It may not be long before Arbitrum outshines Ethereum, but only if…

- Arbitrum’s Distinctive Addresses graph elevated, however its TVL fell.

- ARB’s worth surged by over 4% within the final 24 hours.

Arbitrum [ARB], one of the well-liked layer-2s, lately reached a milestone that may pose a critical problem to the likes of Ethereum [ETH].

Arbitrum is just behind Ethereum

CryptoRank.io, a cryptocurrency analysis and analytics platform, lately posted a tweet highlighting the highest blockchains when it comes to TVL per distinctive handle.

That is calculated by dividing the TVL by the variety of distinctive addresses.

As per the tweet, Ethereum sat within the first spot on the checklist, adopted by Arbitrum. Avalanche [AVAX], Tron [TRX], and Aptos [APT] additionally made it to the highest 5 on the identical checklist.

Curiously, ETH stood at $213, whereas ARB was marginally decrease, at $195.

For the reason that distinction between the 2 was not a lot, AMBCrypto deliberate to check out Arbitrum’s present efficiency to see whether or not we will count on ARB to outshine ETH within the coming days.

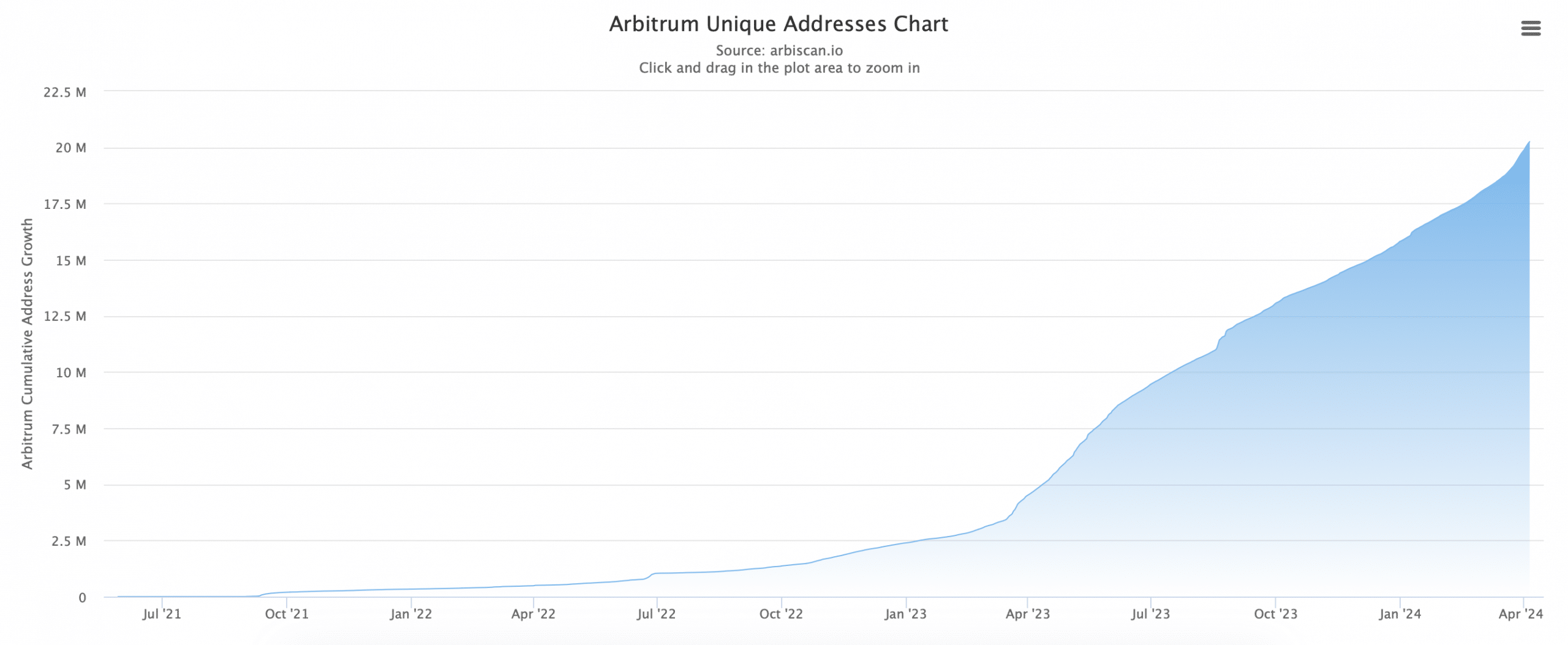

Our evaluation of Arbiscan.io’s data revealed that ARB’s Distinctive Addresses continued to climb sharply because the quantity exceeded 20 million.

At press time, Arbitrum had a complete of 20.25 million Distinctive Addresses, reflecting sturdy community development.

Supply: Arbiscan.io

Arbitrum has to spice up efforts

At first look, this regarded optimistic, however upon nearer inspection, AMBCrypto discovered that ARB may not but have the ability to outperform Ethereum simply but.

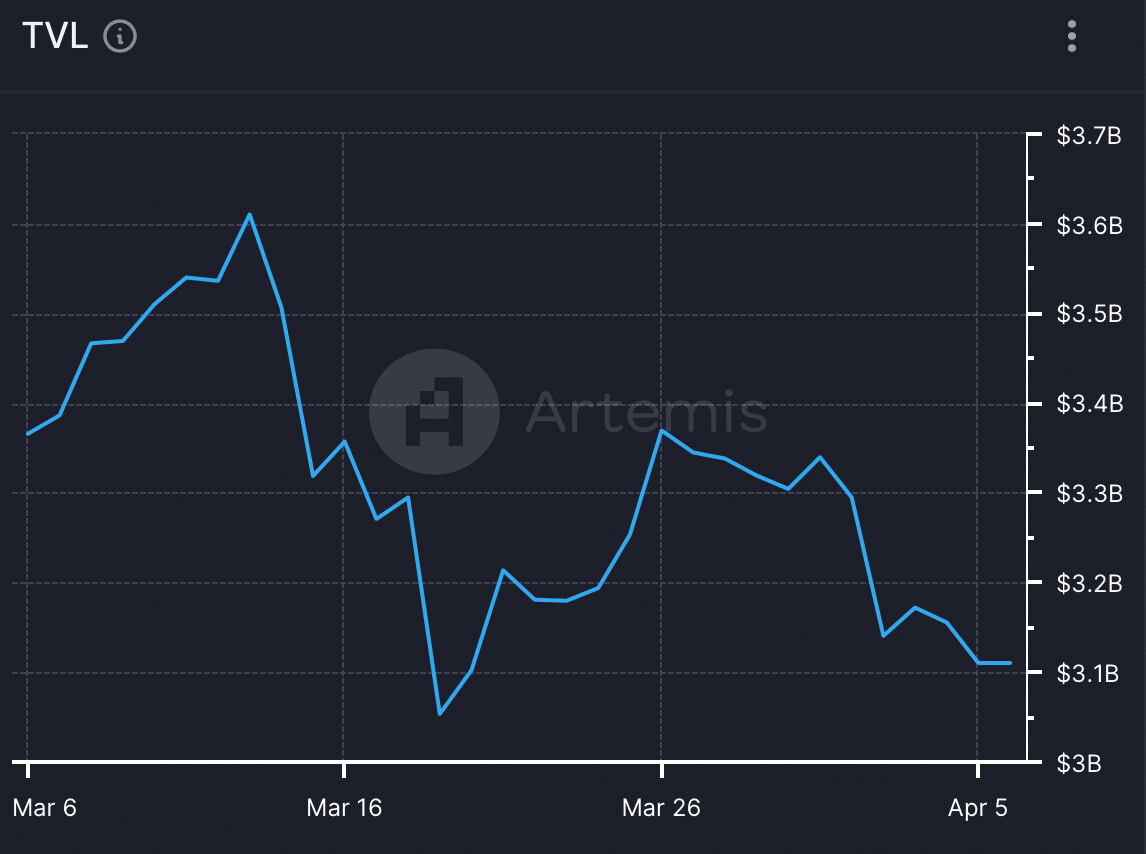

It is because the TVL per distinctive handle additionally takes under consideration a blockchain’s TVL development.

Our have a look at Artemis’ data revealed that whereas ARB’s distinctive addresses grew, its TVL dropped sharply over the past 30 days, suggesting that ARB’s efficiency has to enhance loads to beat Ethereum cohesively.

Supply: Artemis

Arbitrum’s captured worth additionally registered a decline final month. This was evident from the drop in each its charges and income over the past 30 days.

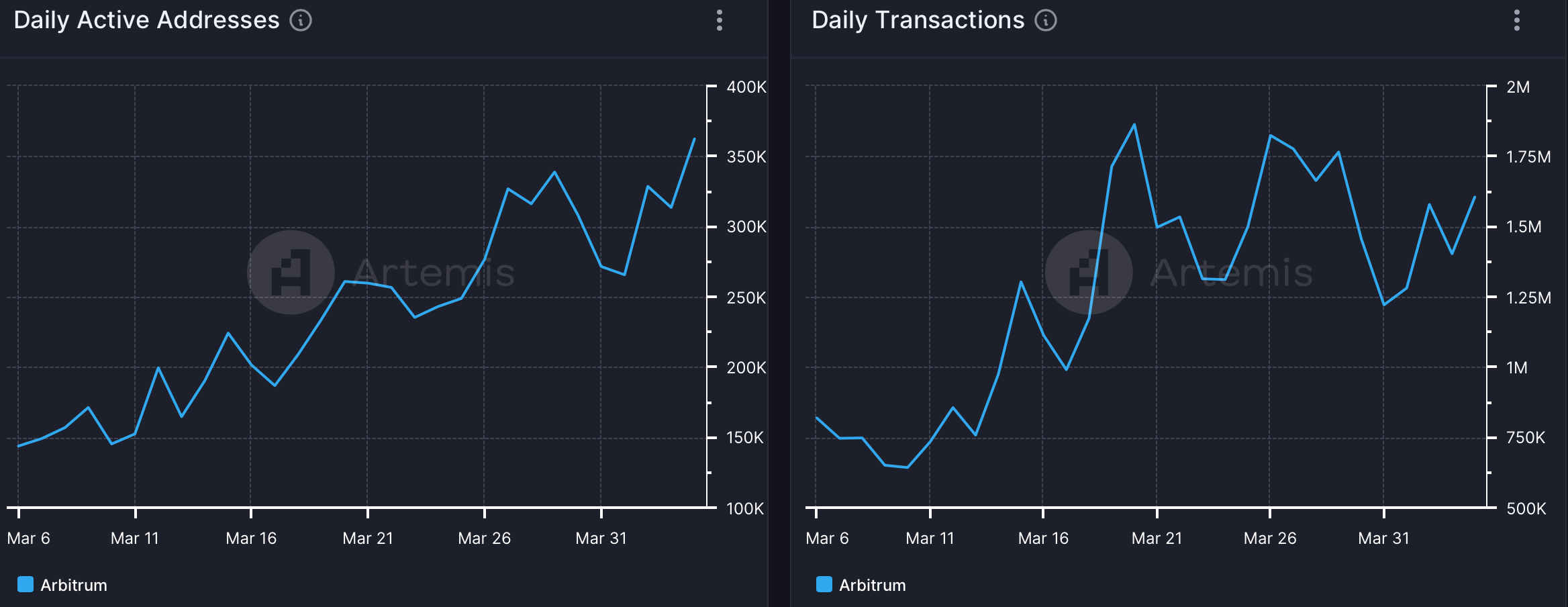

Nonetheless, ARB’s community exercise remained excessive. The blockchain’s day by day energetic addresses and transactions went up, suggesting excessive utilization.

Supply: Artemis

Learn Arbitrum’s [ARB] Value Prediction 2024-25

Within the meantime, ARB bulls additionally stepped up their recreation because the token’s worth registered an uptick. Based on CoinMarketCap, ARB was up by greater than 4% within the final 24 hours alone.

On the time of writing, ARB was buying and selling at $1.47 with a market capitalization of over $3.9 billion.