Metaplanet Repays ¥2B Bonds Early Amid Growing Bitcoin Strategy

In a strategic monetary transfer, Metaplanet has fully repaid its ¥2 billion in zero-interest bonds months forward of schedule. Funded via EVO FUND’s train of inventory warrants, the early payoff helps streamline the corporate’s stability sheet with out denting earnings. The transfer indicators sturdy capital administration as Metaplanet doubles down on its Bitcoin-focused technique.

This full compensation follows an earlier ¥1.5 billion partial payoff on March 27, 2025, funded via EVO FUND’s train of inventory warrants. For the reason that bonds carried no curiosity, the transfer is predicted to have minimal impression on Metaplanet’s 2025 earnings.

Metaplanet has considerably ramped up its Bitcoin accumulation, now holding 4,046 BTC valued at roughly $344.6 million. Over the previous 7 days alone, the corporate added 696 BTC (value about $59.28 million), and over the past 30 days, it collected a complete of 1,811 BTC (value $154.26 million).

The chart clearly exhibits a pointy upward pattern in its holdings ranging from late February 2025, marking its most aggressive shopping for section thus far. Whereas the market noticed widespread panic promoting, Metaplanet made its largest Bitcoin buy but, doubling down on its long-term guess on digital property.

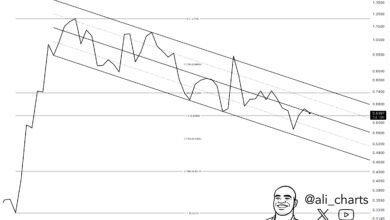

Metaplanet is feeling the warmth as Bitcoin costs drop. Its inventory plunged 20% in a single day, reflecting investor concern over its heavy crypto publicity. In the meantime, Bitcoin crashed 10% in 24 hours, falling to $74,600 amid rising world commerce conflict fears. This marks its lowest degree in weeks, as traders rushed to cut back threat. Bitcoin dominance surged to 63%, its highest since early 2021, highlighting the broader market’s retreat from altcoins.

MetaPlanet CEO Simon Gerovich reaffirmed the corporate’s confidence in Bitcoin. “On Bitcoin’s down days, it’s straightforward to deal with the worth, however these are instances when perception is examined and nurtured. Volatility is a pure a part of an asset that’s actually uncommon, diversified, and has long-term potential,” he emphasised in a contemporary X post.