Bitcoin’s road to $75K – Is crypto’s latest dip a bear trap in the making?

- Bitcoin misplaced its key assist degree and but, retail futures positioning stays stubbornly bullish

- A traditional double-edged sword situation the place market path hinges on spot demand stepping in

“Tariffs are right here to remain,” mentioned Trump. Quickly after, the markets reacted. On the time of writing, Bitcoin [BTC] had pulled again by 8.66% on the charts, retesting sub-$80k ranges as $1.30 billion in liquidations swept the market.

In the meantime, 478k addresses at $78,981 hovered close to breakeven, whereas 5.94 million wallets from $61,129 cashed out earnings. As longs unwinded and weak hands folded, Bitcoin shed over $130 billion in market capitalization.

And but, a rising bid-ask ratio is an indication of accelerating buy-side curiosity. Retail lengthy positions have been regular at 73% too. Traditionally, such set-ups have preceded liquidity sweeps adopted by sharp reversals.

The truth is, the same set-up in March led to a pointy rebound from $77k – Might this dip be one other bear entice?

A key catalyst underpinning market sentiment

The FOMC countdown is on – 30 days out, and markets are bracing for impression. Regardless of elevated FUD, the bid-ask ratio stays within the 99th percentile, signaling persistent buy-side curiosity.

With Q2 uncertainty rising, fee minimize bets are heating up, with some anticipating as much as 4 cuts to counter post-tariff demand slowdown. Recession odds have jumped from 40% to 60%, and even JP Morgan now sees fee cuts coming quickly.

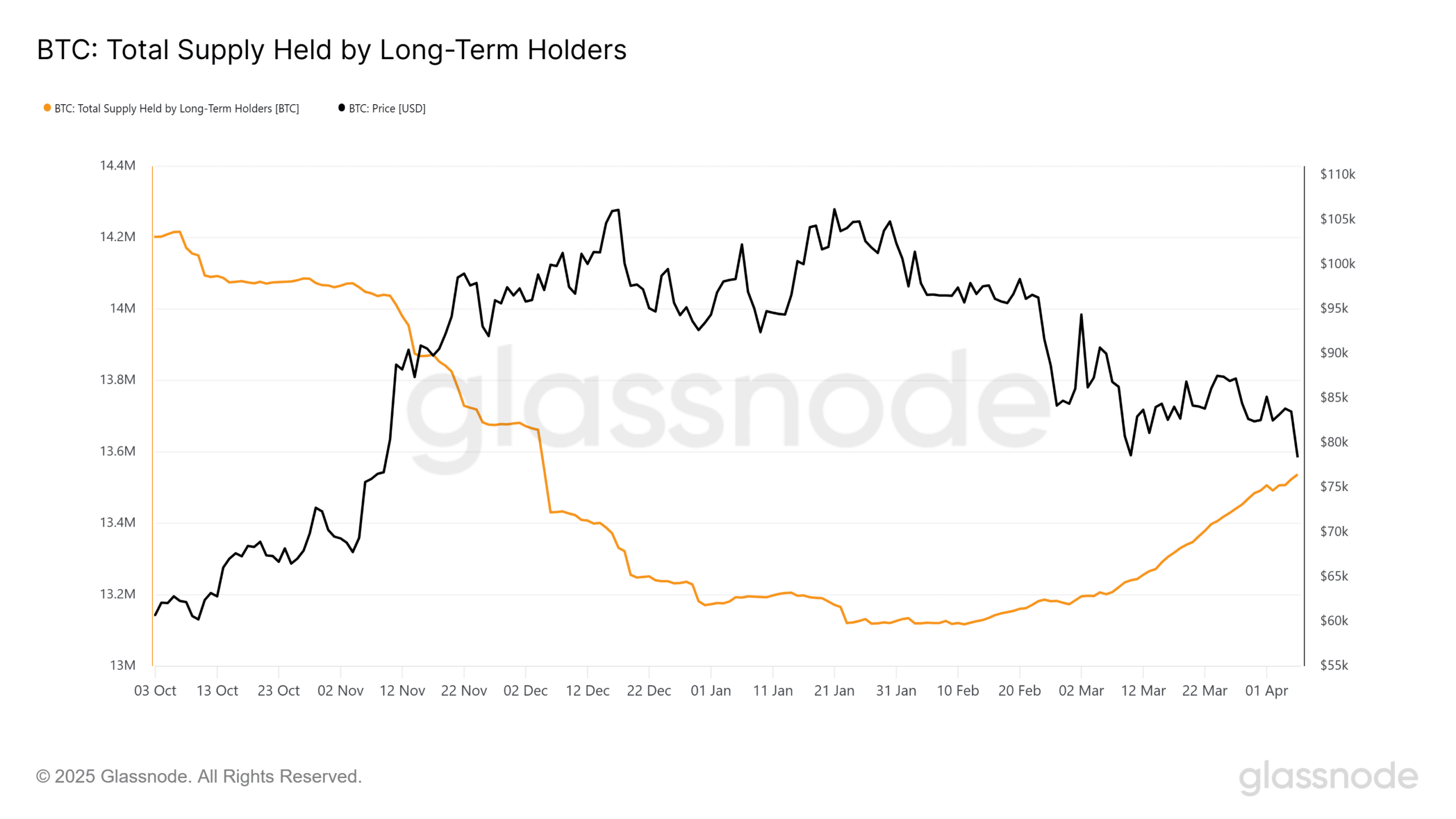

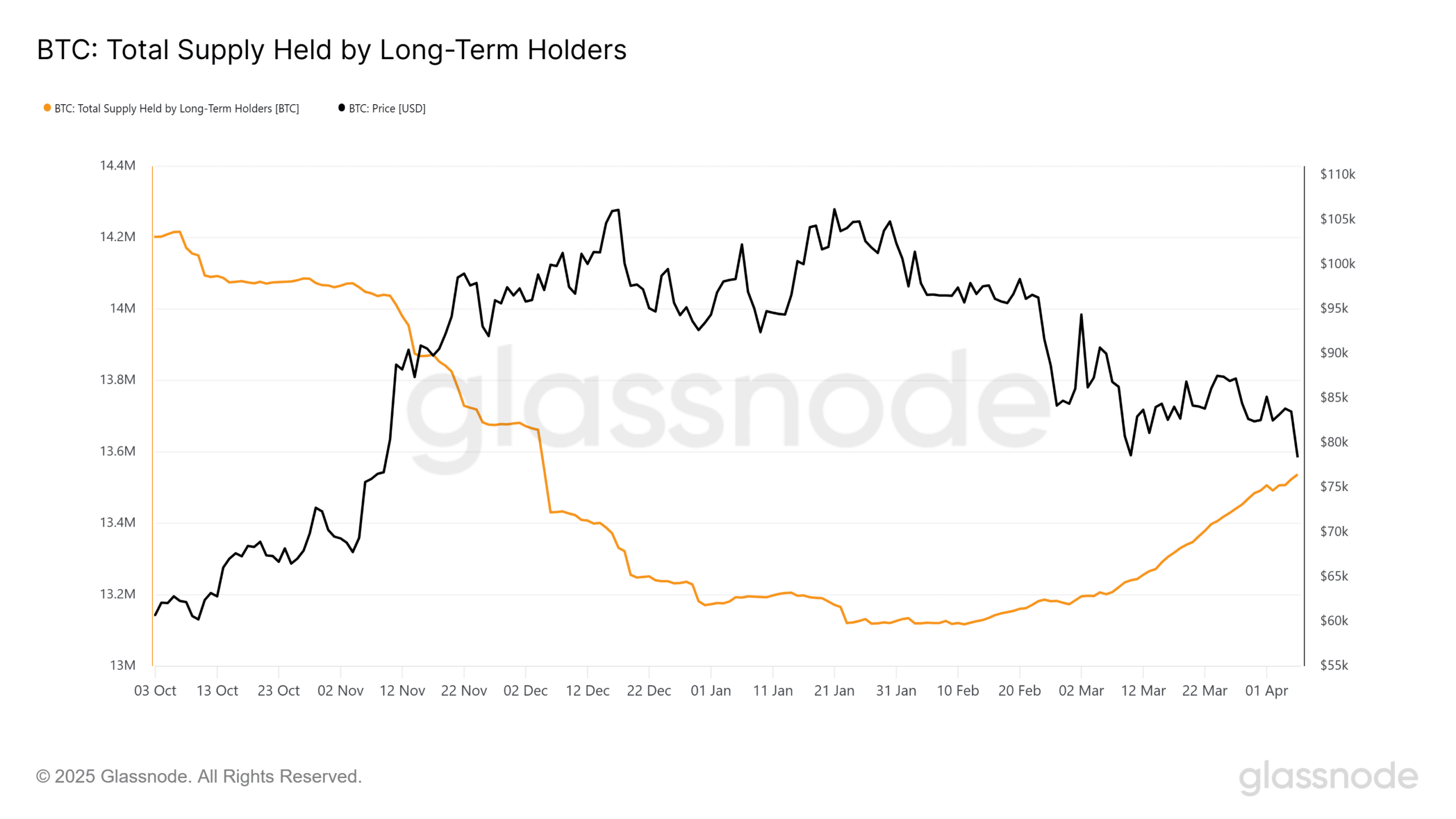

For Bitcoin, the stakes are excessive – Its resilience hinges on how the Fed strikes subsequent. Till then, volatility is probably going, although short-term. Curiously, BTC’s long-term holders (<155 days) have ramped up accumulation, including 14k BTC since 6 April – Marking a three-month excessive.

Supply: Glassnode

In the meantime, derivatives positioning stays unshaken – Funding Charges (FR) have held inexperienced all through the week, reflecting sustained bullish leverage.

Nonetheless, with no surge in spot demand, this positioning dangers unwinding. Up to now, on-chain metrics have highlighted muted dip-buying – An indication that traders are most probably in a risk-adjustment mode, fairly than accumulation.

And but, Bitcoin’s 50-50 long-short equilibrium at present ranges presents a main set-up for a bear entice. In line with AMBCrypto, if liquidity absorbs sell-side strain, a volatility squeeze may set off fast upside growth.

Bitcoin’s fragile bullish construction

Undoubtedly, Bitcoin’s bullish set-up is now displaying cracks – Key assist ranges are breaking, but derivatives merchants stay closely lengthy. If buy-side absorption holds although, a pointy reversal may very well be on the desk.

On the 12-hour heatmap, a $72.94 million liquidity cluster at $75,798 was swept, triggering a 1.20% bounce. Whether or not this alerts absorption or only a non permanent reduction stays to be seen.

Supply: Coinglass

Nonetheless, a powerful bear entice may very well be within the making. In mild of rising Open Curiosity, mounting Fed strain and LTH accumulation at a three-month excessive, Bitcoin’s present dip may be in keeping with a “high-risk, high-reward” set-up.

If liquidity clusters preserve getting absorbed, Bitcoin may very well be prepared for an aggressive reclaim.