New Bitcoin whales surge: Could their massive accumulation spark the next rally?

- New Bitcoin whales are reshaping the market construction, driving demand whereas limiting obtainable provide.

- This dynamic could gas upward value motion within the coming months.

Excessive-net-worth wallets with 1,000+ Bitcoin [BTC] are accumulating quick, signaling sturdy confidence in Bitcoin. Since November 2024, new Bitcoin whales have added over 1 million BTC, together with 200,000 this month.

A brief holding interval (<6 months) signifies sturdy conviction at present value ranges. This sustained shopping for stress suggests current “dips” are being absorbed, decreasing the probability of extended corrections.

With risk-off sentiment dominating the market, retail capital has but to return. On this local weather, the continued accumulation of latest whales might set up a powerful value flooring, reinforcing Bitcoin’s help on this cycle.

Bitcoin’s liquidity profile is shifting

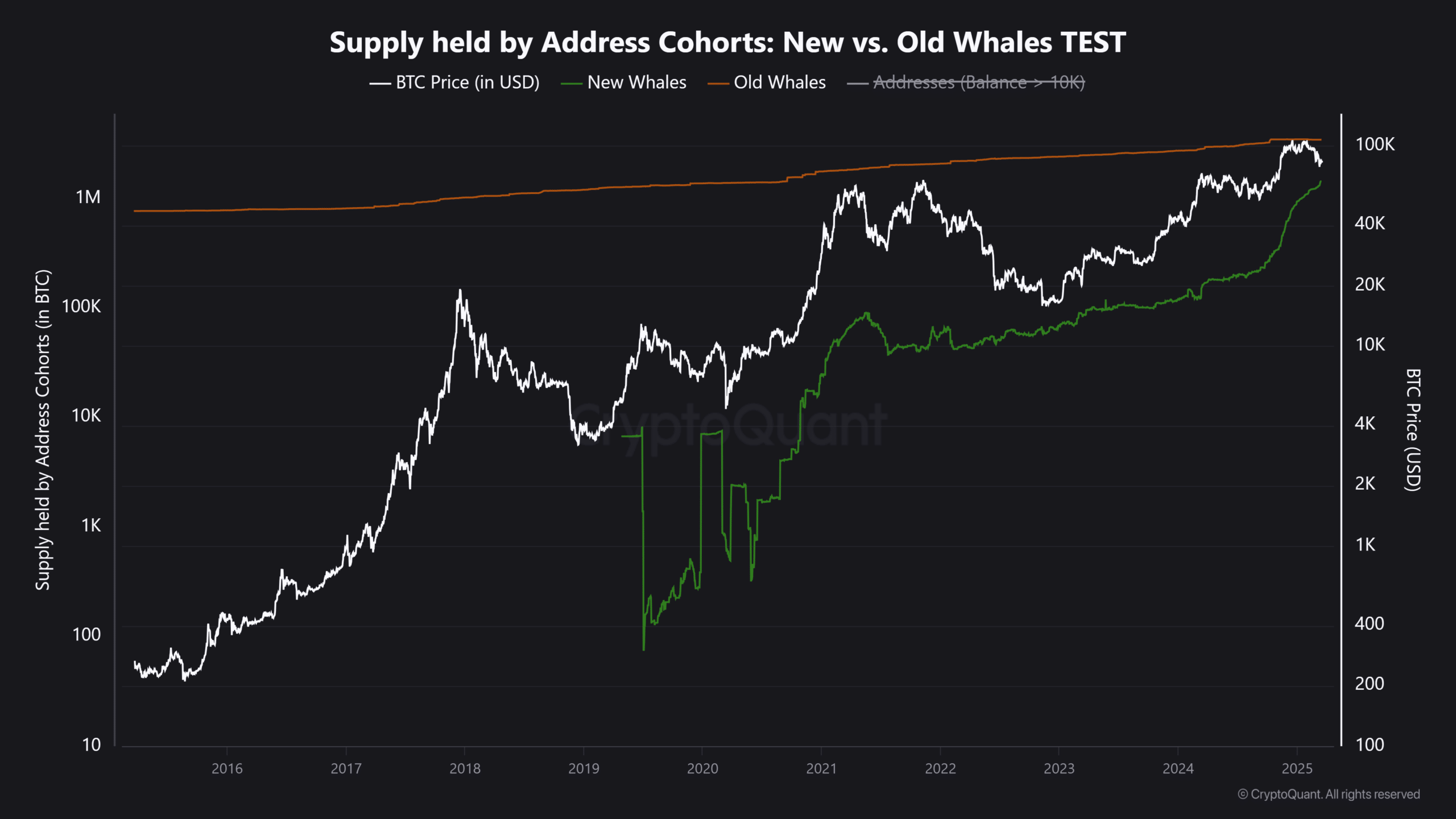

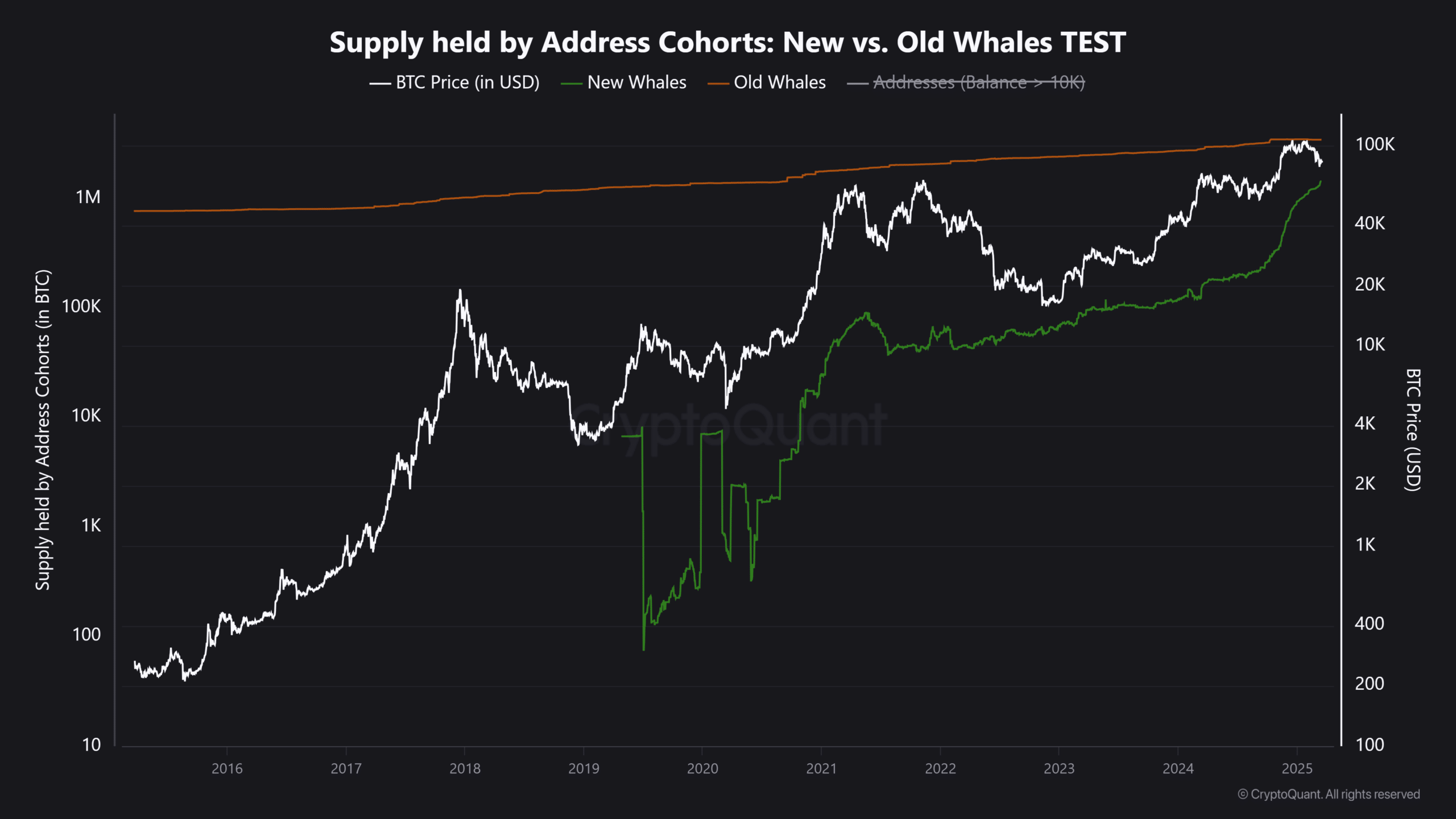

The speedy accumulation of latest whale addresses signifies sturdy inflows of recent capital, as mirrored within the knowledge under.

Complete holdings by these entities (1,000+ BTC, <6 months previous) have surged from 345k BTC to over 1.5 million BTC. On the present market value of $83,580, this represents roughly $125 billion in Bitcoin.

Supply: CryptoQuant

In the meantime, long-term whale holdings (BTC held for a number of years) have declined from 3.48 million to three.45 million BTC, aligning with Bitcoin’s value correction from its $109k all-time excessive on the twentieth of January to $96k on the sixth of February.

The sell-side liquidity from each previous whales and weak fingers have been absorbed by these new whales, whose 2,00,000 accumulation this month has prevented BTC from retracing under $78k.

New Bitcoin whales sign energy: What’s subsequent?

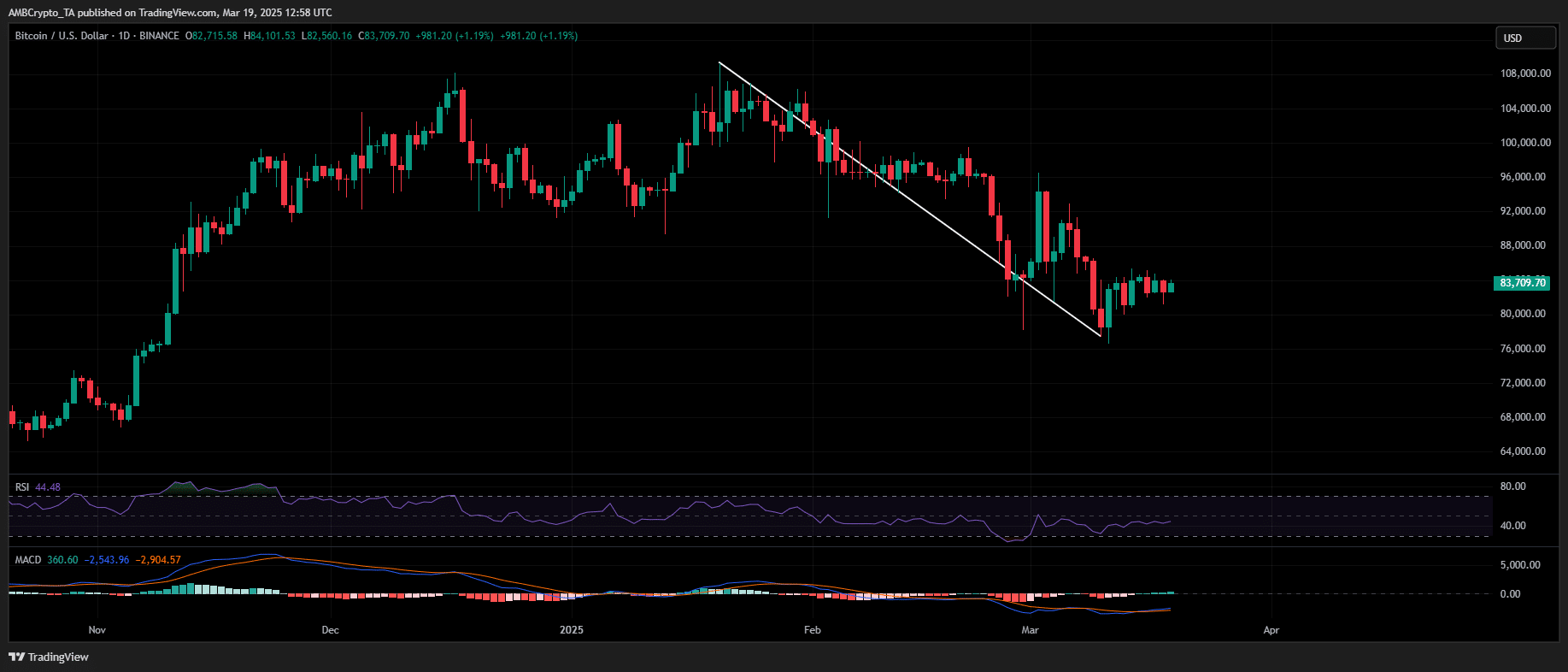

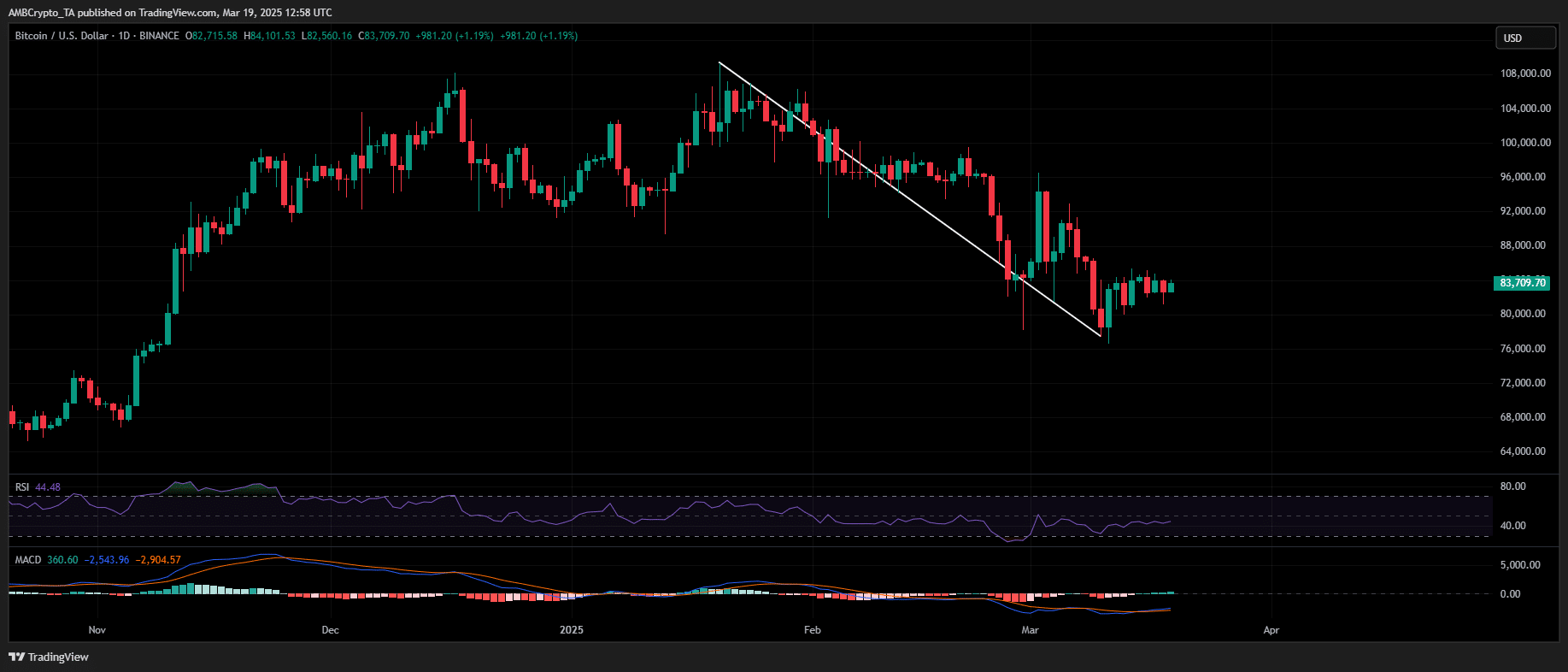

Bitcoin’s current value swings – from its ATH of $109k to its drop under $80k– have been largely influenced by previous whale distributions and macro-driven liquidity shifts.

Supply: TradingView (BTC/USDT)

Nonetheless, new whale inflows are reinforcing help, mitigating draw back dangers. If accumulation continues at present ranges, BTC’s likelihood of retesting all-time excessive will increase.

Moreover, macro elements like potential fee cuts, as soon as Trump’s financial reset takes impact, might additional strengthen Bitcoin’s long-term trajectory, positioning $150k–$160k as a viable long-term goal.