- Crypto mining shares have misplaced $12 billion, regardless of Bitcoin’s stability

- Decoupling between mining shares and Bitcoin might foreshadow volatility and deeper market stress

Crypto mining shares have taken a pointy hit, shedding over $12 billion in market worth and returning to early 2024 ranges. What’s notably notable isn’t simply the size of the drop, however the timing – Occurring regardless of Bitcoin’s [BTC] relative value stability. This decoupling between mining shares and BTC is elevating issues. Particularly because it usually precedes durations of market turbulence.

Might this be an indication of tough waters forward for the crypto sector?

The $12 billion retreat

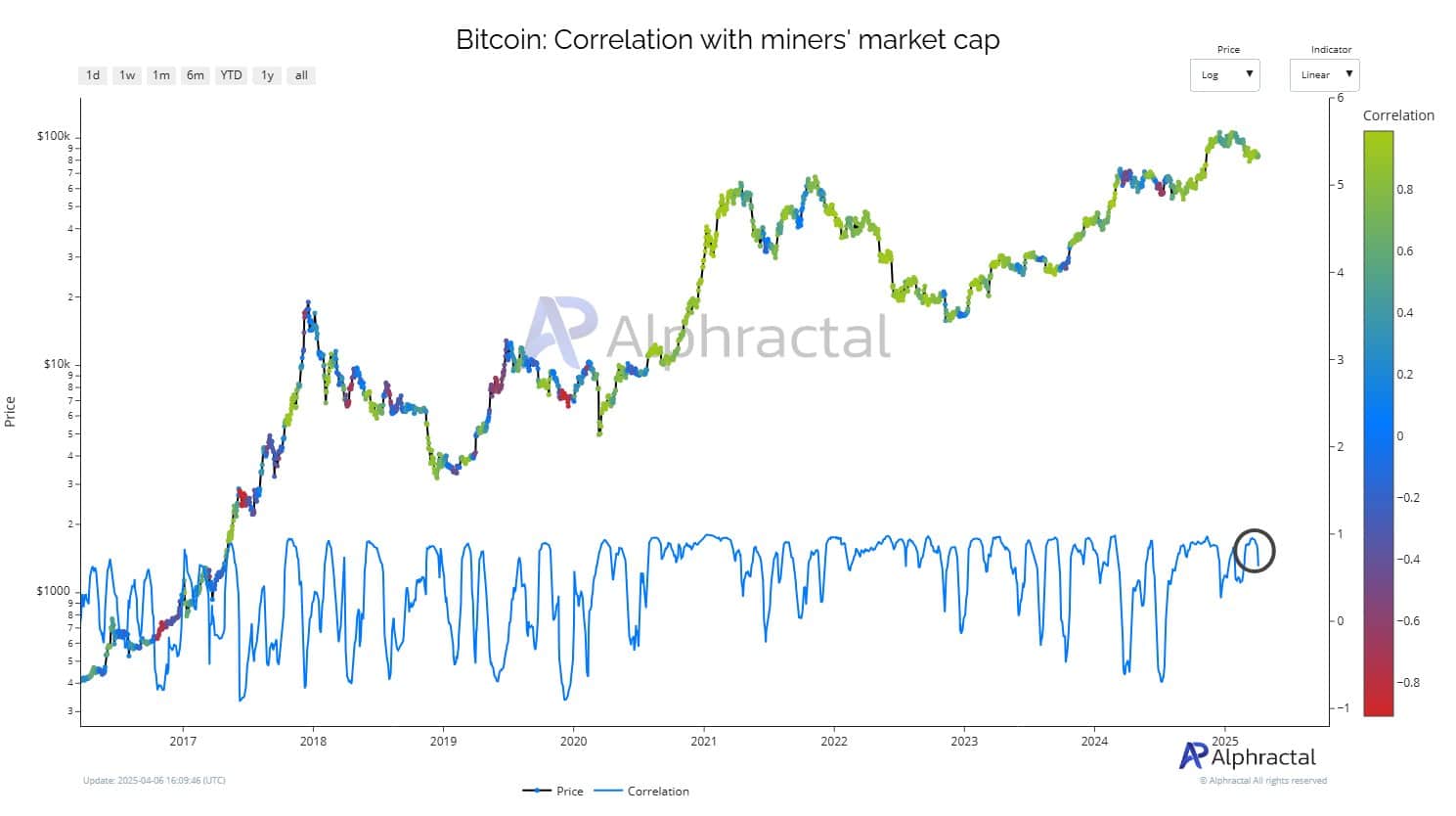

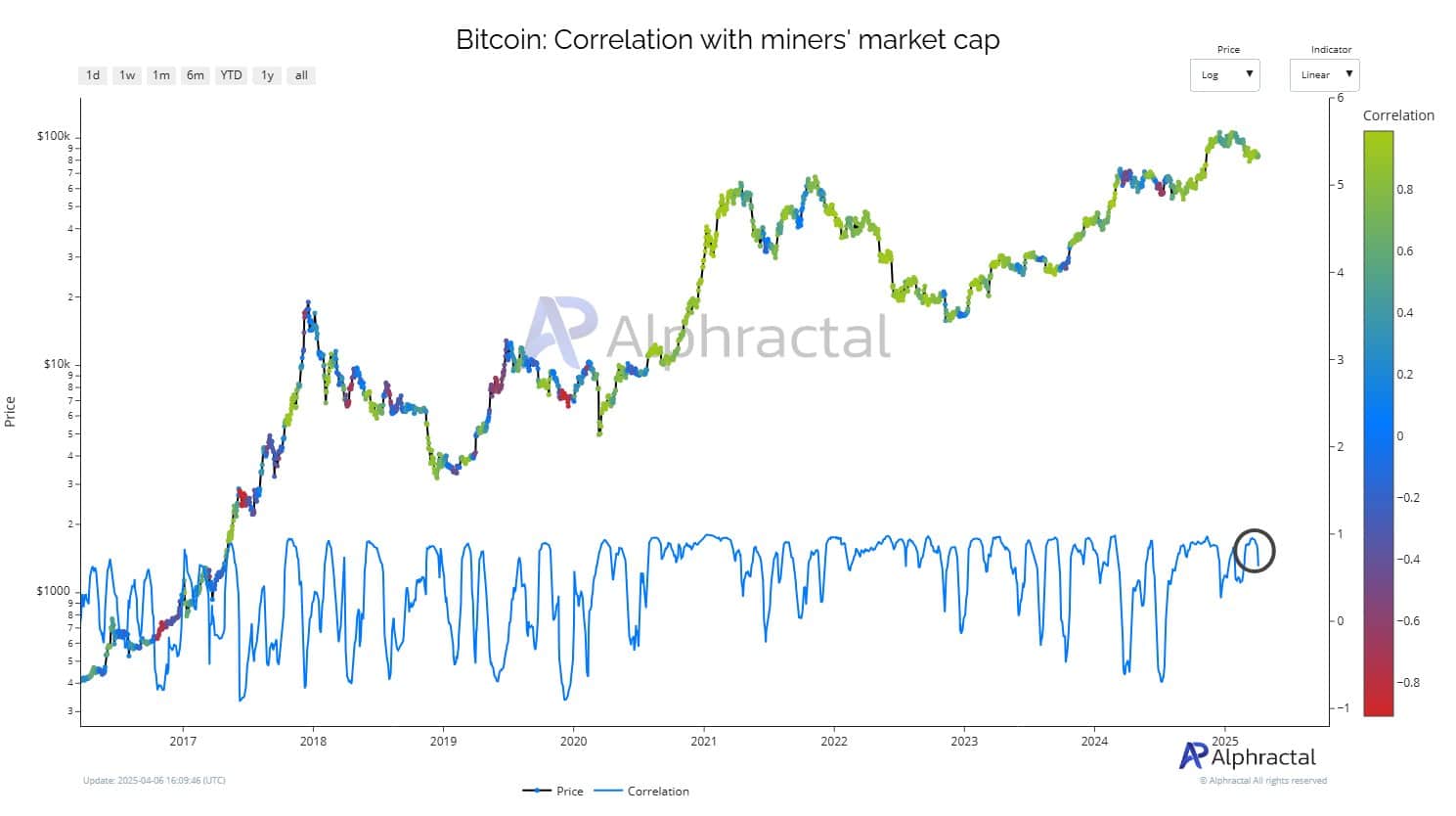

Supply: Alphractal

Bitcoin mining shares have misplaced over $12 billion in market worth since February, falling from above $36 billion to below $24 billion – Erasing all positive aspects made in early 2024. Key miners have seen sharp double-digit declines.

What’s notable is that this plunge comes at the same time as Bitcoin’s value stays comparatively secure.

Decoupling from BTC – A purple flag?

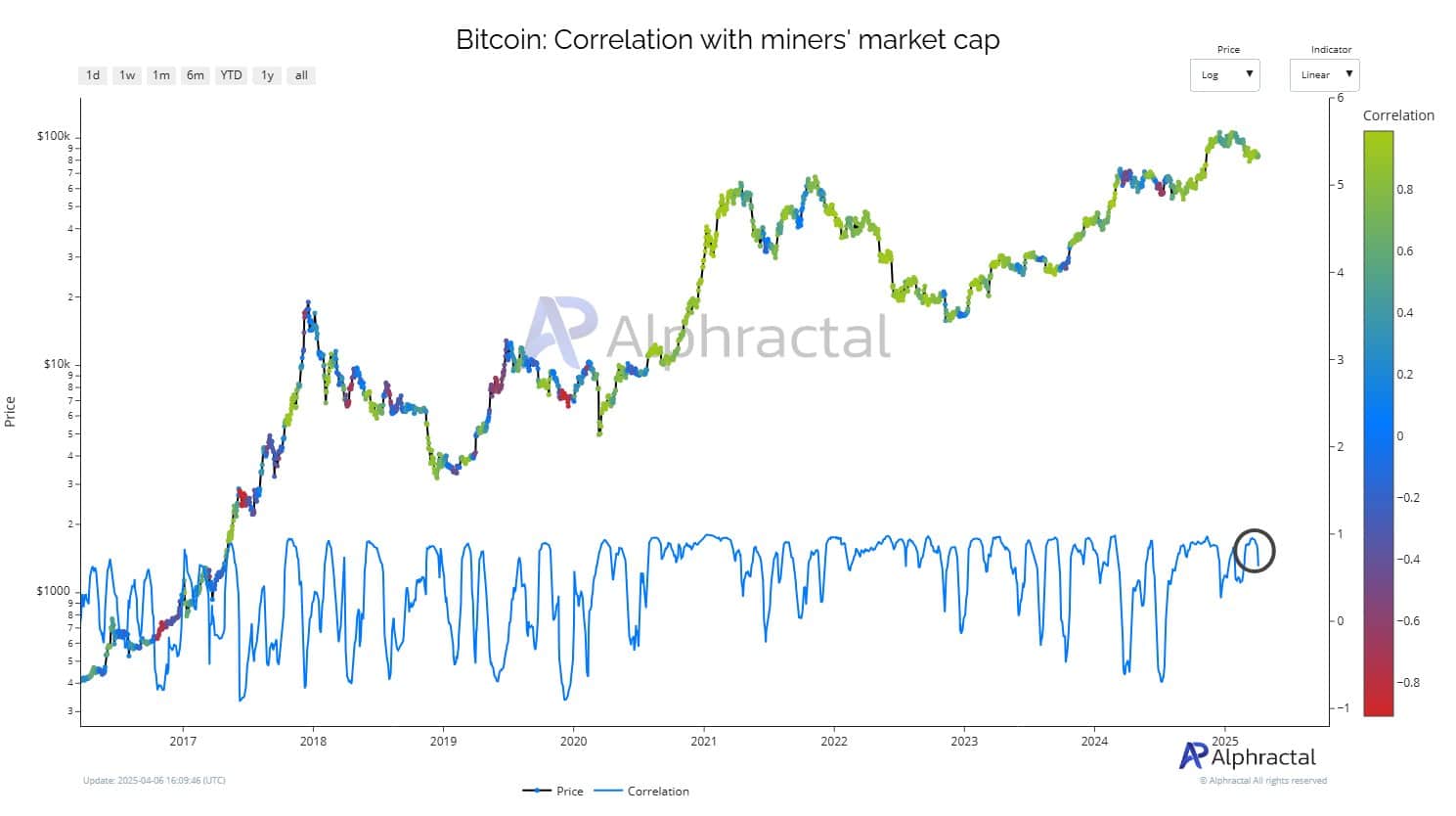

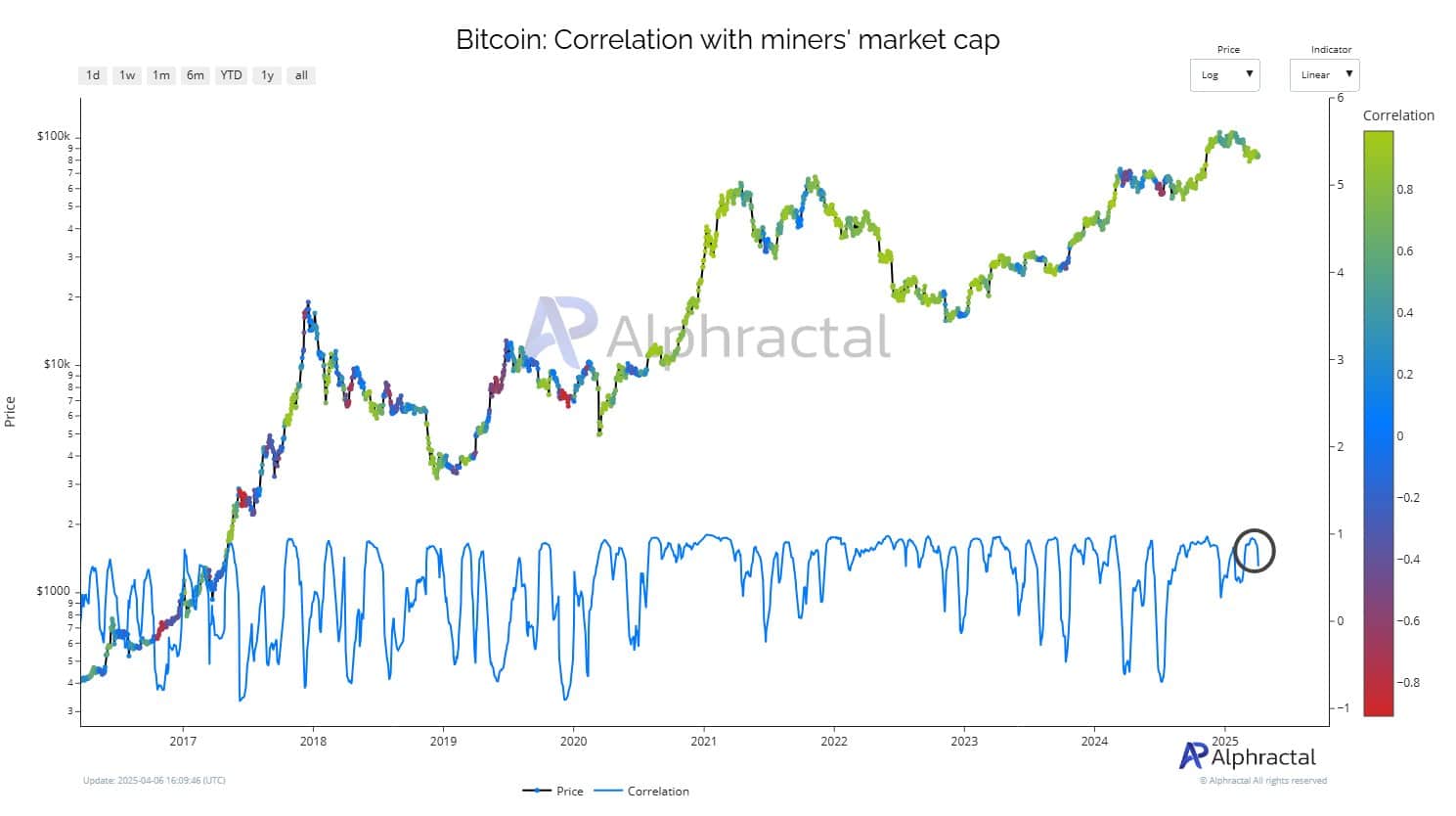

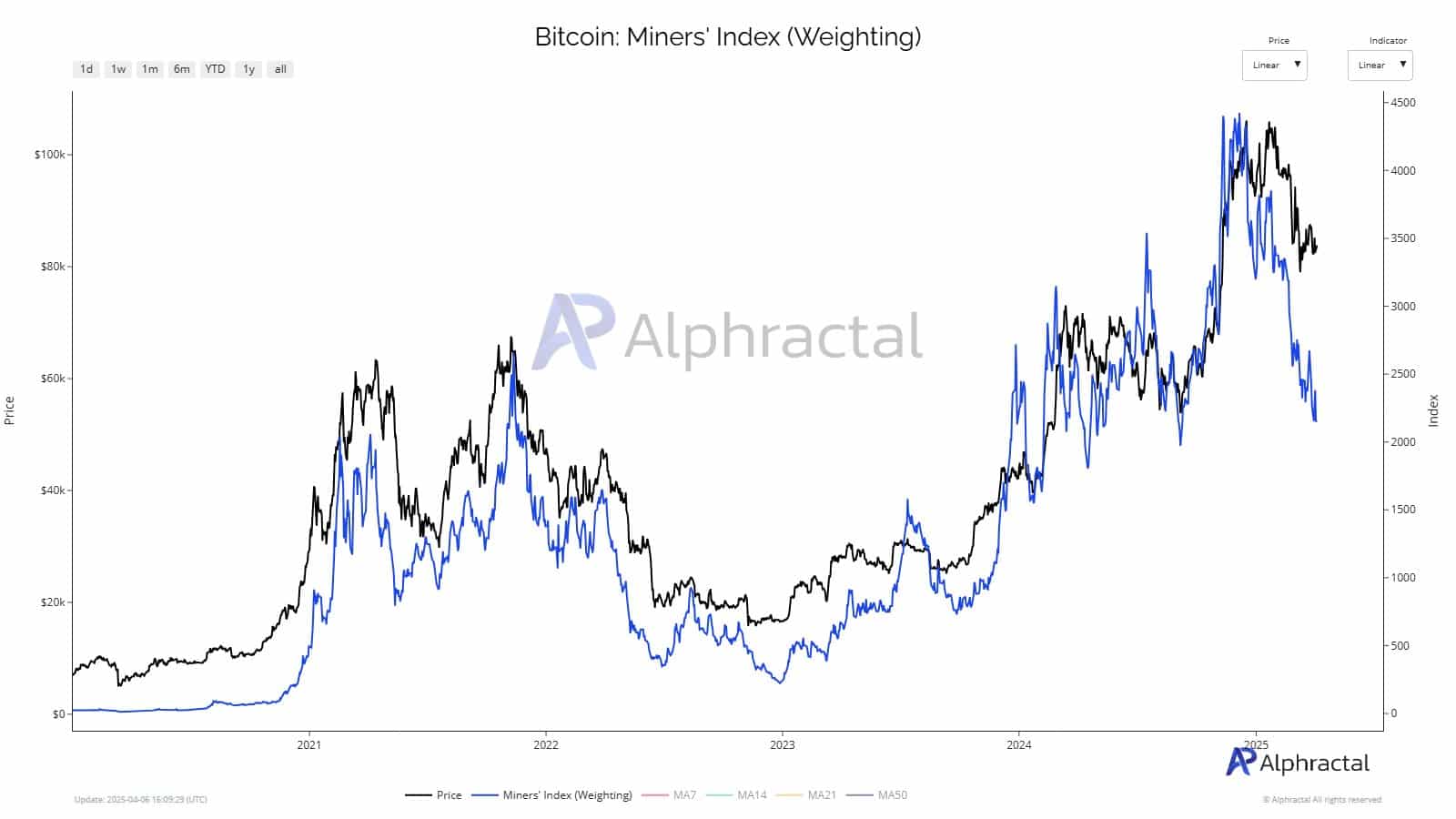

Miners are breaking away from Bitcoin – and never in a great way. Regardless of BTC holding above its $65k help, miner fairness valuations have tumbled, triggering a steep decline in correlation.

Actually, knowledge underlined that the correlation between Bitcoin’s value and miners’ market cap dipped sharply, nearing unfavourable territory for the primary time since mid-2022.

Supply: Alphractal

Traditionally, such decouplings have preceded volatility spikes or directional shifts in BTC.

Whether or not this alerts a market re-evaluation of miners, structural stress forward of the halving, or broader sentiment cracks – This time feels totally different.

Miners’ profitability and sentiment below stress

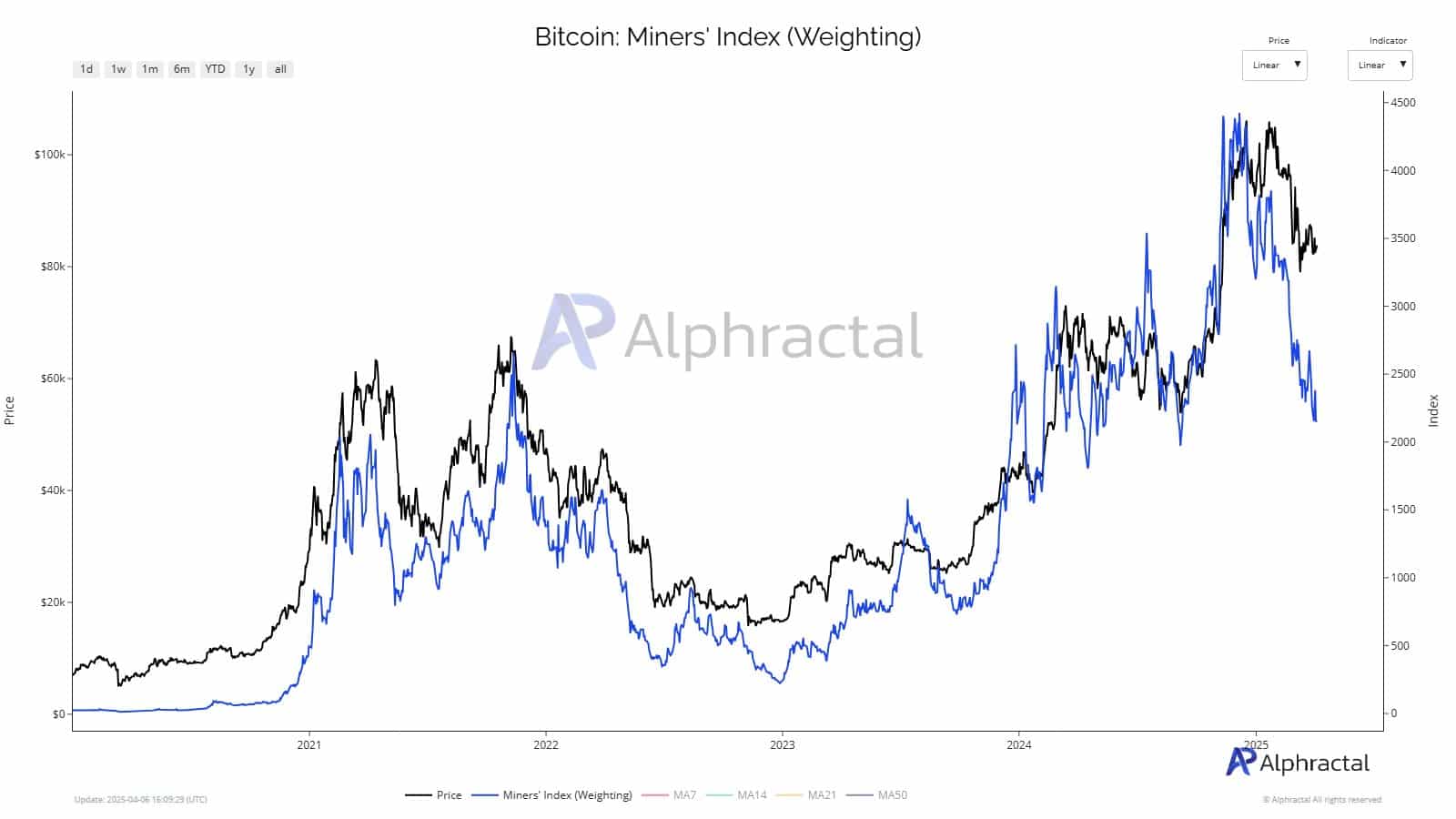

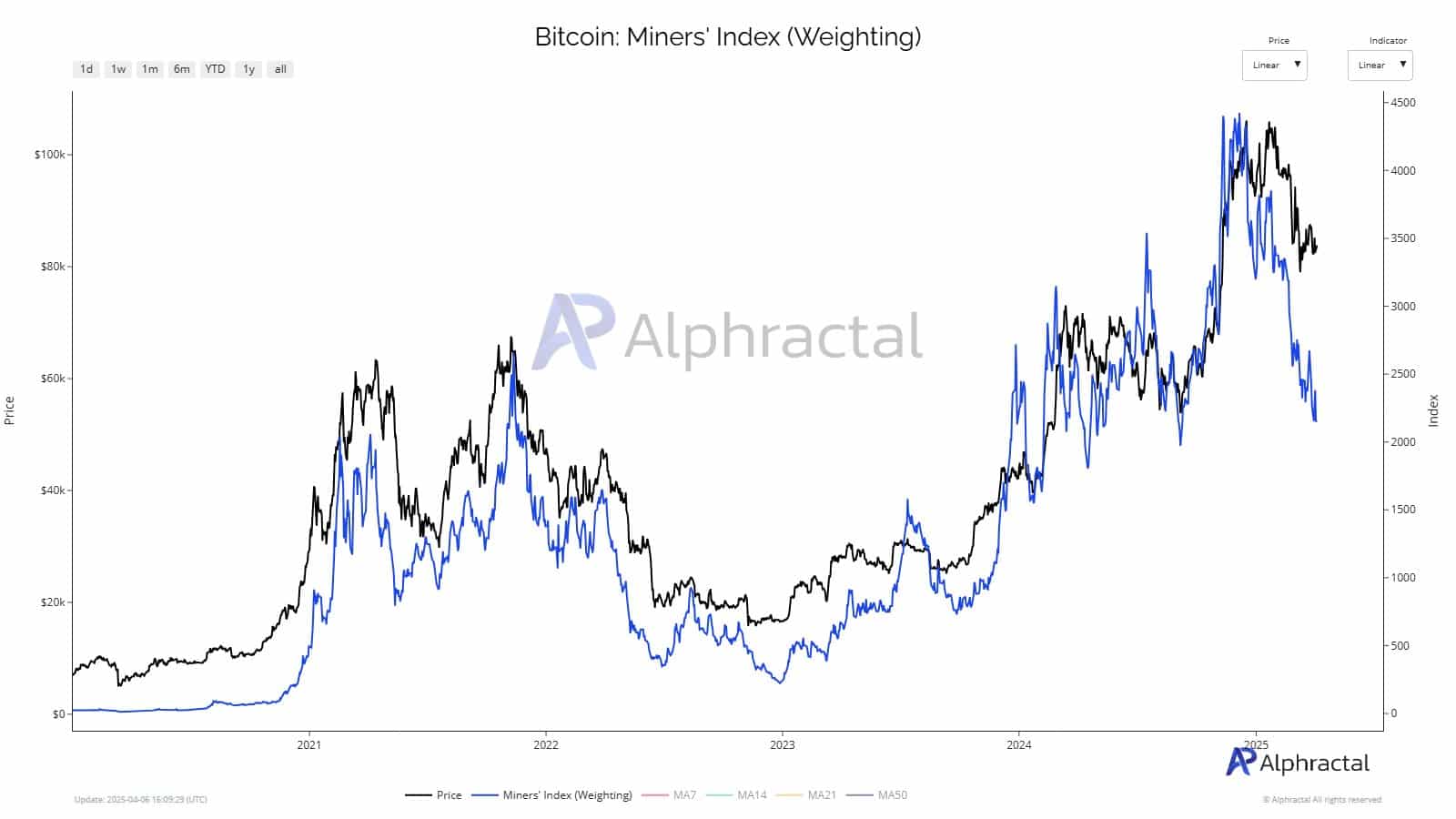

Put up-halving economics, rising vitality prices, and trade-related uncertainty – particularly round President Trump’s April tariff hints – are squeezing Bitcoin miners. The miners’ index highlighted a pointy decoupling from Bitcoin’s value, reflecting deep stress throughout the sector.

On the similar time, investor urge for food seems to be shifting too.

Supply: Alphractal

Based on Galaxy Digital, as an example, Spot Bitcoin ETFs are gaining favor, providing publicity with out the operational and regulatory dangers tied to mining companies.

CEO Mike Novogratz has additionally emphasised ETF-driven inflows as a serious bullish drive for BTC in 2025. With capital rotating out of miner shares, miners could face a sentiment winter at the same time as Bitcoin rallies.

What this implies for the broader market

The decoupling between Bitcoin miners’ shares and BTC’s value could also be a warning sign. Related divergences in early 2022 preceded broader corrections, suggesting miners might once more be a number one indicator of market stress. Establishments are taking word – Underperformance in mining equities level to deeper operational and regulatory challenges, prompting a attainable shift in the direction of direct BTC publicity or ETFs.

Tech shares supply a parallel – Current U.S. tariffs have triggered steep losses, with analysts warning of decade-long setbacks. As with tech, exterior shocks might reshape crypto dynamics, turning this divergence right into a sign and never a blip.

Subsequent: Bitcoin’s highway to $75K – Is crypto’s newest dip a bear entice within the making?

Source link