Stablecoin supply hits $233B in April: USDT, USDC tighten grip on 90% of the market

- USDT leads with $144B cap, capturing 63% of the whole stablecoin market share.

- Stablecoin market cap rose 9.61% between January and April 2025.

The stablecoin sector noticed record-breaking development within the first quarter of 2025.

In accordance with information from IntoTheBlock, the whole stablecoin provide hit $220 billion by April 2025, earlier than rising to $233.47 billion by the primary week of April. It goes on to point out three issues.

Supply: IntoTheBlock

Rising institutional adoption, elevated demand for on-chain liquidity, and the centralization of market energy between two dominant issuers: Tether (USDT) and USD Coin (USDC).

USDT’s standing as crypto’s de facto liquidity engine

USDT boasted a commanding $144B+ market cap, translating to 63% of whole stablecoin provide. USDC, whereas trailing, has reclaimed momentum with a market cap of $59B and a 27% share.

Supply: IntoTheBlock

Collectively, these two juggernauts management over 90% of your entire stablecoin market—leaving little room for challengers and pointing squarely to a centralized energy dynamic.

This development aligns with Circle’s upcoming IPO plans

Lately, Circle filed to go public underneath the ticker “CRCL” on the New York Inventory Alternate.

Backed by JPMorgan and Citigroup, Circle eyes a $5B IPO—regardless of internet revenue sliding 42%, from $268M to $156M.

Nonetheless, the timing is not any accident. The rising stablecoin market affords a positive backdrop for such a transfer, probably rekindling institutional curiosity at scale.

Stepping again, the stablecoin market grew from $206B in January to $225.8B in April, marking a 9.61% improve in simply three months. Nevertheless, this momentum isn’t common.

DAI, FRAX, and TUSD noticed sluggish development, clinging to underneath 10% of market share—a transparent sign of weak traction.

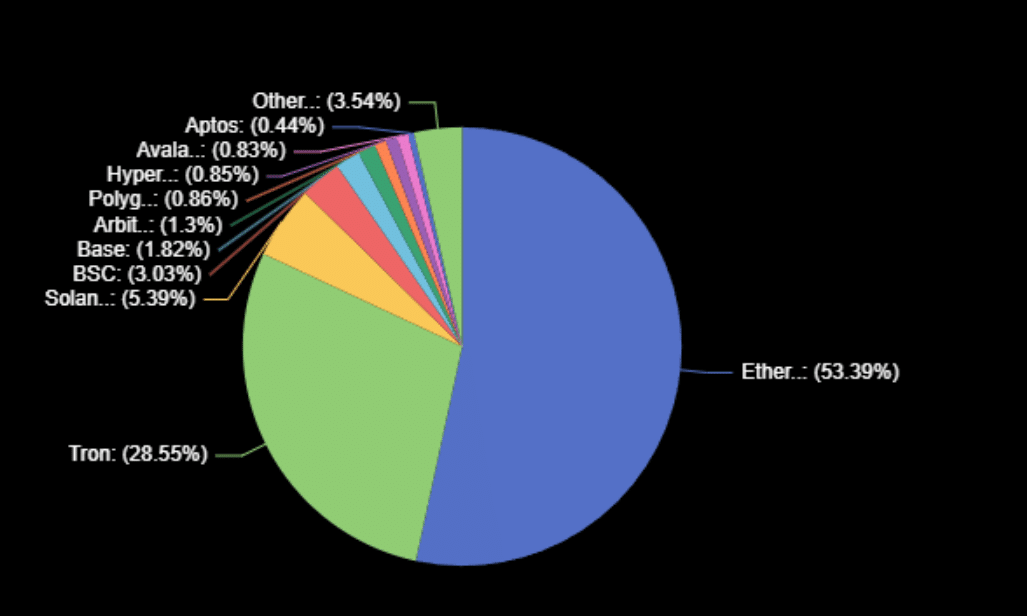

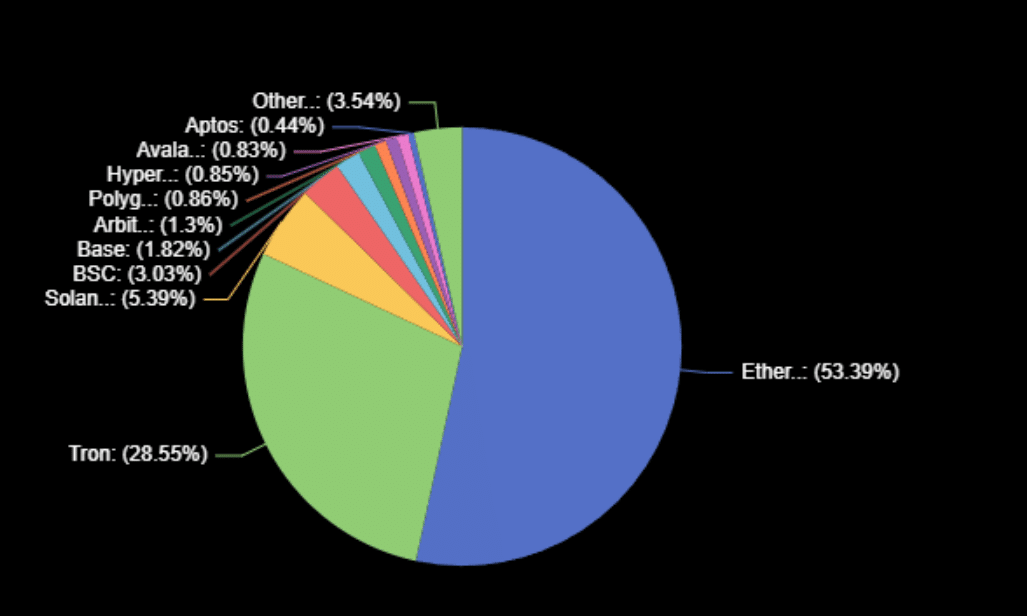

Ethereum nonetheless leads, however Tron is catching up

From a platform perspective, Ethereum [ETH] stays the stronghold, internet hosting 53.39% of all stablecoins. Tron follows with 28.55%, whereas Solana [SOL], BSC, Base [B3], and Arbitrum [ARB] share the remaining fragments.

Supply: DefiLlama

This distribution, whereas according to previous developments, subtly hints at a platform bifurcation, the place Layer 1 and Layer 2 chains more and more specialize.

Having stated that, whereas provide has surged, change exercise paints a extra unstable image.

Supply: IntoTheBlock

February 2025 recorded peak inflows and outflows at $106.57B and $106.01B, respectively. But by March, the tide turned: internet outflows hit -$2.9B, the biggest quarterly drop.

April then noticed a pointy cool-off, with each inflows and outflows plunging over 80% from March ranges.

On prime of that, the thirty first of March witnessed the biggest single-day outflow—a hanging $1.54B, following a hefty $1.39B influx on the third of February.

So the place does this depart the sector?

On one hand, stablecoin provide is scaling excessive, and USDC’s rebound—coupled with IPO information—is reigniting institutional optimism.

On the opposite, falling change flows could sign market fatigue, profit-taking, or a pivot to long-term holding methods.

The approaching quarters will reveal whether or not a broader decentralization is feasible—or whether or not stablecoins will proceed working underneath a decent, two-player regime.