Major Ethereum Whale Dumps 10,000 ETH After 2 Years, Is It Time To Get Out?

Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

An Ethereum whale has dumped its ETH holdings after holding them for over two years, even by means of a bull market. This capitulation from the ETH whale suggests it may be an excellent time to dump the main altcoin, with an extra crash within the coming weeks a risk.

Ethereum Whale Dumps 10,000 ETH After 900 Days

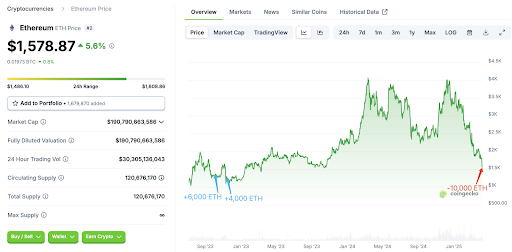

In an X post, on-chain analytics platform Lookonchain revealed that an Ethereum whale lastly capitulated after holding for over 900 days, promoting all their 10,000 ETH for $15.71 million. This whale had initially purchased 10,000 ETH for $12.95 million at a median worth of $1,295 on October 4 and November 14, 2022.

Associated Studying

The Ethereum whale didn’t promote any of their ETH holdings, even when the main altcoin broke by means of $4,000 twice in 2024. Nonetheless, the whale has now capitulated with the Ethereum price beneath $1,500, nearing their common entry worth of $1,295. The investor offered the cash for a $2.75 million revenue, whereas their unrealized revenue was $27.6 million at its peak.

This Ethereum whale isn’t the one one who’s capitulating. As Bitcoinist reported, ETH whales have dumped over 500,000 cash within the area of 48 hours. This growth is because of Ethereum’s huge crash, with the main altcoin prone to dropping decrease. This decline is a part of a broader crypto market crash, which has occurred as a consequence of Donald Trump’s tariffs.

Trump’s tariffs have led to a serious commerce battle with China, which has promised to not again down, additional sparking issues amongst traders. As such, the Ethereum worth appears extra more likely to undergo an extra crash within the meantime, which explains why these Ethereum whales are capitulating to chop their losses.

Donald Trump’s World Liberty Monetary Additionally Capitulating?

Donald Trump’s World Liberty Monetary (WLFI), an Ethereum whale, appears to be feeling the warmth and might need already began capitulating. Citing Arkham Intelligence’s information, Lookonchain revealed {that a} pockets presumably linked to WLFI offered 5,471 ETH for $8.01 million on the worth of $1,465, representing a loss for the whale in query.

Associated Studying

World Liberty Monetary had beforehand purchased 67,498 ETH for $210 million at a median worth of $3,259. The crypto agency is now sitting on an unrealized lack of $125 million, seeing because the Ethereum worth has declined by over 50% since their purchases.

Crypto analyst Ali Martinez predicts that the Ethereum worth will crash additional within the quick time period, indicating that Ethereum whales like WLFI might witness extra unrealized loss on their ETH holdings. Martinez acknowledged that $1,200 could possibly be the place the main altcoin finds its footing.

On the time of writing, the Ethereum worth is buying and selling at round $1,400, down over 8% within the final 24 hours, based on data from CoinMarketCap.

Featured picture from Unsplash, chart from Tradingview.com