Low Bitcoin Volatility Masks Market Dynamics

On the planet of Bitcoin, silence will not be all the time golden. The latest weeks have seen Bitcoin’s value volatility drop to historic lows, with the BTC value buying and selling principally between $29,000 and $30,000. Nevertheless, beneath this placid floor, quite a few intriguing market dynamics are at play.

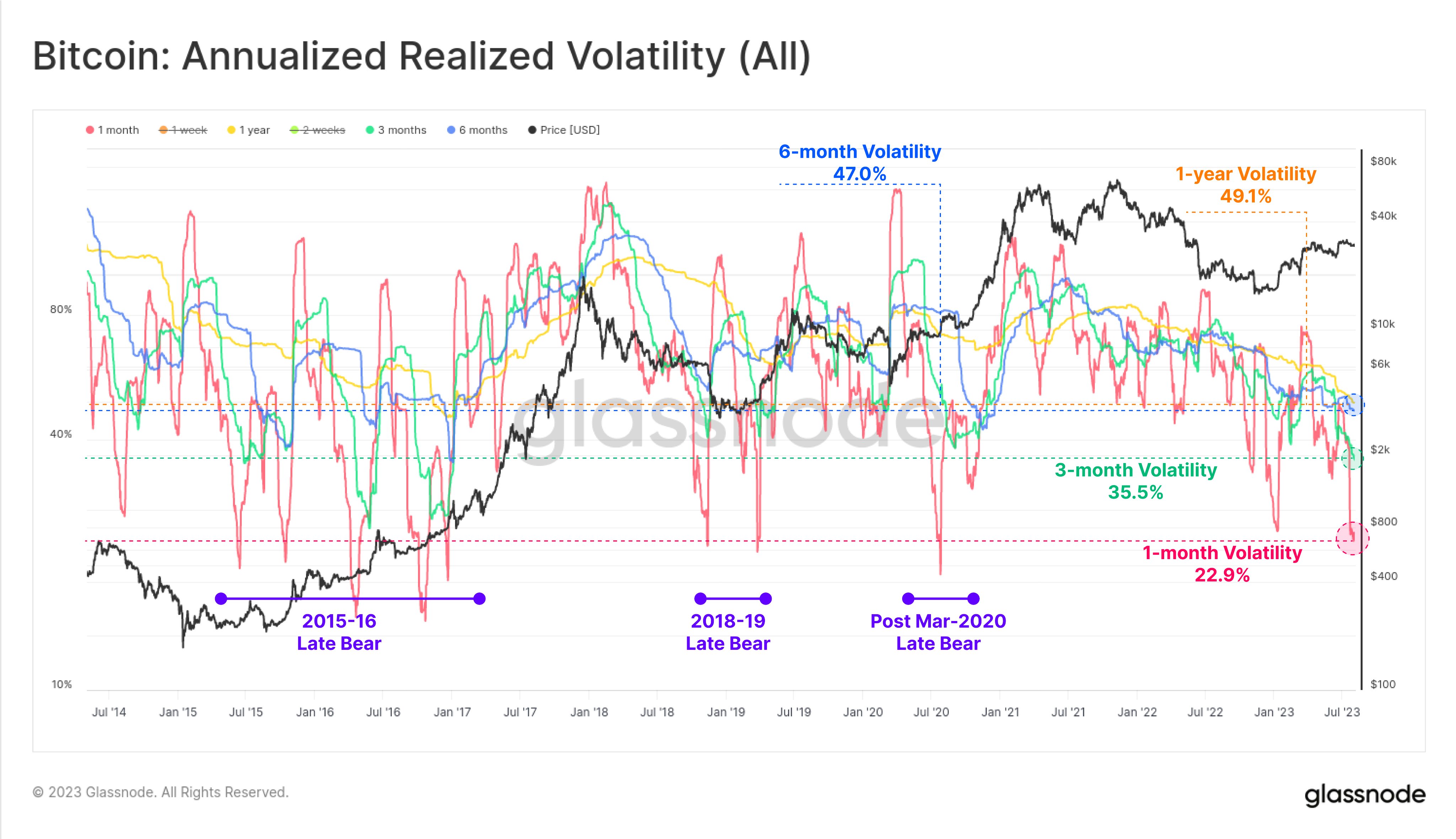

“Realized volatility for Bitcoin has collapsed to historic lows. Throughout 1-month to 1yr timeframes, that is the quietest we have now seen the corn since after March 2020. Traditionally, such low volatility aligns with the post-bear-market hangover durations (re-accumulation section),” said Checkmate, lead on-chain analyst at Glassnode.

The chart shared by Checkmate exhibits that annualized realized volatility resembles the post-bear period for Bitcoin from March 2020 when volatility was at 47%. At the moment, 1-year volatility sits at 49.1%, 3-month volatility at 35.5%, and 1-month volatility at 22.9%.

Give up Earlier than The Storm For Bitcoin

Nevertheless, the low volatility will not be the one story. Checkmate additionally highlighted a brand new all-time excessive for Bitcoin’s long-term holder provide, now at 14.59M BTC, which accounts for 75% of the circulating provide. This exhibits that an more and more excessive variety of Bitcoin buyers are satisfied of a future rally, resulting in a provide scarcity, whereas excessive danger merchants are washed out of the market because of missing volatility.

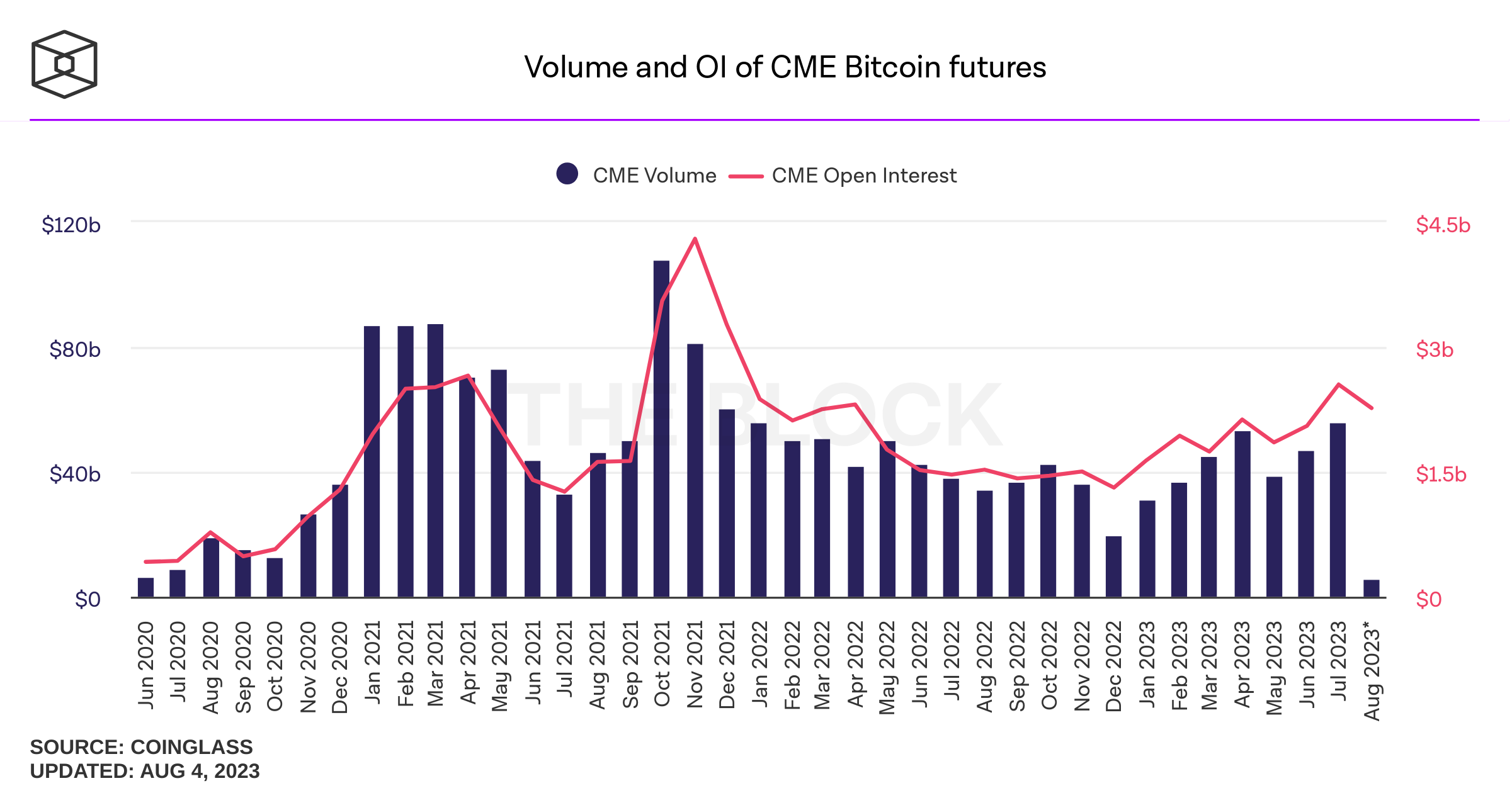

Concurrently, there’s a surge in institutional positioning; quantity and open curiosity of the CME Bitcoin futures have reached a 20-month excessive in July. Regardless of the Bitcoin spot markets recording low volumes, the CME futures noticed the very best quantity since January 2022, with $55.8 billion in July.

The CTFC knowledge reveals an interesting slugfest between two investor teams. Asset managers are $1.2 billion web lengthy, whereas hedge funds are web brief by -$980 million. This standoff suggests an imminent breakout in Bitcoin’s value, doubtlessly leaving one in all these teams with burnt fingers.

On-chain analyst Ali Martinez provided additional perception: “Whilst Bitcoin dropped from $32,000 to $29,000, the variety of new BTC addresses steadily rose! This bullish divergence between value and community development hints at a secure long-term BTC uptrend. Purchase the dip!”

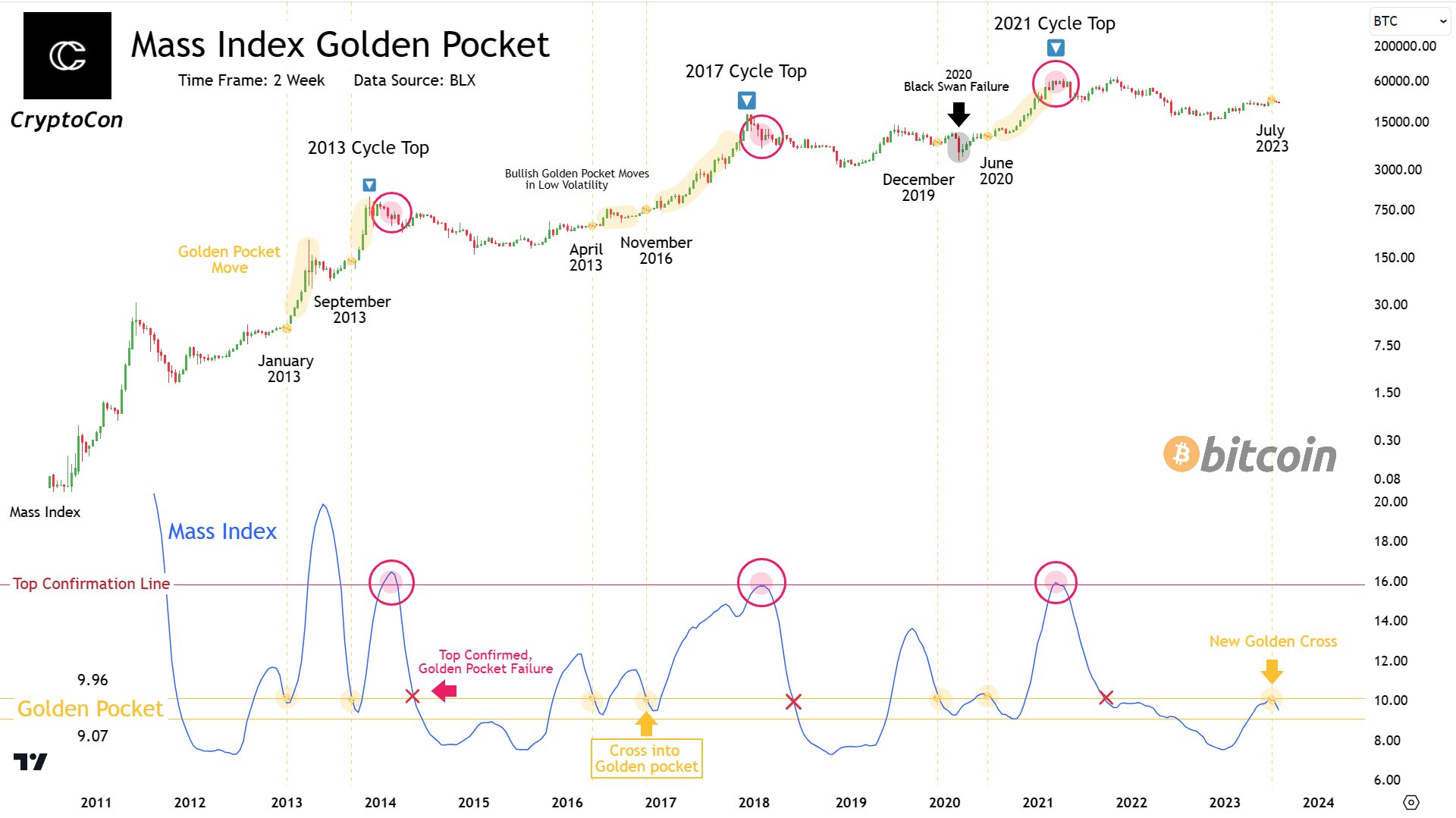

Certainly, the present low volatility section will not be with out precedent or predictive energy. Famend analyst @CryptoCon supplies a compelling perspective on this, stating that such durations of sideways value motion usually are not solely regular however doubtlessly bullish.

“Bitcoin sideways value motion at this level within the cycle is totally regular! The two Week Mass Index crosses into the golden pocket on the most stagnant cycle factors, simply earlier than large bullish strikes. Information in every single place factors to the identical conclusion: Low volatility is bullish,” CryptoCon tweeted.

Chris Burniske, associate at Placeholder VC, additionally shared his perspective on the present market dynamics. “At the moment, vacationers are inactive whereas residents are accumulating swiftly, proudly owning 74.8% of all provide. That’s per an early-stage bull market. Thirty p.c of BTC has left for chilly storage since 2020, leaving exchanges with 2.26 million. Bitcoin appears pretty valued relative to the variety of lively entities on the community.”

Burniske’s simplified value/cycle mannequin initiatives Bitcoin to succeed in close to $39,000 by the fourth quarter of 2023 and $92,000 (base state of affairs) by This autumn 2025 with entities above 600,000.

In conclusion, the present low volatility section of Bitcoin could appear uneventful on the floor, however the underlying market dynamics counsel a special story. The tug-of-war between asset managers and hedge funds, the regular rise in new BTC addresses, and the swift accumulation by long-term holders all trace at a brewing storm.

At press time, the Bitcoin value was at $29,076.

Featured picture from iStock, chart from TradingView.com