CZ denies $2B USD1 allegations tied to Trump – Details inside!

Key Takeaways

- Binance founder denied claims that his presidential pardon utility was linked to an change settlement with Trump-linked World Liberty Monetary.

Binance [BNB] founder, Changpeng Zhao (CZ), has dismissed claims that he solely sought a pardon from President Donald Trump after serving to his crypto enterprise.

Supply: CZ/X

He was responding to a Bloomberg report that alleged that Binance performed a key function in creating the good contract powering USD1, the stablecoin issued by Trump-backed World Liberty Monetary (WLFI).

Claims in opposition to Binance’s CZ

The USD1 was launched in March 2025 and has grown to be the fifth-largest stablecoin with a $2.2 billion market cap as of press time.

Per the Bloomberg report, Binance not solely created the stablecoin but additionally promoted it to its 275 million customers.

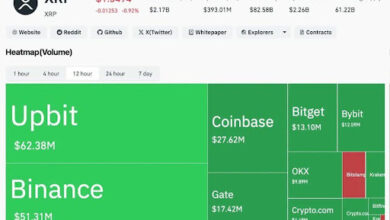

The media outlet added that Abu Dhabi’s MGX invested $2 billion into Binance by way of the USD1 as an alternative of a rival’s stablecoin.

However the writer famous that it was not clear whether or not World Liberty paid Binance or CZ to create the stablecoin.

In fact, the accusations have reignited scrutiny round Zhao’s previous authorized troubles within the U.S.

He confirmed the pardon request, however rejected the timeline

In 2023, CZ and Binance have been fined $50 million and $4.3 billion, respectively, for breaking U.S. anti-money laundering legal guidelines. In truth, CZ was compelled to step down as CEO and was jailed for 4 months.

However this was not the primary time CZ has hit headlines for alleged partnerships with Trump.

In Could, the Wall Avenue Journal (WSJ) reported that the Trump household needed a stake in Binance U.S. Zhao distanced himself from the report, calling it a ‘hit piece.’

Two different studies claimed that he had utilized for a presidential pardon in Could. He denied them, however later confirmed that he had utilized for one after the studies.

BNB market reactions

Naturally, the market didn’t ignore the drama.

Supply: Glassnode

The replace noticed a slight dip in BNB market traction. Per Glassnode knowledge, BNB Every day Energetic Addresses declined 5% to 1 million, and On-Chain Quantity dumped 20% to $467M.

Moreover, the Funding Charges remained flat, suggesting a cool-off into the weekend. At press time, BNB traded at $690, up 14% from June lows.