Mapping Ethereum’s predictions as price nears $2.3K support level

- A metric advised that Ethereum’s value was undervalued.

- Ethereum had a powerful help degree close to the $2,300 mark.

Ethereum’s [ETH] witnessed a value correction over the previous couple of days as its worth plummeted below the $2,400 mark.

Although this may need raised considerations amongst traders, a whale took this chance to stockpile extra ETH earlier than it gained bullish momentum as soon as once more.

Ethereum whales tapped the chance

The final week was a massacre for Ethereum, because it shed quite a lot of its worth. The week began with ETH’s worth going above $2,600, however issues turned bearish quickly.

In keeping with CoinMarketCap, ETH was down by greater than 7% within the final seven days. On the time of writing, ETH was buying and selling at $2,346.75 with a market capitalization of over $282 billion.

Whereas the token’s worth plummeted, whales used this as a possibility to stockpile extra ETH. Lookonchain just lately posted a tweet highlighting this incident.

As per the tweet, whales amassed a complete of 26,841 ETH, which was value over $64.5 million.

Whales are accumulating $ETH at present, with a complete of 26,841 $ETH($64.5M).

0x55C1 withdrew 7,779 $ETH($18.7M) from #Binance 2 hours in the past.https://t.co/k5s2t0kKec

0xDa17 and 0x278f (presumably the identical particular person) withdrew 8,077 $ETH ($19.4M) from #Bitfinex.https://t.co/CyfU4ZMcV8… pic.twitter.com/YDJqpeTLTU

— Lookonchain (@lookonchain) January 22, 2024

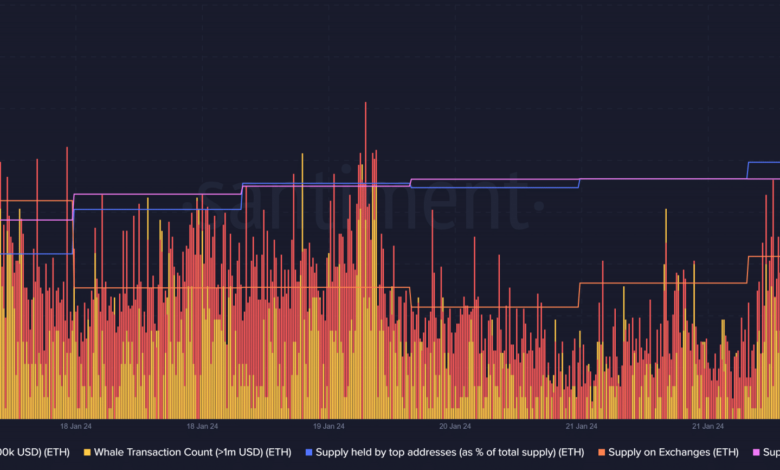

To double-check this pattern, AMBCrypto took a take a look at Santiment’s information. Our evaluation revealed that whale exercise round ETH elevated final week as its Whale Transaction Depend spiked.

The provision held by the highest addresses additionally went up, indicating excessive accumulation.

Supply: Santiment

The broader market additionally appeared to have been accumulating extra ETH whereas its value remained low.

This was evident from the truth that ETH’s Provide on Exchanges dropped, whereas its Provide exterior of Exchanges elevated within the final week.

This may need been the appropriate time to build up ETH earlier than its value takes off.

AMBCrypto’s take a look at Glassnode’s information revealed that ETH’s Community Worth to Transactions (NVT) ratio declined sharply on the twenty first of January.

Each time the metric drops, it signifies that the asset is undervalued, hinting at a pattern reversal for Ethereum.

Supply: Glassnode

Ethereum to start a bull rally quickly?

To know whether or not Ethereum would start a rally within the coming days, we checked its liquidation ranges. As per our evaluation, ETH has a powerful help zone close to the $2,300 mark.

Subsequently, it gained’t be stunning to see ETH contact that degree earlier than it regains bullish momentum.

Supply: Hyblock Capital

Learn Ethereum’s [ETH] Value Prediction 2024-25

Ethereum’s MACD displayed a transparent bearish higher hand out there at press time.

Its Cash Circulate Index (MFI) additionally registered a downtick, suggesting that the potential for ETH touching $2,300 earlier than beginning a bull rally was excessive.

Supply: TradingView