New lows for Ethereum gas usage as ETH tumbles below $3400: What now?

- Ethereum fuel costs declined, however charges paid out to validators rose.

- The worth of ETH declined, nonetheless, Community Progress surged.

The latest market drawdown impacted Ethereum [ETH] considerably as ETH’s costs fell under the $3400 degree.

Low Ethereum fuel, excessive charges

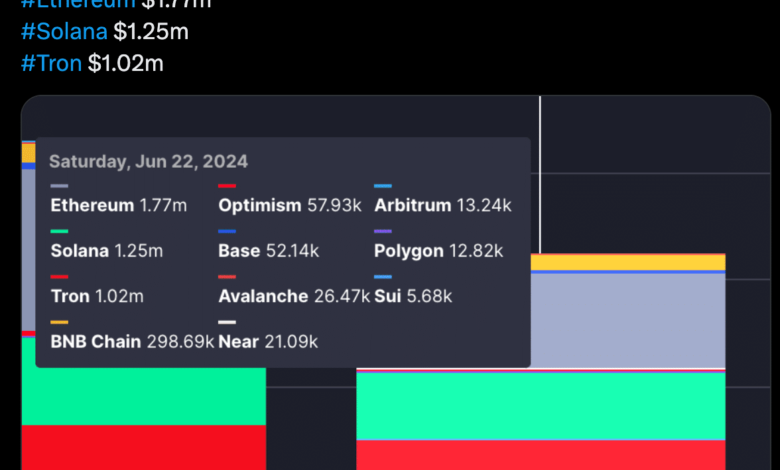

Coupled with that, the Ethereum fuel value declined. Regardless of the declining fuel costs, when it comes to charges paid out to validators, Ethereum outperformed different networks similar to Solana [SOL] and Tron [TRX] by a big margin.

The upper validator charges, regardless of a fuel value drop, may point out continued sturdy community utilization on Ethereum.

Even with decrease per-transaction charges, a better quantity of transactions may generate extra whole charges for validators.

Whereas validator charges is perhaps excessive now, they won’t be sufficient to offset the general value decline of Ethereum.

Supply: X

On the time of writing, ETH had fallen by 4.14% within the final 24 hours. One of many causes for the decline in ETH’s value can be its correlation to BTC which additionally fell significantly over the previous few days.

In accordance with AMBCrypto’s evaluation of IntoTheBlock’s information, ETH’s correlation to BTC was at excessive 0.78.

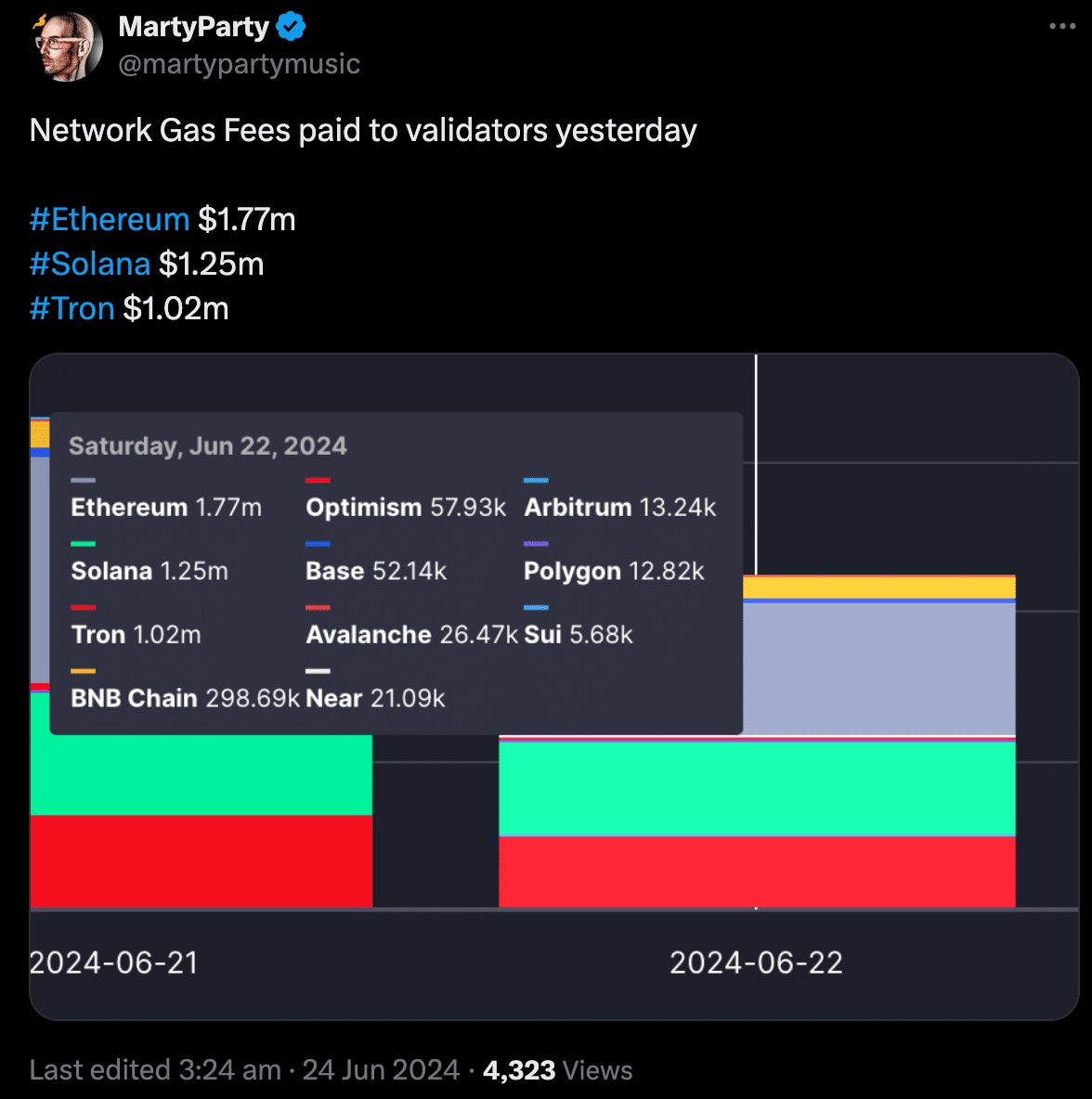

Even with a major decline in Ethereum’s (ETH) value, a big portion of holders appear to be in it for the lengthy haul. On common, buyers are holding onto their ETH for a whopping 2.3 years.

This long-term view is additional supported by the truth that cash being actively traded are nonetheless held for a mean of two months, indicating a reluctance to promote.

The typical holding time of traded cash presents helpful insights into investor confidence.

When cash are held for longer intervals, it suggests buyers imagine within the long-term potential of Ethereum and are comfy holding onto their property.

Conversely, frequent buying and selling exercise might point out a give attention to short-term earnings and fewer religion in the way forward for the market.

Supply: IntoTheBlock

On-chain information

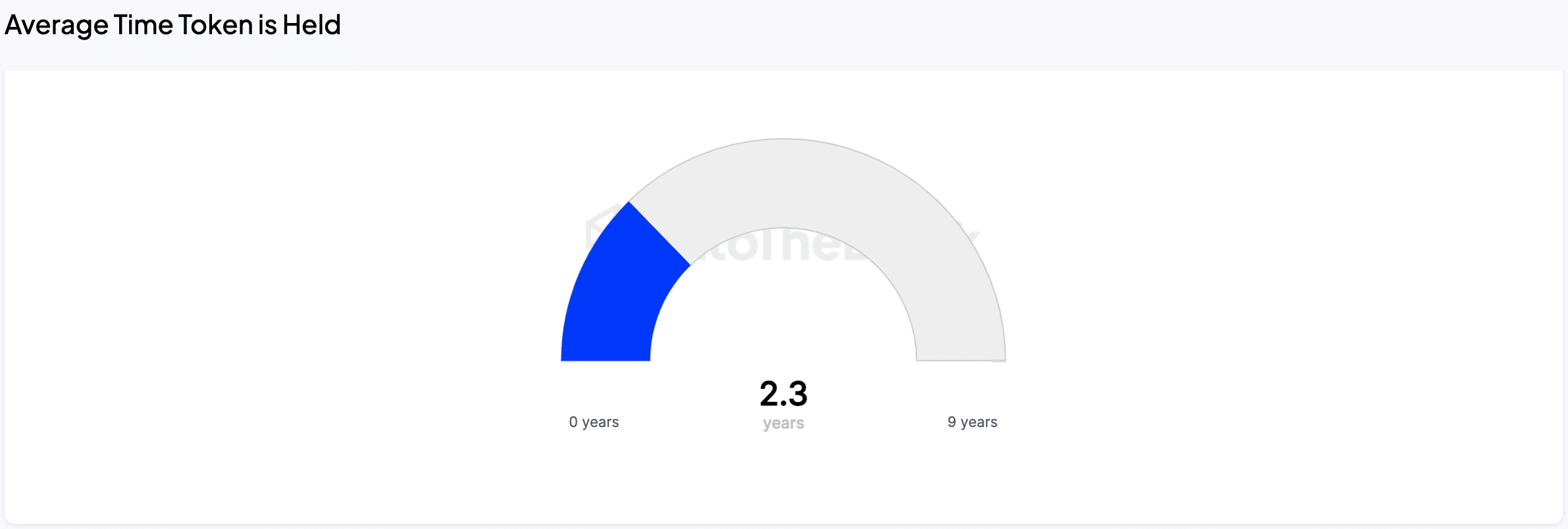

Community Progress for ETH surged materially over the previous few days.

Learn Ethereum’s [ETH] Value Prediction 2024-2025

So, many new addresses have been interacting with ETH on the time of writing, implying that a considerable amount of addresses have been excited by shopping for ETH on the present discounted charges.

Furthermore, the speed at which ETH was buying and selling had additionally grown, suggesting that the frequency at which ETH was being transacted had surged.

Supply: Santiment