Bitcoin whale moves $206 mln as BTC holds firm above $100K

- Whale transfers recommend long-term holding or OTC trades, not fast sell-side stress.

- Retail traders proceed profit-taking, pushing Change Netflow into optimistic territory.

Over the previous week, as Bitcoin [BTC] reclaimed $100k, whale exercise has intensified from each the promote and purchase sides.

Previously 24 hours alone, Whale Alert flagged a large 2,000 BTC switch value roughly $206 million.

The vacation spot? Unknown wallets with no trade ties. Such a switch that’s not paired with exchanges might imply two main issues.

First, the whale is shifting funds to a private or safe pockets for long-term holding that’s usually considered as accumulation or intent to carry.

Second, it could point out over-the-counter OTC transfers between personal gamers or establishments and don’t have any impression on costs.

Since this whale switch just isn’t paired with inflows to exchanges, it’s not a right away bearish sign. Amidst this whale switch is a surge in whale exercise that has dominated the market over the previous days.

Accumulation rating flashes near-max ranges

In keeping with Glassnode, massive wallets continued to steer accumulation, with these holding 1K–10K BTC accumulating a rating of 0.9, nearly 1, whereas sharks snapped up a 0.8 rating.

Supply: Glassnode

In the meantime, whale trade exercise slowed.

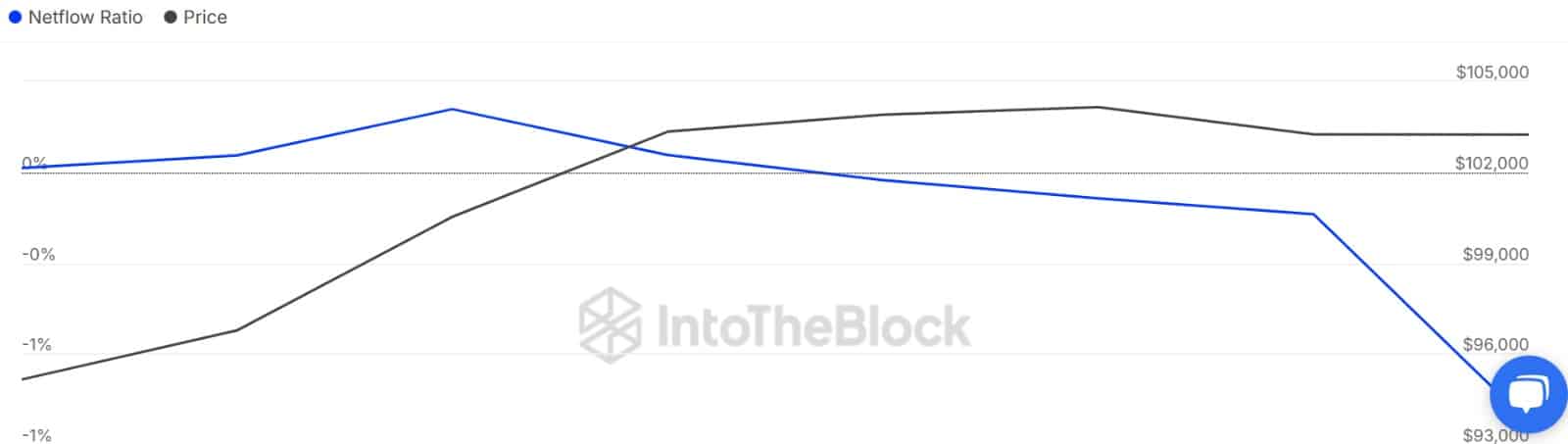

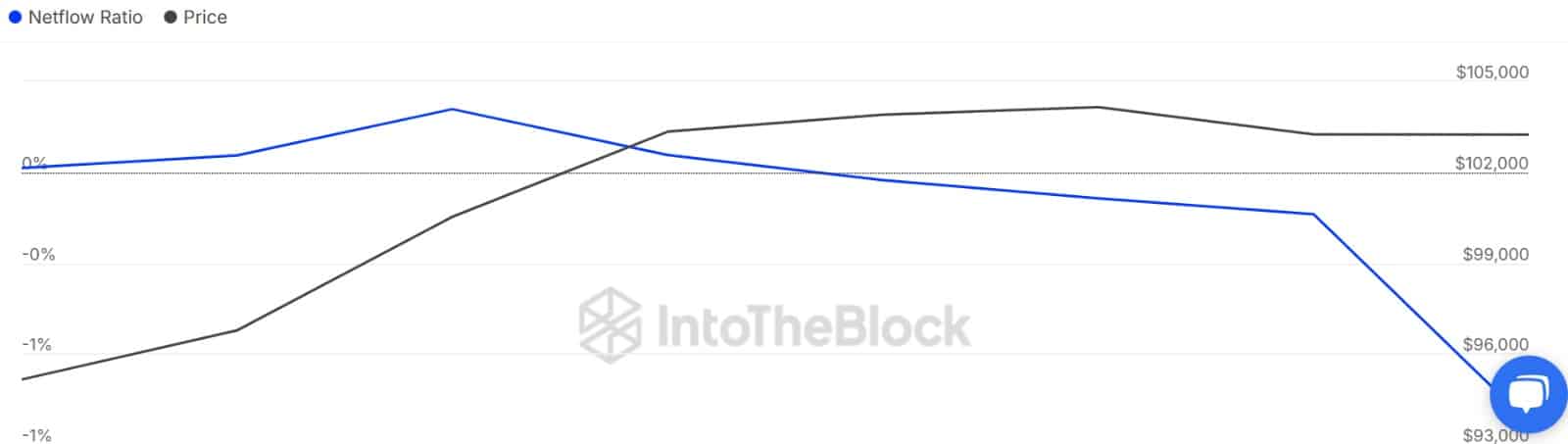

As an illustration, ultra-large whales have been on the impartial zone round 0.5. Due to this fact, Giant Holders Netflow to Change Netflow Ratio continued to say no, reaching destructive territory round -0.69.

Such a drop implied that whales weren’t sending BTC to exchanges as an alternative, they have been withdrawing extensively.

Supply: IntoTheBlock

Retail exits might stall momentum

The rising whale exercise, particularly on the buildup aspect, indicators rising confidence in Bitcoin as they anticipate costs to rise additional.

Traditionally, rising accumulation amongst massive gamers has resulted in greater costs as demand drives costs up. If the continuation of the development holds with whale accumulation, BTC is more likely to attain greater ranges.

On the flip aspect, smaller traders have been promoting into energy.

Wallets holding lower than $10 in BTC continued to distribute, reflecting a excessive promoting exercise from small holders as they take revenue.

The revenue taking from retailers has resulted in a optimistic Change Netflow, particularly since extremely massive wallets are additionally promoting, though on the impartial zone.

A optimistic netflow suggests the next trade of inflows than outflows.

Supply: CryptoQuant

If retail promoting persists, BTC might chop between $100K and $105K for some time.

But when smaller holders cool off and extremely whales flip from impartial to accumulation, Bitcoin might break above $108K within the close to time period.