NFT sales hit second-highest level of 2024 in December, data shows

Ending the 12 months on a excessive be aware, December’s gross sales of non-fungible tokens climbed to $877 million, making it the second-best month in 2024.

Blockchain-based digital collectibles had a robust December, with $877 million in gross sales, making it the second-best month of 2024. This increase wrapped up a wild 12 months for the NFT market, which noticed a pointy restoration within the final quarter.

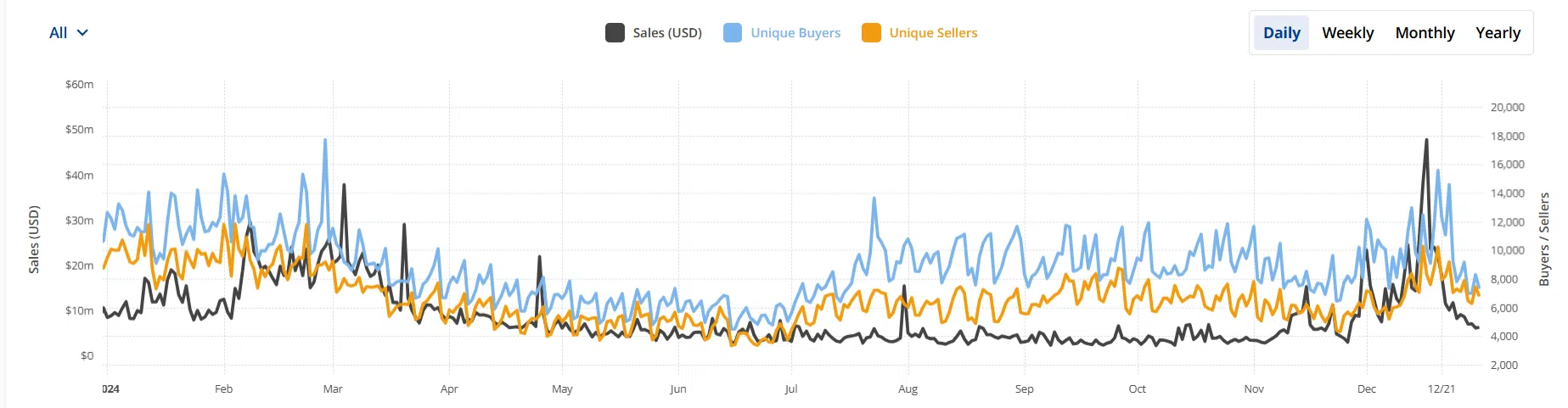

CryptoSlam knowledge exhibits that NFT gross sales for 2024 completed at $8.83 billion, surpassing 2023 by over $100 million. Whereas the 1.1% progress won’t appear large, it highlights the market’s capability to bounce again after months of falling gross sales.

NFT gross sales in 2024 | Supply: CryptoSlam

December stood out, due to Ethereum-based collections like Pudgy Penguins, Azuki, and Bored Ape Yacht Membership, knowledge exhibits. Ethereum NFTs led the month, bringing in $488.4 million of the entire gross sales, in accordance with NFT Value Flooring knowledge. Pudgy Penguins took the lead, with over $285 million in buying and selling quantity, whereas different collections like Lil Pudgys and Azuki collectively added one other $222 million.

In a commentary to crypto.information, Nicolás Lallement, co-founder of NFT Value Flooring, famous that the NFT market had a “sturdy Q1 2024 for each Ordinals (Bitcoin) and Solana NFT collections,” including additional {that a} “repricing of Ethereum-based collections was lengthy overdue.”

“As a set off for that repricing we now have the present ‘token connected to NFTs’ meta. Tasks like Pudgy Penguins, Doodles, and Azuki have both launched or introduced plans for meme/L2 gov tokens, which have pushed vital curiosity and repricing in blue-chip NFTs.”

Nicolás Lallement

Lallement factors out that the repricing “isn’t solely pushed by airdrops” as many NFT holders “have shifted earnings from speculative memecoin trades into long-term conviction performs, favoring high quality collections.” He says the pattern has been “notably noticeable on Ethereum, given the truth that it’s house to essentially the most consolidated set of blue chip collections.”

“Waiting for 2025, I anticipate a trickle-down impact that may profit your complete NFT ecosystem. It would doubtless begin with collections tied to airdrops, then lengthen to Ethereum-based blue-chip PFP collections, generative artwork (resembling Artwork Blocks), and finally embrace Solana and Bitcoin.”

Nicolás Lallement

The NFT market actually bounced again in This autumn. After a troublesome Q3, with solely $1.12 billion in gross sales, it shot up by 96%, reaching $2.2 billion in This autumn. November’s $562 million in gross sales helped set issues up for December’s near-billion-dollar displaying.

You may additionally like: Way of life app STEPN GO expands Adidas partnership with bodily NFT sneakers

Trade consultants credit score the rally to growing confidence within the crypto market. As an example, DappRadar researchers famous that the rise in token costs most likely fueled optimism, drawing new consumers into the area. DappRadar’s blockchain analyst Sara Gherghelas believes that the divergence “might be attributed to renewed buying and selling exercise in high-value collections, resembling these from Yuga Labs, coupled with rising token costs.”

“Improved liquidity and elevated engagement with blue-chip collections are fostering confidence amongst collectors and buyers, who at the moment are viewing NFTs not solely as speculative property but additionally as cultural commodities,” Sara Gherghelas wrote in a report.

Nonetheless removed from its peak

Regardless of the year-end rally, 2024’s complete NFT gross sales stay far beneath the market’s peak years. In 2021, NFTs generated $15.7 billion in gross sales, practically double this 12 months’s figures. The next 12 months was much more spectacular, with $23.7 billion in gross sales.

Lallement believes that that NFTs maintain a “distinctive place” as each high-risk speculative property and standing symbols. He defined that, traditionally, throughout the later phases of a bull market, individuals who’ve seen their wealth develop are likely to shift their focus from speculative investments to standing property like digital artwork and collectibles.

“This habits stems from a need to flex wealth and acquire peer recognition inside their communities. For NFTs to return to their 2021–2022 highs, we’ll doubtless want BTC to achieve a big value stage (e.g., $150K) and ETH set up a brand new all-time excessive (a number of multiples over earlier one, perhaps circa $10k).”

Nicolás Lallement

As soon as these milestones are met, Lallement anticipates a “rotation of capital from fungible tokens to pick NFTs.” He believes that as market individuals begin reallocating their positive aspects into high-value collections, it may drive one other wave of inflated valuations. “Sturdy token efficiency can rejuvenate investor confidence, create a wealth impact, and reignite the speculative and cultural enchantment of NFTs as each investments and standing artifacts,” he concluded, including that this dynamic will doubtless proceed, reinforcing the NFT market’s boom-and-bust nature alongside broader crypto tendencies.

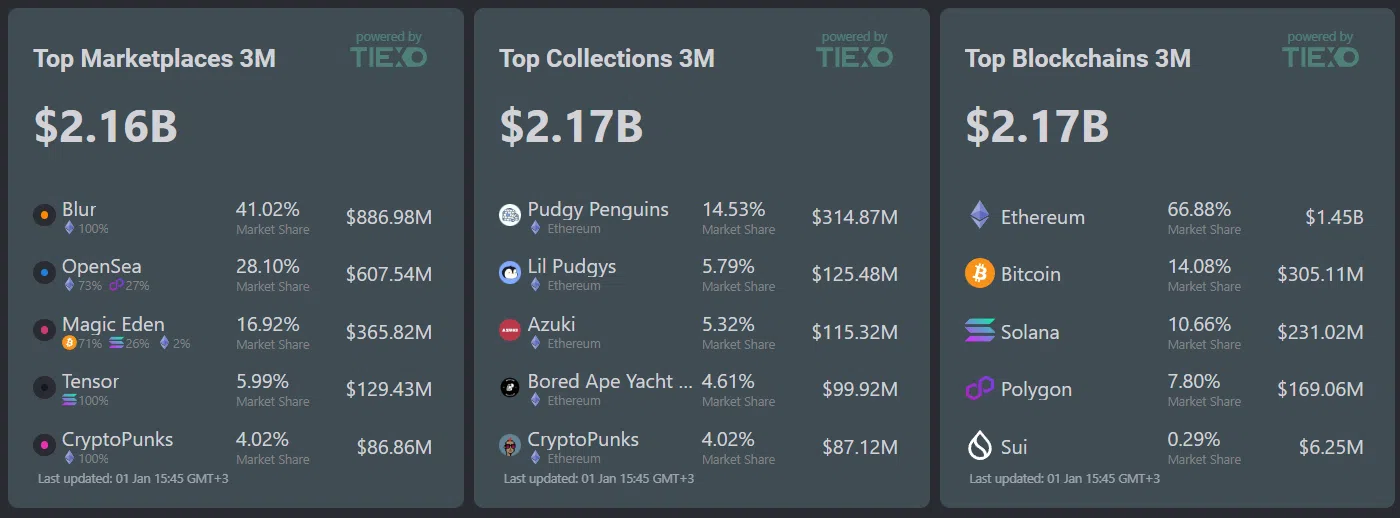

NFT exercise in This autumn 2024 | Supply: Tiexo

Blur and OpenSea have been the highest marketplaces in This autumn, making up nearly 70% of all NFT gross sales, in accordance with knowledge from NFT analytics platform Tiexo. Blur turned out to be the chief with over $885 million in gross sales for the quarter, whereas OpenSea adopted with $607 million. Magic Eden, which focuses on Solana NFTs, recorded $365 million in gross sales.

The range in market exercise exhibits that the NFT ecosystem continues to be maturing. Consequently, nobody platform or blockchain totally dominating. Although Ethereum continues to be the chief in all-time NFT gross sales, Solana and Bitcoin are progressively gaining the share.

The December rally leaves us questioning what’s subsequent for NFTs. Will the momentum proceed into 2025, or will it die down? We’ll doubtless discover out quickly, as analysts predict Bitcoin’s rally will peak in mid-2025, which may impression the NFT market too.

Learn extra: NFT gross sales surge 33% to $302m: Pudgy Penguins #4611 goes for nearly $494k