MSTR’s 57% crash: Is institutional adoption drying up for Bitcoin and altcoins?

- As Bitcoin slides 22%, Technique follows.

- Will deep-pocket buyers step in to purchase the dip, or will the uncertainty power them to decelerate?

Strategy [MSTR] has crashed 57% to $230, hitting a four-month low – intently following Bitcoin’s [BTC] 22% plunge. Given MSTR’s huge Bitcoin holdings, the correlation is not any shock.

With Trump ruling out BTC within the U.S. strategic reserve, issues are rising about its impression on institutional adoption. Might this shake confidence in Bitcoin and altcoins?

Institutional fallout: Trillions erased

Danger-on belongings reacted negatively to the latest crypto summit – Bitcoin shed $100 billion in market worth in a single day, whereas the S&P 500 worn out $1.4 trillion.

Technique noticed an excellent steeper decline.

With 499,096 BTC in its treasury, Technique had positioned itself for Bitcoin’s long-term appreciation, particularly amid hypothesis that the U.S. authorities would possibly add BTC to its strategic reserves.

Nonetheless, Trump’s outright dismissal of this concept dealt a heavy blow to MSTR’s technique, triggering a wave of sell-offs. However the fallout didn’t cease there.

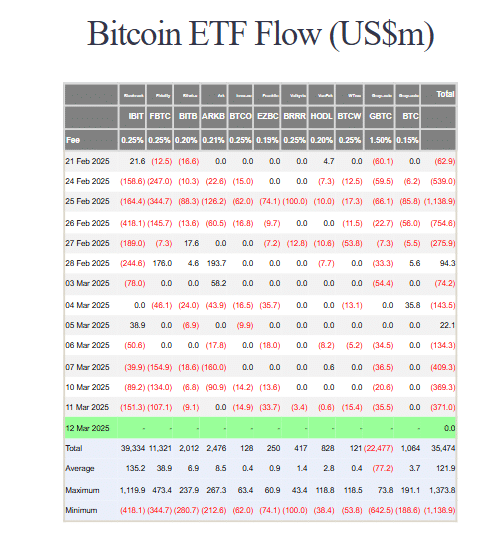

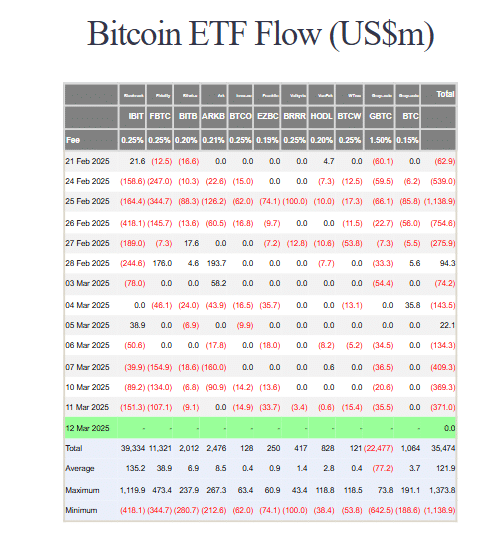

Bitcoin Trade-Traded Funds (ETFs) witnessed over $500 million in outflows on the identical day, reinforcing bearish sentiment.

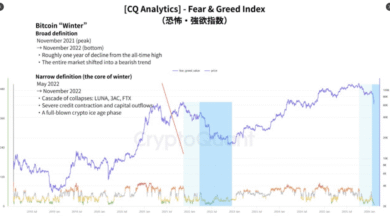

Since February, institutional outflows have dominated, with billions leaving exchanges – a pattern that reveals no indicators of reversal but.

Supply: Farside Traders

Bitcoin dominance vs. altcoin liquidity disaster

Regardless of the absence of institutional capital inflows into BTC, Bitcoin dominance (BTC.D) stays above 60%, signaling that capital isn’t flowing into altcoins.

Traditionally, Bitcoin downturns triggered rotation into high-cap options, however this cycle seems completely different.

As a substitute of threat redistribution, liquidity is leaving the market completely.

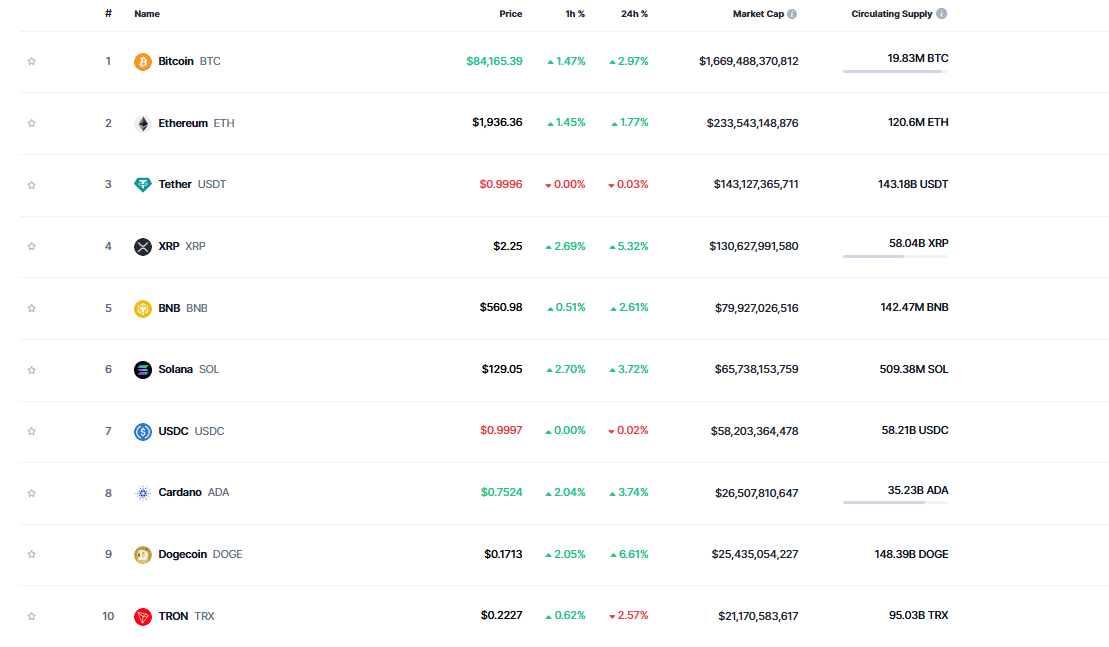

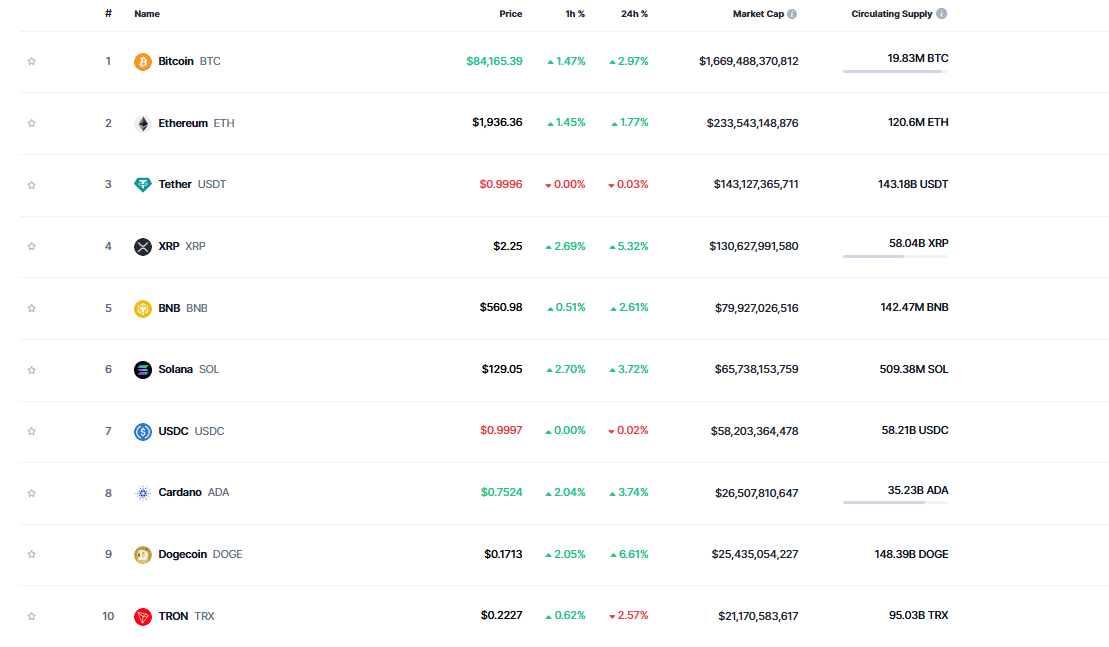

The highest 10 cryptocurrencies have all dropped beneath key value zones, with Ethereum [ETH] shedding the $2,000 stage for the primary time since 2023.

Supply: CoinMarketCap

This shift underscores the market’s dependency on Bitcoin for capital inflow. In bearish situations, altcoins undergo as BTC turns right into a threat asset.

MSTR stands as a crucial case examine, illustrating the broader impression of macro traits. With institutional capital drying up, BTC’s short-term volatility persists, dampening altcoin’s general attraction.