NEAR Protocol: Short-term rally or bearish reversal, what’s ahead?

- Current developments present regular, measured progress for NEAR’s Complete Worth Locked (TVL).

- NEAR may see a short rally earlier than doubtlessly dropping to the $2.45 degree.

Over the previous 24 hours, NEAR Protocol [NEAR] has emerged as one of many market’s prime gainers, surging by 10.42%. This marked its first double-digit acquire following a month-long decline of 25.79%.

Regardless of the latest upward momentum, a broader perspective reveals potential obstacles that would hinder additional progress. If these obstacles maintain, NEAR may face a drop into cheaper price areas.

Consistency amid declining exercise

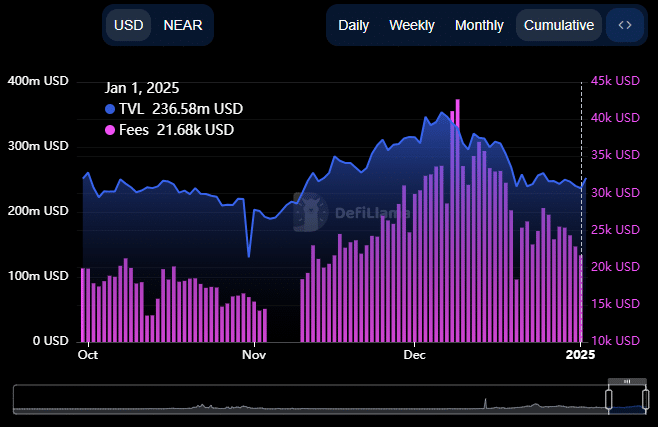

In keeping with DeFiLlama, the Complete Worth Locked (TVL) on NEAR Protocol has maintained a gradual vary, oscillating between $259.85 million and $236.58 million.

At press time, the TVL stood at $253.52 million. This vary usually signifies energetic participation, although it leaves room for both a major rally or a pointy decline.

Supply: DeFiLlama

TVL represents the whole worth of belongings locked in a blockchain’s good contracts, displaying the extent of consumer engagement throughout actions reminiscent of staking, lending, and liquidity provision.

However the TVL doesn’t give a lot data as a standalone. To realize additional perception into NEAR’s on-chain exercise, AMBCrypto analyzed its payment knowledge.

Larger charges usually point out elevated community exercise, whereas decrease charges counsel a slowdown.

As of this writing, NEAR recorded its lowest payment era up to now eleven days, with $21,680 collected.

This decline factors to diminished consumer participation, which may negatively have an effect on NEAR’s worth efficiency and its ecosystem’s progress trajectory.

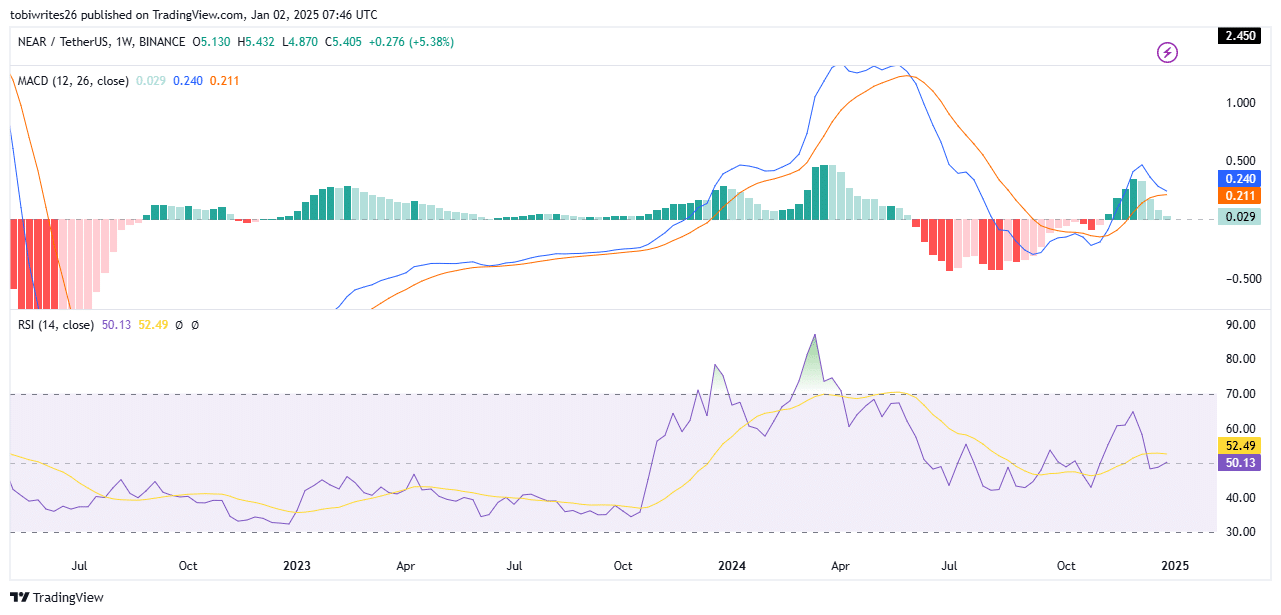

Combined indicators: MACD and RSI diverge

Technical indicators for NEAR had been conflicting, with the Transferring Common Convergence Divergence (MACD) pointing to a bearish pattern, whereas the Relative Energy Index (RSI) urged growing momentum.

On the weekly chart, the MACD appeared near forming a bearish Loss of life Cross—a sample that happens when the MACD line (blue) crosses under the sign line (orange).

That is sometimes accompanied by an growing variety of pink histogram bars, which additional affirm bearish sentiment. If this sample solidifies, NEAR’s worth could begin trending downward.

Supply: TradingView

Regardless of this looming bearish sign, the RSI supplied a extra optimistic view. It has lately returned to the constructive area, with a press time studying of fifty.13, indicating delicate bullish momentum.

Nevertheless, the RSI’s place close to the impartial line (50) nonetheless suggests uncertainty. A drop under this degree may set off a bearish reversal, reinforcing the draw back dangers.

Extra evaluation by AMBCrypto signifies that whereas the RSI could climb barely within the brief time period, it’s prone to reverse and fall under the impartial zone, aligning with the MACD’s bearish outlook.

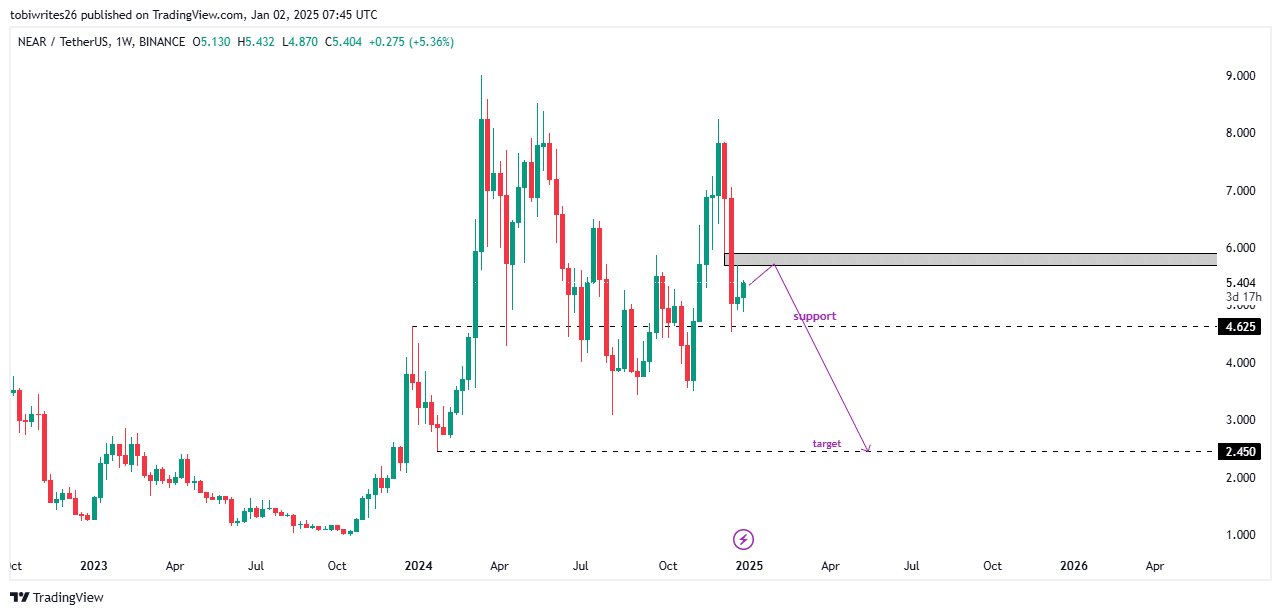

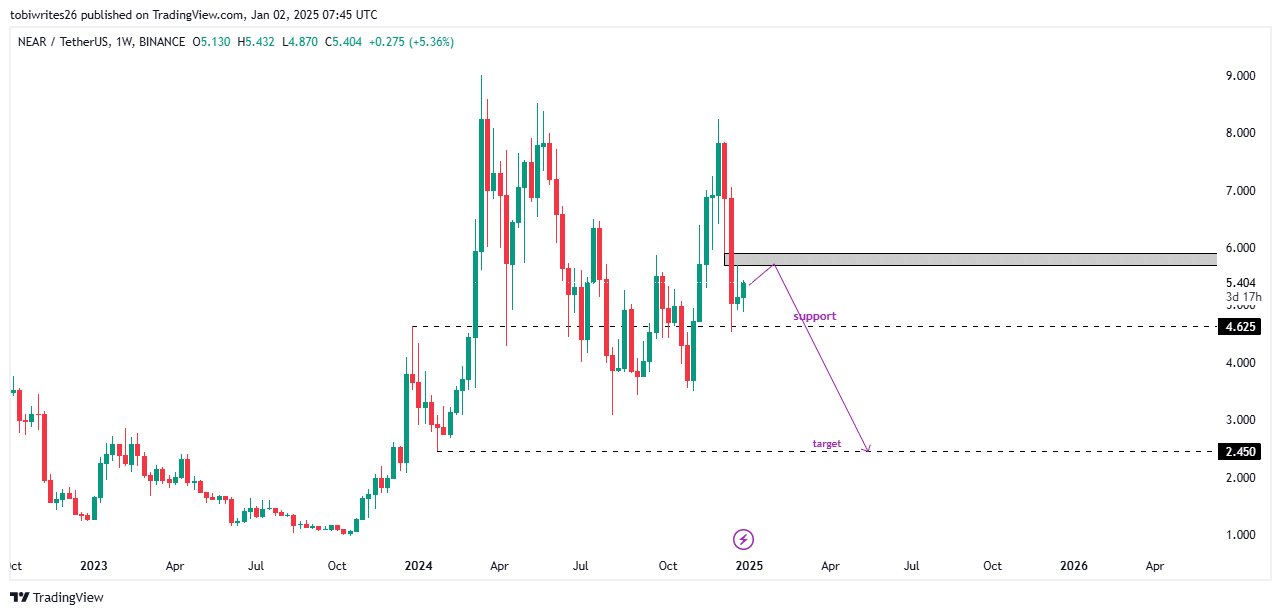

Key ranges come into focus

On the weekly chart, NEAR could first push larger right into a provide zone earlier than reversing again to a assist zone. From there, it may bounce briefly earlier than falling additional to the $2.45 goal, as urged by the present worth setup.

Supply: TradingView

Learn NEAR Protocol’s [NEAR] Value Prediction 2025–2026

If the availability zone fails to carry, NEAR may climb larger, regaining bullish momentum and presumably setting a brand new month-to-month excessive.

With the upcoming loss of life cross on the MACD, which may set off a significant drop in worth, alongside different metrics, NEAR nonetheless tilt to the bearish finish.