Metaplanet’s 2025 vision: CEO outlines plan to acquire 10,000 BTC

- Metaplanet goals to develop its Bitcoin holdings to 10,000 BTC by 2025.

- Bitcoin’s surge to $100K drives institutional curiosity, boosting Metaplanet’s inventory and crypto technique.

The ultimate month of 2024 marked a historic milestone for Bitcoin [BTC], because the main cryptocurrency surged previous the $100,000 mark.

Regardless of dealing with a number of fluctuations, BTC was buying and selling at $99,234.19, at press time, after a modest 0.87% improve within the final 24 hours, in accordance with CoinMarketCap.

Metaplanet’s 2025 plan

Using the wave of this bullish momentum, Metaplanet has introduced formidable plans to extend its Bitcoin holdings fivefold, concentrating on 10,000 BTC by 2025.

Additionally, offering insights on the identical, Metaplanet CEO Simon Gerovich took to X (previously Twitter) and stated,

“In 2025, we purpose to increase our Bitcoin holdings to 10,000 BTC by using essentially the most accretive capital market instruments out there to us.”

Gerovich outlined formidable targets for the agency’s future, specializing in transparency and deepening shareholder engagement via progressive initiatives.

The group plans to harness partnerships to drive Bitcoin adoption inside Japan and globally, solidifying its function within the crypto ecosystem.

Is Metaplanet taking inspiration from MicroStrategy?

Metaplanet’s technique mirrors MicroStrategy’s famend Bitcoin funding strategy, positioning the agency as a serious participant in cryptocurrency.

The agency presently holds 1,762 BTC, valued at $173.4 million from 19 acquisitions. This makes it the biggest company Bitcoin holder in Asia.

On the twenty third of December, the corporate introduced a major buy of 619.7 BTC at a mean worth of ¥15.3 million ($97,786) per Bitcoin. This buy pushed its whole holdings to 1,761.98 BTC, valued at over $164 million.

In keeping with BitcoinTreasuries information, it now ranks fifteenth globally amongst publicly listed firms in Bitcoin possession. Gerovich put it greatest when he mentioned,

“Collectively, we’re not simply constructing an organization however driving a motion.”

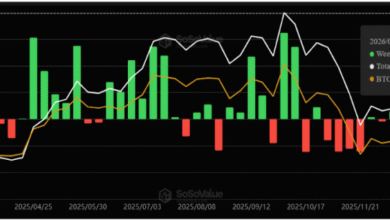

Influence on Metaplanet’s inventory worth

Metaplanet’s formidable BTC accumulation technique aligns with bullish predictions from asset managers like VanEck and Bitwise. They foresee Bitcoin surging to $180,000–$200,000 by 2025, probably even increased below a pro-crypto U.S. administration.

This technique has positively influenced Metaplanet’s inventory efficiency, with shares climbing 2.73% to ¥3,575.00, reflecting rising investor confidence in its forward-looking strategy.

It stays to be seen how rising institutional demand for Bitcoin will reshape the broader crypto market.