MakerDAO’s DAI supply surges but on-chain activity tells a different tale

- The DAI stablecoin witnessed a big surge in marketcap.

- MakerDAO’s MKR wasn’t seen to be influenced by surging DAI demand.

The DAI stablecoin lately skilled an enormous surge in its marketcap. Primarily based on the underlying mint and burn mechanism, the surge indicated that the stablecoin has been hit with a robust demand wave.

Learn Maker’s [MKR] worth prediction 2023-24

Assessing the demand for DAI

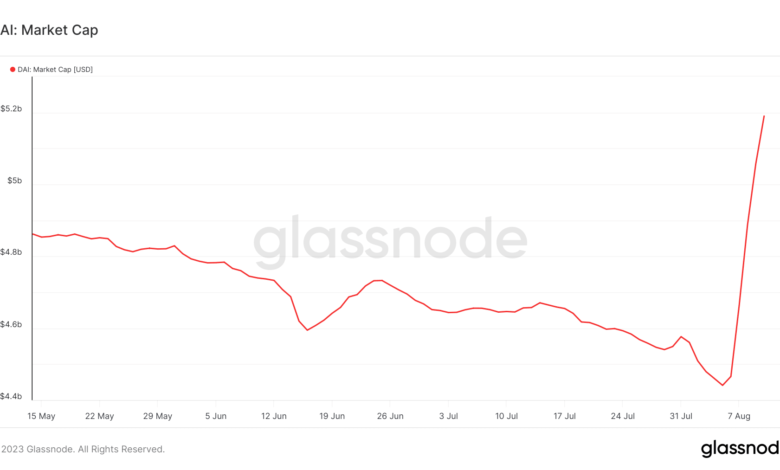

To place issues into perspective, DAI had a $4.44 billion marketcap as of 5 August. The marketcap determine soared to $5.1 billion 5 days later. This meant that DAI’s marketcap grew by roughly $750 million in only a few days.

The identical stablecoin had beforehand been experiencing liquidity outflows within the final three months.

Supply: Glassnode

So, what’s the purpose behind these observations? The sudden marketcap pivot means DAI’s provide skilled exponential development within the final 5 days. An incentive to mint DAI is the seemingly purpose for its hovering provide.

In line with current experiences, MakerDAO’s DAI financial savings charge (DSR) lately pushed as much as 8%.

MakerDAO’s DAI financial savings charge (DSR) rises to eight%, triggering a notable development in provide. Prior to now week, the quantity of DAI incomes DSR climbed by practically $1B, and the DAI provide elevated by $800M, reaching a three-month excessive. #DAI pic.twitter.com/IneytHA2wO

— IntoTheBlock (@intotheblock) August 11, 2023

Now we have to have a look at a few of the mechanics that underpin the MakerDAO ecosystem to know how the DSR was influencing DAI provide. An overcollateralized mint and burn system powers the mechanism.

Customers can deposit the accepted cryptocurrencies as collateral, which is then used to mint DAI. This minted DAI, due to this fact, acts as a mortgage issued in opposition to the deposited cryptocurrency.

The inducement behind that is that DAI holders get to earn passive revenue paid out from stability charges collected from collateralized debt positions (CDPs). An 8% DSR represents a wholesome return therefore a robust incentive to mint extra DAI. However does this translate to extra on-chain exercise?

DAI’s on-chain metrics confirmed that the surge in DAI provide doesn’t essentially recommend a surge in DAI-related transactions. For instance, energetic addresses and switch charges have been on an general downward trajectory for the reason that begin of August.

Supply: Glassnode

Alternatively, MakerDAO introduced lately that the Spark protocol has been experiencing explosive development. Extra importantly, over 198 million DAI was borrowed on the protocol since its launch in Might.

Spark Protocol launched in Might.

Three months later, it has climbed to the highest 30 DeFi protocols based mostly on whole worth locked.

From 0 to 198 million DAI borrowed — what a leap!

Let’s discover Spark Protocol’s unbelievable development.

— Maker (@MakerDAO) August 10, 2023

Is MKR benefiting from DAI’s hovering provide?

The DAI minting will seemingly not have an effect on MKR’s worth. It’s because MKR is used as a governance token and never collateral for the DAI mint and burn mechanism. MKR’s worth motion has been general bearish since 2 August. It peaked at $1366 on the identical day, but it surely exchanged fingers at $1248 at press time.

Supply: TradingView

Is your portfolio inexperienced? Take a look at the MKR Revenue Calculator

Be aware that the retracement within the first week of August represents a bullish recess contemplating that MKR was beforehand on a robust and prolonged rally. Thus, merchants might solely wait and watch which course will MKR head in over the following few days.