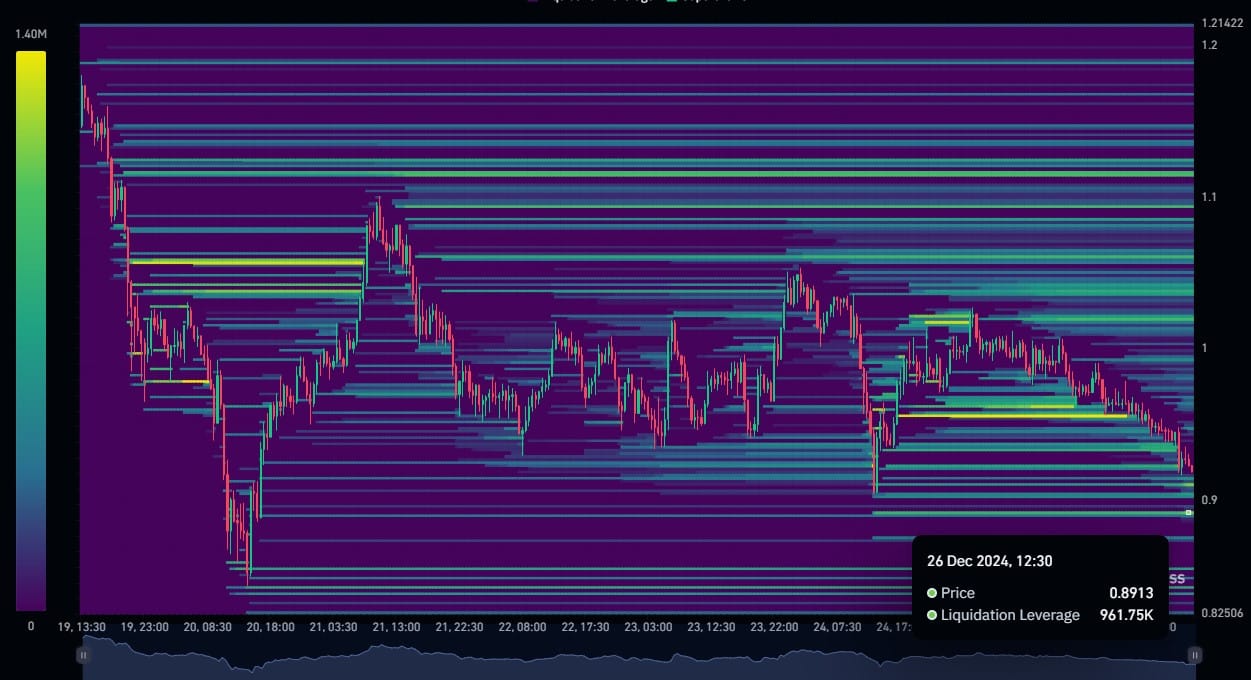

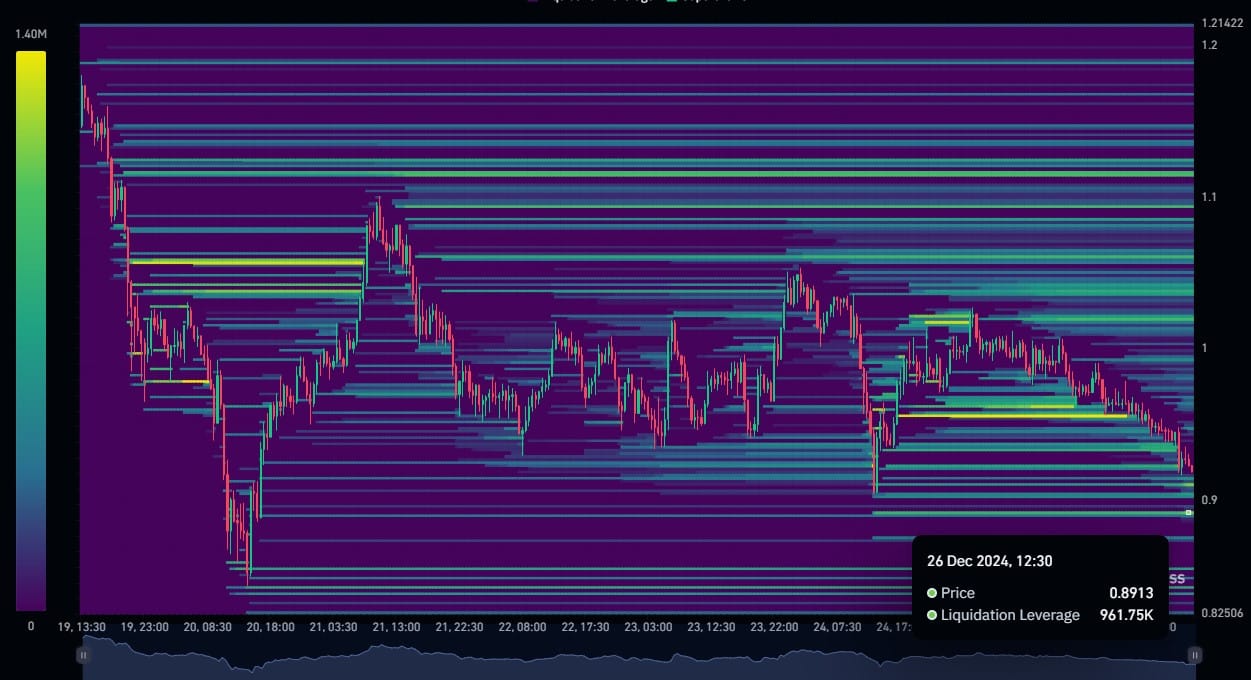

Will Fantom’s $961K liquidation pool trigger a trend reversal for FTM’s price?

- Fantom’s $961k liquidation pool pointed to a pivotal check on the $0.88 worth degree

- Altcoin trade outflows have dropped sharply, elevating issues about market confidence

Fantom’s (FTM) worth is at an important level proper now, with the altcoin consolidating inside a requirement zone on the charts. In reality, the $961K liquidation pool tied to the $0.88 worth degree makes this space one to look at carefully. On the time of writing, the altcoin gave the impression to be buying and selling above the help of an ascending triangle – A sample typically linked to potential upward motion.

The importance of this worth degree can’t be ignored.An in depth above $0.88 may enhance purchaser confidence and possibly ignite a rally.

Conversely, any penetration will set off liquidation orders, including to the promoting stress which may destabilize the value additional.

Supply: Coinglass

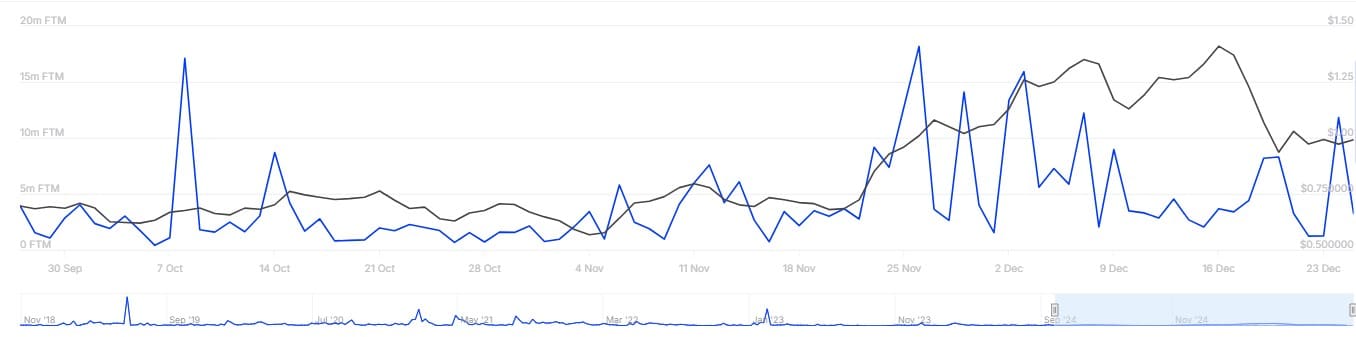

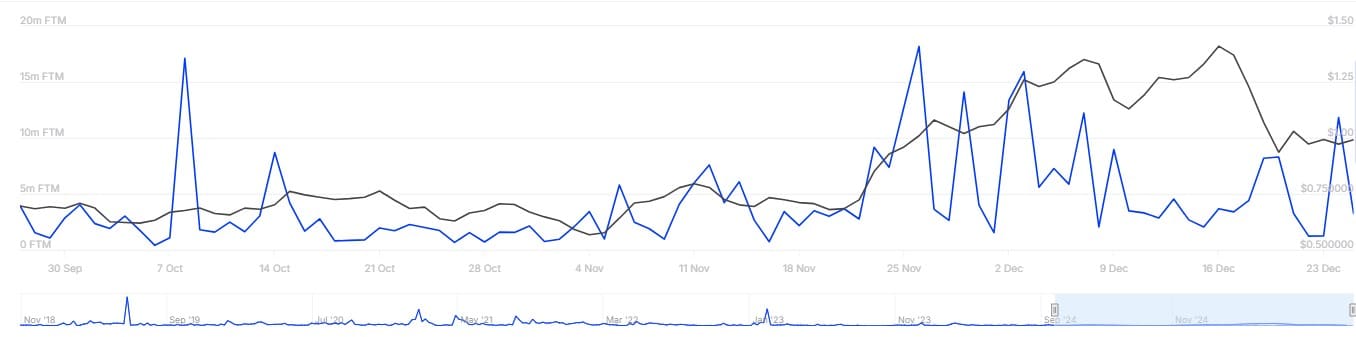

Change outflows mirror shifting sentiment

Within the last 24 hours, Fantom has seen a pointy decline in trade outflows. This metric, which tracks the motion of tokens from exchanges to personal wallets, normally displays the confidence degree of buyers.

A decline like this means that fewer merchants are shifting their holdings off exchanges, indicating hesitation over the token‘s near-term prospects.

This discount of outflows corresponded to the prevailing consolidation and revealed that the market has been indecisive. Investors might really be ready for clearer indicators earlier than making their subsequent transfer.

Supply: IntoTheBlock

$0.88 emerges as a decisive worth degree for Fantom

The ascending triangle help and the liquidation pool at $0.88 create an attention-grabbing interaction, establishing this worth degree essential for Fantom’s subsequent transfer.

A profitable maintain above this degree would arguably validate Fantom’s triangle sample and arrange the stage for a bullish breakout. This may get better investor confidence and reverse the downtrend in trade outflows.

Nevertheless, if the $0.88 help fails to face the bear’s stress, the next liquidation stress may push the value down additional.This might consequently disrupt the altcoin’s technical construction.

On this case, broader market sentiment and exterior elements will seemingly play a job in figuring out whether or not Fantom can maintain its place or not.

Supply: TradingView

With FTM’s worth consolidating close to its key degree, there’s a lot at stake in each short-term buying and selling and long-term funding.

The $0.88 degree is setting as much as be a key battle line between FTM’s bears and bulls. The path of the break will spell both renewed bullish momentum or additional declines on the charts.