Loom Network (LOOM) Shows Explosive Performance, and Here’s Reason

Disclaimer: The opinions expressed by our writers are their very own and don’t signify the views of U.Right now. The monetary and market data offered on U.Right now is meant for informational functions solely. U.Right now is just not responsible for any monetary losses incurred whereas buying and selling cryptocurrencies. Conduct your personal analysis by contacting monetary consultants earlier than making any funding choices. We imagine that every one content material is correct as of the date of publication, however sure gives talked about might now not be out there.

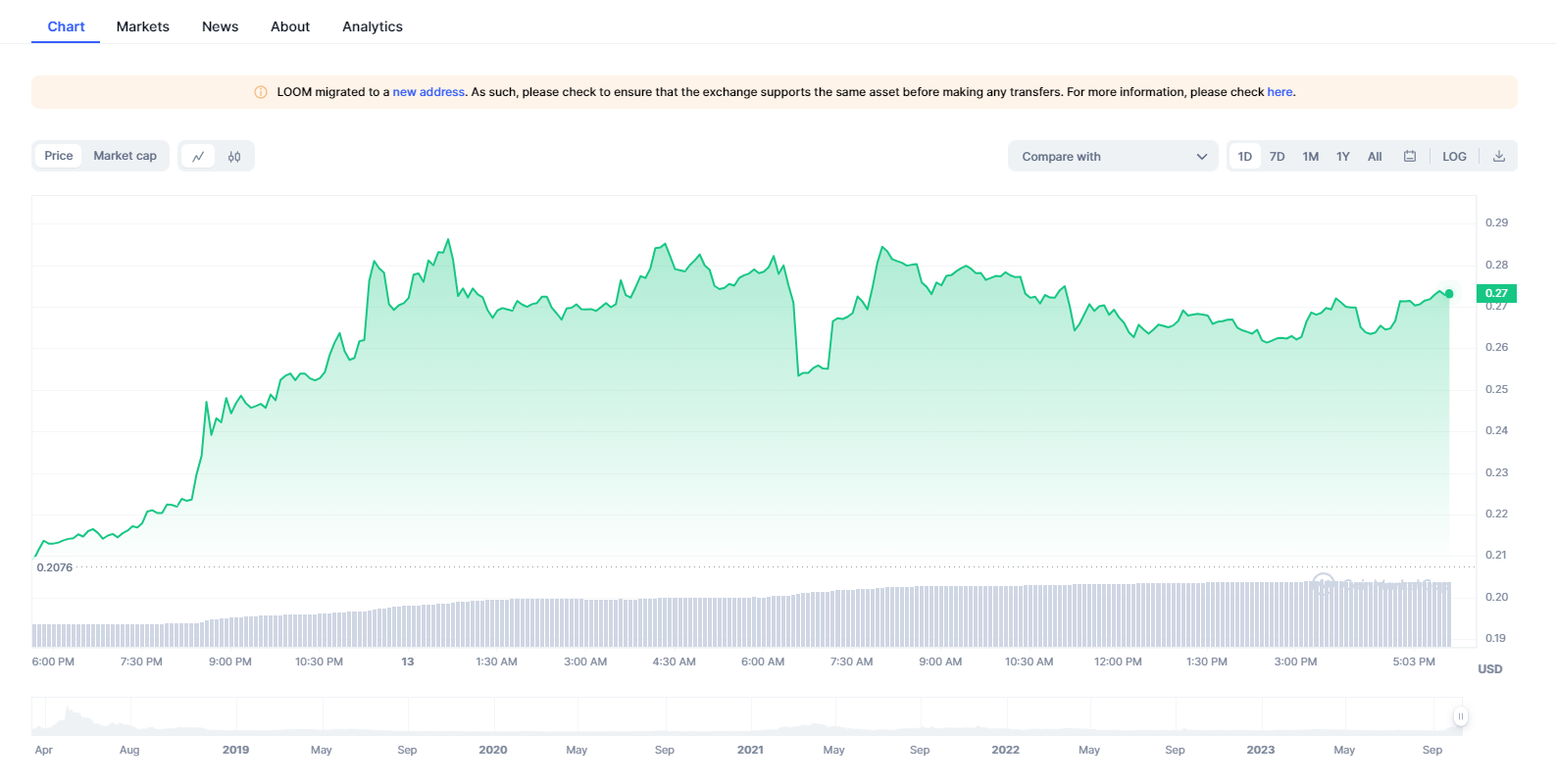

Loom community’s native token, LOOM, has been on a meteoric rise, displaying explosive efficiency on the crypto market. One would possibly marvel concerning the catalyst behind such bullish momentum, and it’s linked to an thrilling improvement.

Right now, it was introduced that Loom is becoming a member of forces with Atlassian, a world chief in staff collaboration software program. The businesses have signed a definitive settlement whereby Atlassian will purchase Loom for a whopping $975 million. This information has despatched ripples throughout the business, marking a brand new chapter of progress and alternative for each entities.

Reflecting in the marketplace’s response, the LOOM token’s value surged, mirroring the neighborhood’s optimism about this partnership. The combination foresees a future the place the mundanities of data work are minimized, leveraging the most effective of JIRA, Confluence and Loom’s modern video options.

The foundations of this acquisition hint again a number of years, due to the continual efforts of key figures in each firms. Loom has all the time been on Atlassian’s radar, particularly famous by Atlassian’s cofounders, Mike Cannon-Brookes and Scott Farquhar. Their perception in Loom’s potential was evident even when the platform was registering beneath a million looms monthly again in 2019. Flash ahead to the current, and Loom boasts over seven million looms recorded month-to-month.

This acquisition doesn’t simply signify a change of palms. It’s a testomony to Loom’s vital progress and sturdy monetary well being. The imaginative and prescient shared by Loom’s leaders is to make this acquisition probably the most profitable within the software program world. They aspire to a future during which customers can not think about utilizing Atlassian instruments like Confluence and JIRA with out the built-in options of Loom.

Solana’s progress in hassle

Solana (SOL) has undoubtedly caught the eye of many within the crypto world, particularly with its spectacular surge in September. Nonetheless, upon scrutinizing its charts throughout totally different time frames, sure patterns emerge that recommend this progress is likely to be beneath a possible risk of receding.

On the each day chart, Solana witnessed a exceptional bullish run in September, characterised by sharp upward candles. This section noticed intensive shopping for strain, which led to the crypto breaking previous earlier resistance ranges.

Nonetheless, this similar chart now reveals that SOL is experiencing a interval of consolidation, with costs shifting sideways, and candles have gotten smaller. There may be an obvious battle between consumers and sellers, resulting in a state of equilibrium.

Extra considerably, the Shifting Common (MA) strains showcase a possible bearish crossover within the close to future. The short-term MA appears to be approaching the long-term MA from above, a basic indicator of a possible downtrend. If this crossover occurs, it might sign a shift in momentum from the bulls to the bears.

Switching our consideration to the weekly chart, the angle turns into much more enlightening. SOL’s explosive progress is extra evident, with a pointy vertical climb. Nonetheless, after this climb, the chart showcases crimson candles, hinting at a bearish reversal. The amount bars under the value candles additionally present a sign of decreased shopping for curiosity in current weeks in comparison with the height in September.

Cardano lands on necessary assist

Over the previous few months, Cardano (ADA) has been beneath the watchful eyes of many buyers, merchants and market analysts. The second picture reveals the Complete Worth Locked (TVL) in Cardano, which might be thought-about a metric for gauging the energy and potential of a blockchain community. A excessive TVL signifies sturdy platform exercise and person engagement, and as depicted, Cardano noticed its peak TVL round April, after which it started its descent.

The each day value chart of ADA additional corroborates the pattern seen in its TVL. As we are able to see, ADA has been on a downward trajectory, with the value being suppressed beneath each the medium and long-term shifting averages, signaling prevailing bearish sentiment. The lengthy downward crimson candles point out sturdy sell-offs, with minor upward inexperienced candles representing momentary aid or minor bullish pullbacks.

Notably, ADA appears to have reached a crucial “Adamantium” assist stage – a stage it’s hesitant to breach. However the million-dollar query is: will ADA bounce again from right here?

The truth that ADA is generally following the overall market tendency is price highlighting. It’s not simply ADA that’s going through the warmth; a big chunk of the market is presently present process the same section. Cardano’s value actions have proven a powerful correlation with different main property, indicating that its value is closely influenced by broader market traits.

Concerning the writer

Arman Shirinyan