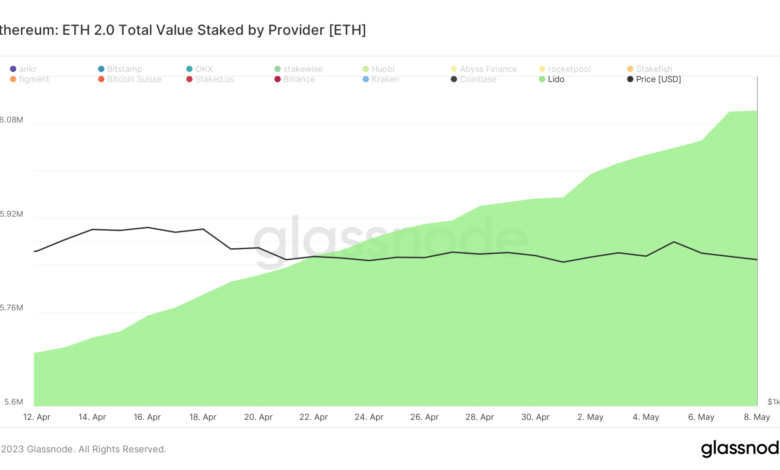

“Liquid staking supplier Lido nonetheless holds the biggest market share, with 33.5% dominance, adopted by the staking providers of the centralized exchanges Coinbase with 11% and Kraken with 7.1%.”

For the reason that Shanghai Improve went dwell on Ethereum, the full quantity of ETH tokens transferred to the ETH 2.0 deposit contract through Lido has rallied by 7.2%. Per knowledge from Glassnode, at press time, Lido housed 6.1 million ETH out of the full quantity of ETH cash which were staked.

Supply: Glassnode

Additional, Lido has skilled a spike in its ETH staking APR because the implementation of Shapella. Knowledge from Dune Analytics confirmed a 62% soar in ETH staking APR since 12 April. For context, this stood at 4.37% the day Shapella went dwell on Ethereum. As of this writing, it was pegged at 7.09%.

Supply: Dune Analytics

At $11.96 billion at press time, the protocol’s complete worth locked (TVL) has additionally seen a 5% improve because the Shanghai Improve.

On 2 January, Lido’s TVL rallied above that of MakerDAO [MKR] to displace the latter because the decentralized finance (DeFi) protocol with probably the most TVL. As MakerDAO recovers from the aftermath of the de-pegging of its DAI stablecoin, its TVL was $7.25 billion at press time, with an 8% decline within the final month.

Supply: DefiLlama

Learn Lido DAO’s [LDO] Value Prediction 2023-2024

LDO treads in the other way

Whereas Lido Finance logs general ecosystem progress because the Shanghai Improve, the worth of its governance token LDO has since declined. Exchanging arms at $1.81 at press time, the token’s worth has dropped by 23% prior to now 27 days.

An evaluation of the alt’s value motion on a day by day chart revealed a big decline in shopping for strain within the final month. Key momentum indicators have trended downwards prior to now few weeks, suggesting that LDO has seen much less accumulation.

Supply: LDO/USDT on TradingView