NFT giants are protesting Blur and OpenSea over royalty rates

Main NFT creators Yuga Labs and Bored Ape Yacht Membership rethink listings on dominant platforms Blur and OpenSea, difficult current royalty cutbacks.

Main gamers within the non-fungible token (NFT) house, together with Yuga Labs Inc., creators of the Bored Ape Yacht Membership and CryptoPunks, together with Pudgy Penguins assortment, are reevaluating their partnerships with dominant marketplaces like Blur and OpenSea. Some are both suspending new listings or considering such actions, in keeping with studies from Bloomberg.

This 12 months, each Blur and OpenSea have considerably diminished the royalty percentages that creators obtain from secondary market transactions, as they purpose to spice up transaction volumes within the declining NFT market. In line with knowledge analytics agency Nansen, royalties in September stood at a modest $2.4 million, a pointy distinction to the January peak of $269 million.

Yuga Labs shouldn’t be fucking round.

They’ve made it clear that their collections will solely be traded on royalty-enforced marketplaces (X2Y2 + SudoSwap V2).

Their newest Mara assortment blocks buying and selling on OpenSea, Blur, LooksRare, and SudoSwap V1. pic.twitter.com/J5iav8abvX

— cygaar (@0xCygaar) September 27, 2023

NFT market panorama shifts dramatically

Yuga Labs has taken the initiative to halt buying and selling of its latest NFT assortment, Mara, on Blur and OpenSea, stating that solely marketplaces that keep ample royalties could have the privilege to listing their tokens. The corporate even disclosed job cuts in gentle of the hostile market situations.

You may also like: NFTs surge following SEC’s failure to attraction Grayscale ETF

Initially, Blur made headway out there with its aggressive low-fee construction, quickly overtaking OpenSea and forcing the latter to reevaluate its payment insurance policies. As of now, Blur’s base royalty payment is pegged at 0.5%, whereas OpenSea has transitioned to non-compulsory creator charges. Collectively, these platforms are liable for round 70% of all NFT transactions.

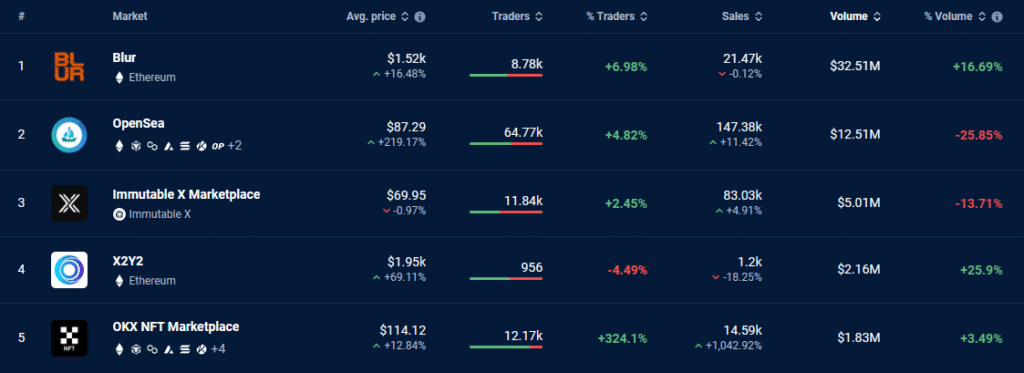

High 5 NFT marketplaces by weekly buying and selling quantity

Amidst the declining royalties, many tasks are increasing into completely different markets, similar to gaming or bodily collectibles. For instance, Pudgy Penguins have diversified into merchandising. This 12 months, product gross sales have garnered $7 million, starkly contrasting a mere $300,000 earned from NFT royalties.

At this time marks the start of a brand new period for merchandise and experiences powered by the blockchain.

Pudgy Toys will not be simply toys. They’re a toy-line licensed instantly from our neighborhood that provides patrons their first NFTs and Web3 expertise. pic.twitter.com/LEzdM8CTUR

— Pudgy Penguins (@pudgypenguins) September 26, 2023

As of now, the premier collections by Yuga Labs and Pudgy Penguins make up an astonishing two-thirds of this 12 months’s NFT buying and selling volumes. For sure, potential withdrawal from mainstream platforms will doubtless have a major affect on the general market.