Market Guru Predicts Price Dip Below $20,000

Bitcoin (BTC) has been struggling to regain its momentum as its worth stays caught beneath the $27,000 mark. This extended interval of stagnation has prompted Michael J. Kramer, a famend market strategist, to voice his apprehensions about an impending market breakdown for Bitcoin.

Taking to Twitter, Kramer shared his considerations, highlighting the potential dangers and uncertainties surrounding the cryptocurrency’s worth trajectory.

Because the cryptocurrency’s worth stays inert, it’s essential to look at the elements contributing to this example and delve into its implications for buyers and the broader crypto panorama.

Bitcoin Worth: Considerations Come up Over Potential Slide Beneath $20K

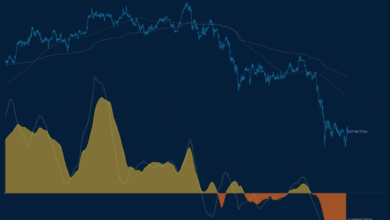

Because the cryptocurrency market faces one other bout of turbulence, Bitcoin’s worth has faltered, with the present worth pegged at $26,863, based on CoinGecko. The crypto has misplaced 2.1% of its worth within the final seven days.

In his evaluation, Kramer not solely highlights the potential for Bitcoin to achieve the important psychological degree of $20,000 but additionally attracts consideration to the implications such a downturn could have on the broader inventory market.

Supply: Coingecko

Bitcoin serves as a barometer for different threat belongings, offering precious insights into market sentiment. Ought to Bitcoin expertise a considerable slide beneath the $20,000 threshold, it may sign elevated threat aversion amongst buyers, probably dampening confidence within the inventory market and different asset courses.

Regulatory Uncertainty Casts Darkish Clouds For Bitcoin

Simply as analysts eagerly anticipated a possible breakout in Bitcoin’s worth, the cryptocurrency market took an surprising flip, descending right into a interval of decline fueled by heightened regulatory uncertainty.

Regardless of preliminary optimism, the prevailing macroeconomic local weather and regulatory challenges have conspired to dampen the prospects of a big worth surge within the close to time period.

Analysts had speculated that Bitcoin may expertise an inflow of funding if the US had been to default on its debt obligations. Nevertheless, this potential situation carries substantial threat, as there’s a actual risk that the US Treasury could face a scarcity of funds. The implications of such a liquidity crunch may very well be felt throughout the crypto house, impacting the general demand and sentiment for digital belongings.

BTCUSD nonetheless caught within the $26K territory. Chart: TradingView.com

Volatility Anticipated To Persist

Including to the market’s woes, Democrats in the US legislature have taken steps to solidify the Securities and Trade Fee’s (SEC) authority over cryptocurrencies. This transfer has raised considerations {that a} important variety of tokens could also be categorised as securities, probably subjecting them to stricter rules.

The prospect of elevated regulatory scrutiny looms over the crypto market, injecting a component of uncertainty and warning amongst buyers and trade members.

In gentle of those developments, the volatility that has lengthy characterised the crypto market is more likely to persist.

-Featured picture from Pixabay