Ethereum Surges, Solana and Base Close Behind

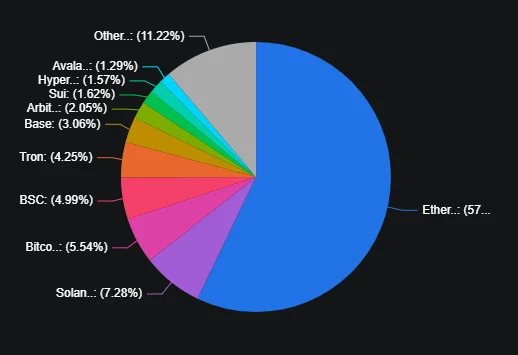

DeFi’s multi‑chain story this week is one in every of each consolidation and diversification. In line with DeFiLlama’s July 12 knowledge, the ten blockchains locking up probably the most capital noticed a mixed Complete Worth Locked (TVL) of over $114 billion, with Ethereum alone accounting for almost two‑thirds of that complete.

Whereas Ethereum’s TVL jumped nearly 11% on the again of unlocked staking rewards from the Shanghai improve, capital additionally flowed into excessive‑pace networks and rollups, exhibiting DeFi’s evolving, multi‑chain actuality. From Bitcoin’s rising yield‑bearing devices to the emergence of latest layer‑2 contenders, this week’s figures reveal each the enduring clout of older chains and the rising attraction of subsequent‑technology platforms.

Ethereum and the Layer‑1 Heavyweights

This week, Ethereum as soon as once more asserted its supremacy in decentralized finance, with Complete Worth Locked surging by almost 11% to about $72.1 billion. A lot of that influx stems from renewed exercise on lending platforms and automatic market makers following the Shanghai improve, which unlocked beforehand staked ETH and unleashed contemporary liquidity throughout the community’s main protocols.

Not far behind, Bitcoin’s DeFi ecosystem, powered largely by wrapped BTC devices and BTC‑pegged swimming pools, noticed its TVL climb roughly 11% to $6.9 billion, exhibiting that Bitcoin is now not only a retailer of worth however an more and more lively yield‑searching for asset.

In the meantime, BNB Sensible Chain (BSC) added round 4.5% (lifting its TVL to $6.2 billion) as engaging yields on BSC‑native AMMs and contemporary bridge deposits from different networks continued to attract capital. TRON additionally booked an 11.4% weekly acquire, now holding $5.3 billion, because of its rock‑backside charges and increasing USDT‑backed liquidity swimming pools.

Layer‑2 Rollups and Rising Contenders

Past the large three, a bunch of layer‑2 options and different chains are carving out their niches. Solana recorded a 7.4% uptick to roughly $9.1 billion, pushed by excessive‑throughput DEX exercise and a spate of latest lending protocols on its quick, low‑charge community. Coinbase’s Base rollup impressed with an 11.6% weekly acquire, pushing its TVL near $3.9 billion, as each merchants and builders flock to its Ethereum‑backed atmosphere.

Different notable performers embody Arbitrum (slipping simply 0.9% to $2.5 billion), Avalanche (+7.9% to $1.6 billion), Polygon (+1.4% to $1.1 billion), and OP Mainnet, which led the pack with a 16.1% bounce, rounding out the highest ten and collectively highlighting that DeFi’s future is undeniably multi‑chain.

The capital continues to ebb and movement between layer‑1 behemoths, rollups, and different networks, so maintaining a tally of these ten chains will stay important for anybody monitoring the place probably the most thrilling DeFi innovation and the deepest swimming pools of liquidity are happening.