Little hype for ETH? Here’s how Spot Ethereum ETFs can change that

- Grayscale’s newest report recommended U.S voters usually tend to purchase ETH after ETF approval

- Whereas ETH’s worth surged on the charts, its community progress fell

The latest market drawdown has affected a bunch of cryptocurrencies over the previous couple of days. Evidently, Ethereum [ETH] was no exception, with its worth struggling to interrupt previous the $3,000-level, on the time of writing.

Will Ethereum lastly see inexperienced?

Nevertheless, there could also be some hope for Ethereum maximalists, regardless of the altcoin’s falling costs. A brand new survey by Grayscale has painted a bullish image for Ethereum’s future.

In accordance with the identical, when the long-awaited Spot Ethereum ETF goes stay, practically 1 / 4 of potential U.S voters could be extra prone to spend money on the altcoin. This surge in curiosity could be in keeping with the broader pattern of crypto adoption too.

The survey additionally discovered that almost half of all voters, 47% to be exact, now anticipate to incorporate cryptocurrencies of their funding portfolios – A major hike from 40% simply six months in the past. The big scale curiosity from individuals in including crypto to their portfolios may additional assist ETH in the long term.

Much like Bitcoin’s ETF launch, an Ethereum ETF would supply a well-recognized, regulated means for brand new traders to enter the market. This inflow of capital, notably from establishments, may drive up Ethereum’s worth on account of elevated demand. This was seen with Bitcoin, the place the ETF approval coincided with a major worth rally.

A U.S-approved Ethereum ETF could be a significant vote of confidence from regulators, doubtlessly easing institutional considerations in regards to the cryptocurrency’s legitimacy.

How is ETH doing?

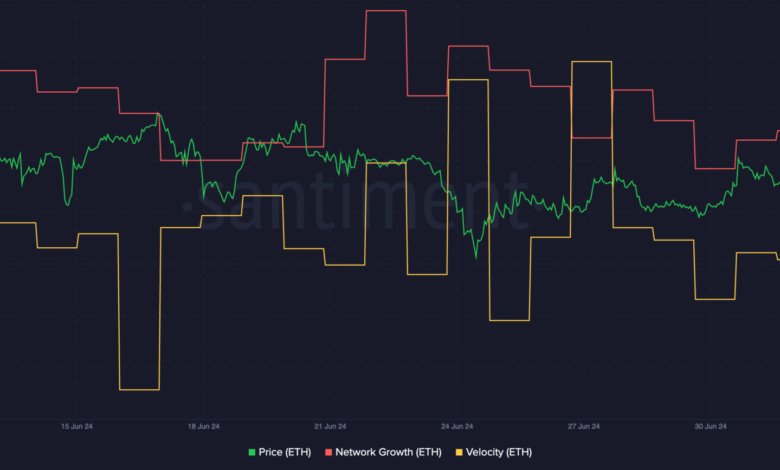

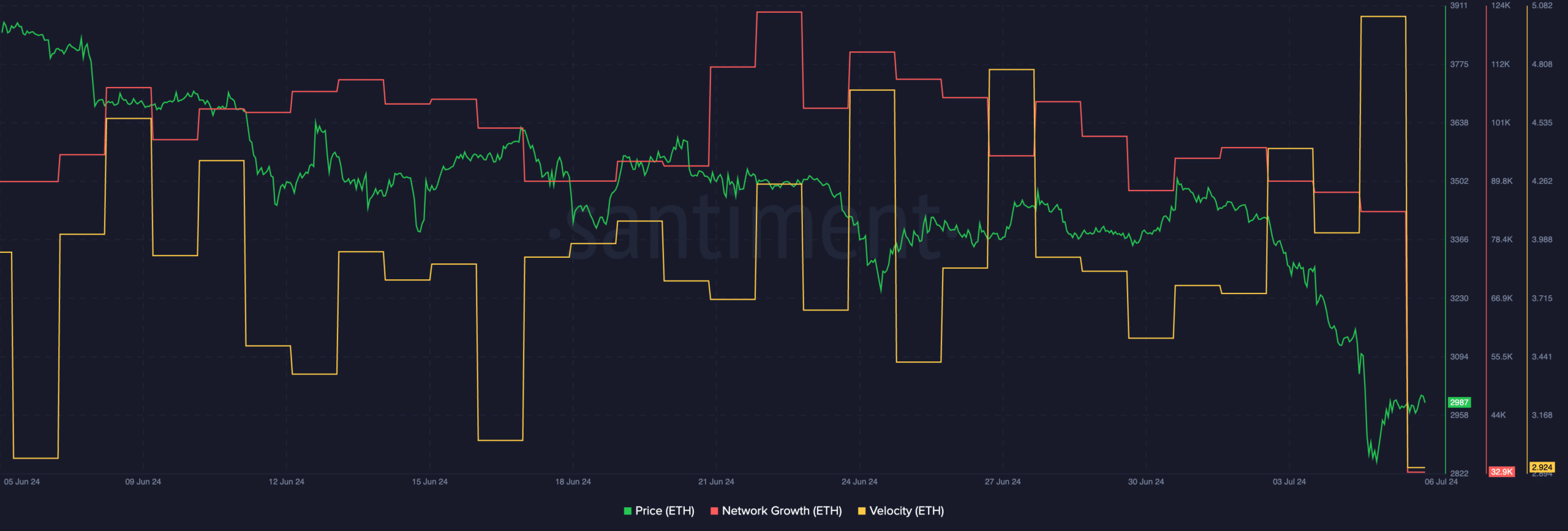

At press time, ETH was buying and selling at $2,987.46 following a 4.19% hike over the past 24 hours. The community progress for ETH declined materially over the interval. This indicated that regardless of low costs, most new traders have been unwilling to purchase ETH.

Moreover, the speed across the token additionally fell, implying diminished frequency of buying and selling for ETH.

Learn Ethereum’s [ETH] Value Prediction 2024-2025

Therefore, it’s price anticipating what the ultimate launch of Spot Ethereum ETFs will imply for the altcoin’s worth sooner or later.

Supply: Santiment

On the opposite aspect of the world, it might appear that Hong Kong may quickly welcome Ethereum staking ETFs, and inside simply 6 months too. This, in keeping with Hashkey Capital’s Vivien Wong. The truth is, Wong additionally claimed that native regulators are actually speaking to business insiders over the mentioned proposal.