Move over, Bitcoin! Ethereum might be the next SoV

- ETH’s inactive provide surged considerably from 2020 to 2022.

- Staked ETH continued to develop regardless of a substantial drop in yields.

Ever since its launch in July 2015, Ethereum [ETH] has scaled new heights of success by redefining the utility of blockchain know-how. The main innovation caused by the second-gen blockchain was the appearance of good contracts, a major worth enchancment from its predecessor Bitcoin [BTC].

Is your portfolio inexperienced? Take a look at the Ethereum Revenue Calculator

Have the brand new capabilities improved ETH’s standing as a retailer of worth (SoV), thought-about because the holy grail of any asset class?

ETH as a financial savings possibility?

Cryptocurrency funding agency CoinShares’ newest analysis threw mild on some attention-grabbing points of ETH’s possession and distribution the world over. In keeping with the report, regardless of being primarily used as a medium of change (MoE) for transactions on the community at the moment, ETH’s utilization has begun to shift in the direction of a SoV.

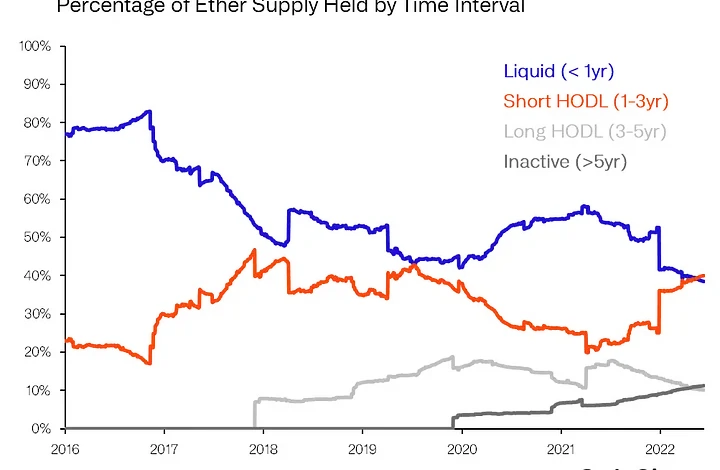

As indicated by the coin age bands under, ETH’s dormant provide elevated sharply over the previous 4-5 years. The inactive provide, outlined as cash that haven’t been transferred within the earlier 5 years, climbed from 3% in 2020 to greater than 10% in 2022. Alternatively, the cash which have moved during the last yr dropped steadily in the identical interval.

Curiously, this era additionally included the 2021 bull market throughout which ETH attained its peak. This implied that traders resisted the urge to money out their holdings.

Supply: Coinshares

Furthermore, ETH that was being locked within the staking contract continued to develop regardless of a substantial drop in yields. This prompt that customers had been locking up ETH as a financial savings mechanism.

It ought to be famous that the under information was earlier than the launch of the Shapella Improve which enabled unstaking. Nevertheless, staked ETH has elevated much more after the improve, as seen in one of many earlier articles.

Supply: Coinshares

ETH retraces losses

ETH surged previous the $1,900 mark on the time of writing, retracing all losses incurred after SEC’s lawsuit towards main crypto buying and selling platforms earlier this month. As the costs rallied, traders turned grasping. Whale transaction rely i.e., variety of transactions transferring ETH price greater than $100,000, shot up dramatically, as per Santiment.

Supply: Santiment

Learn Ethereum’s [ETH] Worth Prediction 2023-24

ETH turned the buzzword on crypto-focused social channels because of the rally.

In keeping with social intelligence agency LunarCrush, Ethereum was additionally one of many prime trending cryptos by social engagements.

TRENDING: TOP CRYPTOCURRENCIES BY SOCIAL ENGAGEMENTS$btc $eth $pepe $sol $arbhttps://t.co/yOJ8UGKGVw pic.twitter.com/C2Tw16ZnXj

— LunarCrush (@LunarCrush) June 21, 2023