Maker: Can short-term bullishness push MKR towards $1500?

- MKR has a bearish swing market construction and a bullish substructure.

- Because of the short-term bullishness, a transfer to $1,500 appeared probably.

Maker DAO [MKR] has gained 6.7% over the previous week. This determine would have been nearer to twenty%, however the swift losses of Bitcoin [BTC] on Saturday took MKR token costs down 11%.

The Maker DAO token might probably resume its upward trajectory within the coming days.

Shopping for strain alerts bullish intent

Supply: MKR/USDT on TradingView

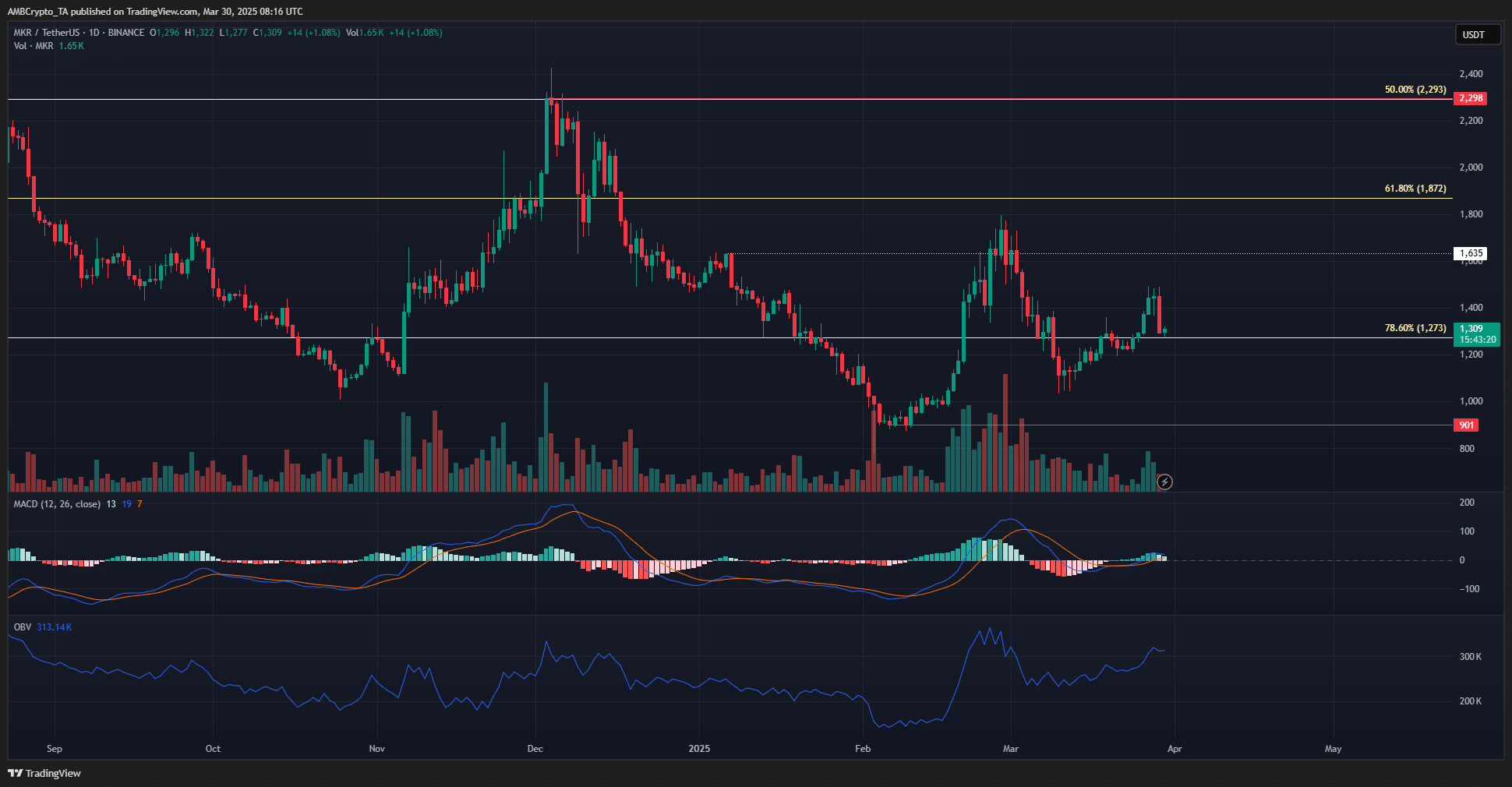

The 1-day chart confirmed that MKR has a bearish swing construction and a bullish substructure, each of that are studied utilizing swing highs and lows.

The swing construction refers back to the longer-term construction, which is prone to dictate the development within the coming months. The substructure was bullish after the late February rally past $1,635.

This bullish substructure was nonetheless in play however could be damaged if the worth fell beneath $1,115. Due to this fact, traders have motive to be cautiously optimistic. The OBV additionally agreed with this discovering.

It confirmed regular shopping for strain over the previous month. The retracement to $1,115 in early March didn’t suppress the bulls an excessive amount of.

There was renewed shopping for strain up to now three weeks as Maker DAO costs bounced from $1,115 to $1,309.

The MACD additionally climbed above the zero line, however was barely above the extent. As such, it did now present overwhelmingly bullish momentum on the every day chart.

The Fibonacci ranges additionally helped the evaluation. With the worth capable of climb again above the 78.6% stage at $1,273, it was a clue {that a} restoration was attainable.

But, because of the bearish swing construction, bulls must be ready to take earnings and lower losses shortly, if the shopping for strain begins to slacken.

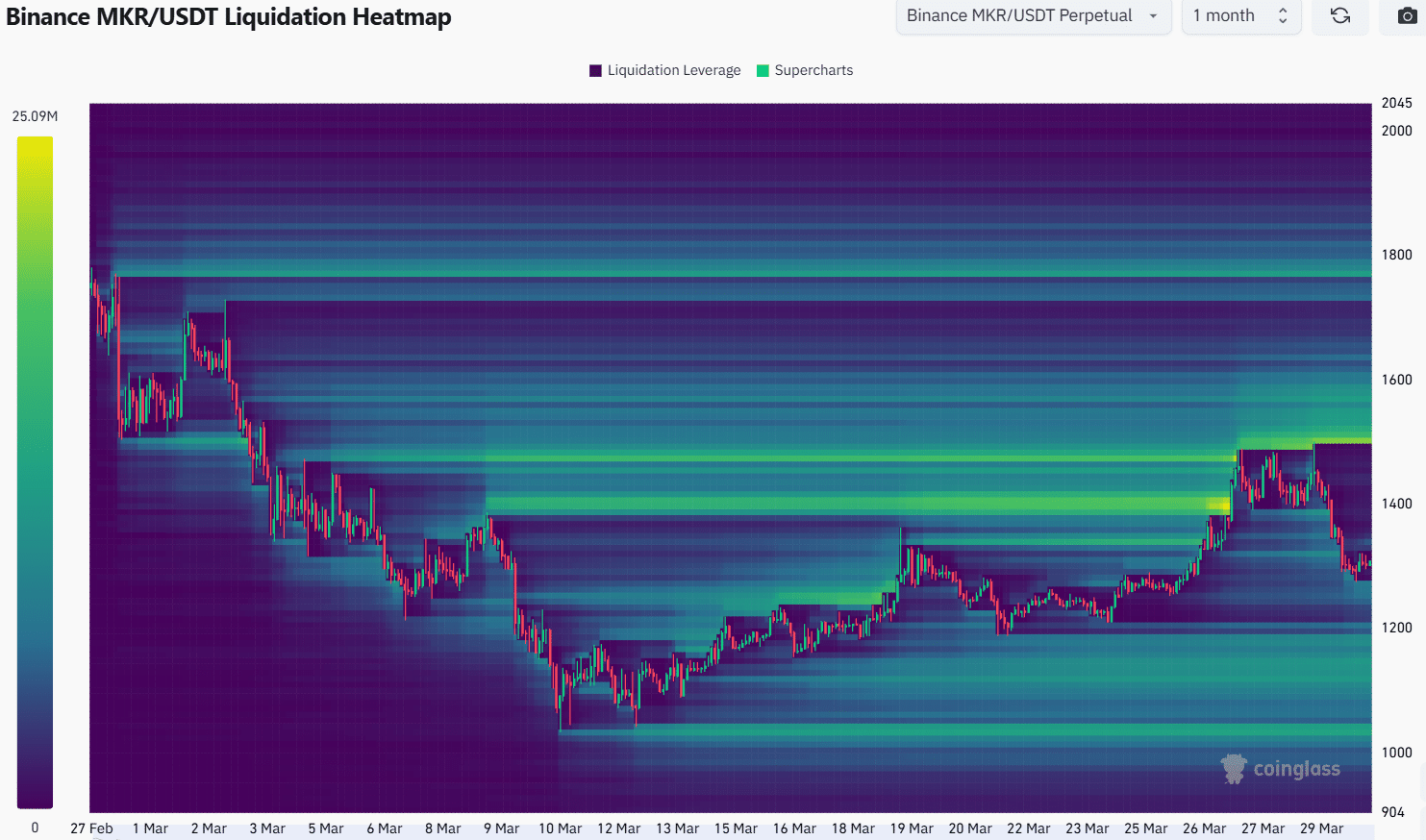

The liquidation heatmap confirmed that the $1,500 stage was the subsequent goal, because it was a robust magnetic zone. The $1,160-$1,180 was additionally a area which might appeal to the costs decrease.

Aside from the losses on Saturday, MKR has maintained a bullish development over the previous few days. This short-term bullishness might take over and drive the worth to $1,500 as soon as extra.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion