Market panic hits Bitcoin: Is a year-end BTC rally still on the cards?

- Bitcoin’s derivatives metrics seemed optimistic.

- However promoting stress remained dominant out there.

Bitcoin [BTC] has been fighting its value motion because it has didn’t fulfill traders of late. This has sparked concern in your complete neighborhood, as urged by newest datasets.

Nevertheless, this panic out there may have the potential to show issues round for the king coin.

Bitcoin traders are panicking!

Bitcoin’s value witnessed an over 11% value correction final week, pushing its value beneath $95k. In reality, AMBCrypto reported earlier that as we approached the Santa Claus rally, an occasion that traditionally has pushed the crypto market up, Bitcoin was struggling.

On the time of writing, the king coin was buying and selling at $94,078 with a market capitalization of over $1.86 trillion.

It was attention-grabbing to notice that regardless of the double-digit weekly correction, only one.98 million BTC addresses have been “out of the cash,” which accounted for lower than 4% of the full variety of Bitcoin addresses, as per IntoTheBlock’s data.

Amidst all this, Santiment, an information analytics platform, posted a tweet, highlighting a notable growth. Based on the tweet, the crypto markets have opened the week retracing additional, instilling panic towards the retail crowd.

Notably, Bitcoin and Ethereum [ETH] are seeing huge FUD from newer merchants who joined markets prior to now 2–3 months.

The tweet talked about,

“Traditionally, when retail merchants start to promote based mostly on panic and emotion, whales and sharks have alternatives to scoop up extra cash with little resistance, creating bounces.”

Due to this fact, there’s a excessive risk of a development reversal as we rely the remaining days of this yr.

Will BTC register greens quickly?

As per our evaluation of CryptoQuant’s data, promoting sentiment remained dominant out there. This was evident from the rising change reserve.

Nevertheless, Santiment’s tweet talked about that if whales scoop up BTC, it may set off a reversal. However that was additionally not occurring.

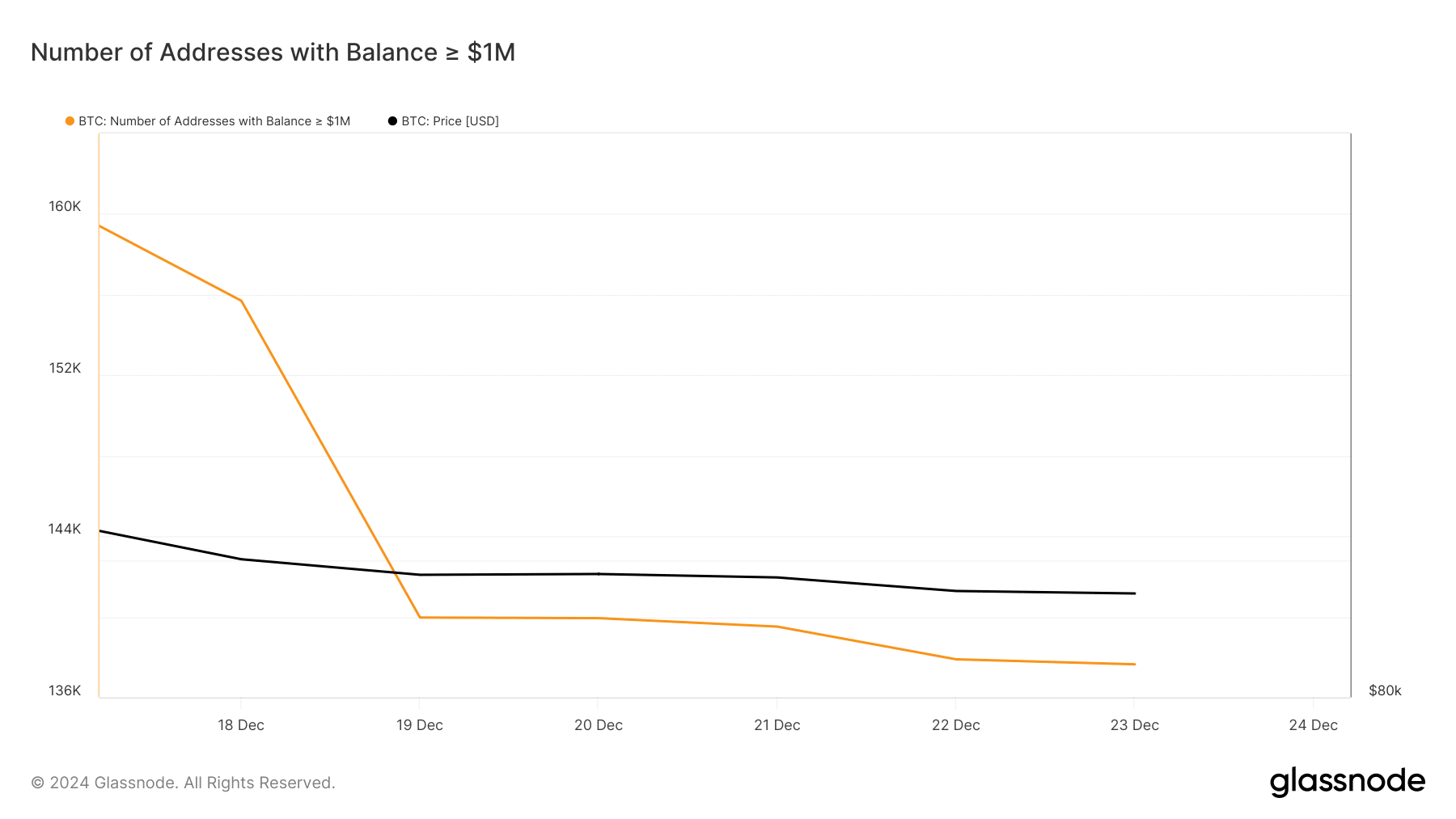

Bitcoin’s variety of addresses with balances of greater than $1million declined sharply final week, indicating that the big-pocketed gamers have been additionally promoting their holdings, which may trigger extra bother for BTC within the coming days.

Supply: Glassnode

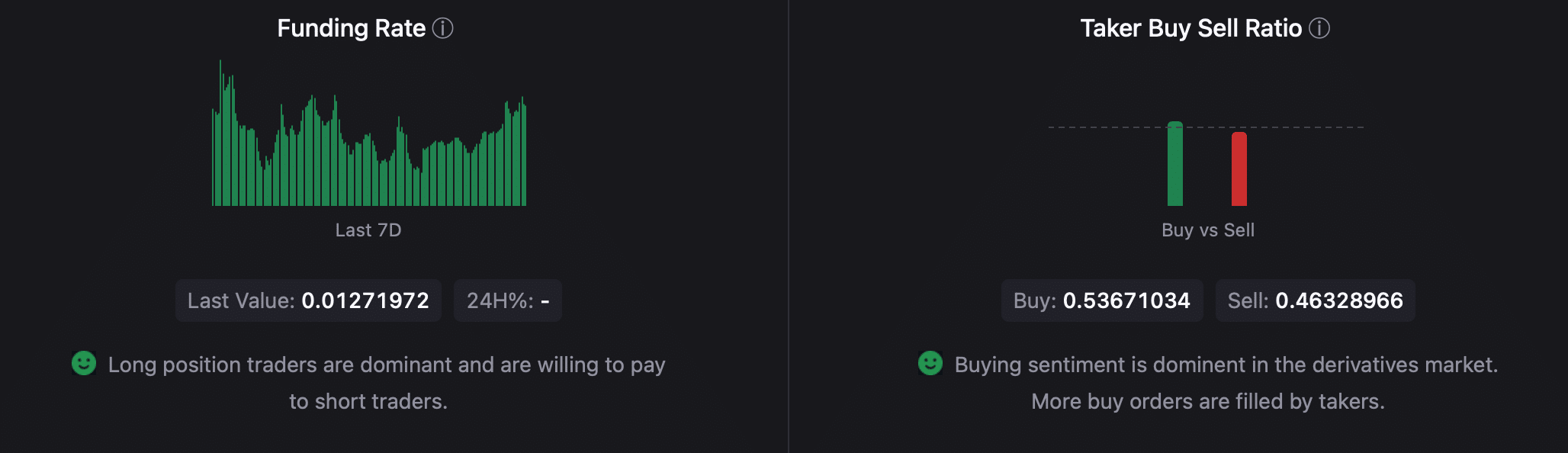

Nonetheless, issues within the derivatives market seemed bullish as BTC’s funding price was rising.

Learn Bitcoin [BTC] Value Prediction 2024-25

A funding price improve within the crypto market implies that the price of holding lengthy positions will increase—an indication of rising bullish sentiment round an asset.

The taker purchase/promote ratio was additionally inexperienced. This meant that purchasing sentiment was dominant within the derivatives market. If these metrics are to be believed, then anticipating a development reversal for BTC isn’t too formidable.

Supply: CryptoQuant