Spot Ethereum ETFs Set A New Record In July With $5.4 Billion Monthly Inflow

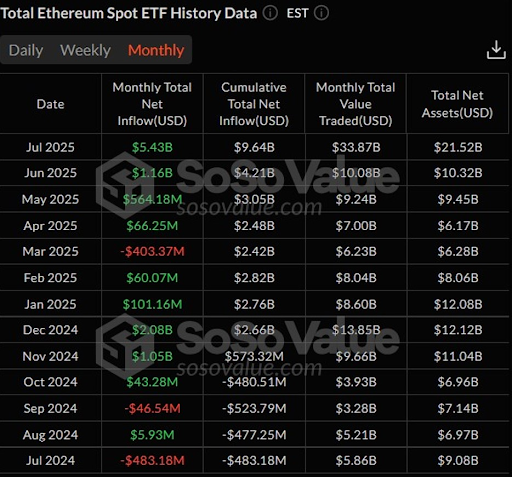

In a robust present of investor confidence, spot Ethereum exchange-traded funds (ETFs) broke all information in July with $5.43 billion in web inflows. It marks the very best month-to-month influx since their market debut and displays a pointy 369% rise from June’s influx of $1.16 billion.

With 20 straight days of web inflows, spot ETH ETFs at the moment are cementing Ethereum’s rising position as a number one digital asset within the eyes of conventional market members.

Spot Ethereum ETFs Hit Milestone With $5.43 Billion Influx

Based on data from SoSoValue, the $5.43 billion web influx in July additionally dwarfed Could’s $564 million and April’s $66.25 million. It fully reversed the damaging outflow development seen in March, which noticed a $403 million drop. Because of this rise, cumulative web inflows throughout all spot Ether ETFs have now reached $9.64 billion, displaying a 129% enhance in comparison with June’s cumulative total.

Associated Studying

The huge progress didn’t cease at inflows alone. Complete web property throughout all spot ETH ETFs jumped to $21.52 billion, doubling from $10.32 billion only a month earlier. These funds now account for 4.77% of Ethereum’s whole market capitalization, displaying that ETFs have gotten a gateway for capital getting into the ETH market.

Institutional interest has performed a task on this progress as BlackRock’s ETHA remains the main spot Ethereum ETF by property, pulling in $18.18 million on July 31 and now holding $11.37 billion. Constancy’s FETH additionally gained $5.62 million that very same day, elevating its web property to $2.55 billion. Grayscale’s ETHE nonetheless manages a strong $4.22 billion asset base, even with a $6.8 million outflow, displaying its continued relevance.

Ethereum Value Rallies As ETF Inflows Hit New Highs

The record-setting ETF inflows additionally lined up with a pointy worth rally in ETH all through July. ETH began the month at $2,486 and climbed to a excessive of $3,933, a rise of almost 60%. By the tip of the month, it had settled at $3,698, making July Ethereum’s strongest month-to-month worth transfer since October 2021. The regular rise in ETF inflows might be a key driver behind this surge, displaying that extra capital getting into the area might have instantly boosted market sentiment and pricing.

Associated Studying

The ETH rally additionally marked the longest bullish monthly candle in almost three years. As costs climbed, the spot ETFs recorded their longest-ever streak of every day web inflows, 20 days in a row with out a single outflow after July 8. A few of the single-day positive factors got here mid-month, together with $726.7 million on July 16, $602 million on July 17, and $533.8 million on July 22.

Ethereum may problem its all-time excessive of $4,878, set in November 2021, as its rising position in decentralized finance and the growing use of regulated funding autos may assist the asset. If the present tempo of inflows and buying and selling exercise continues, it may quickly take heart stage in a broader altcoin-led market cycle.

Featured picture from UnSplash, chart from TradingView.com