NFT weekly sales drop 9% to $145m, Bitcoin leads despite downturn

Over the past seven days, the non-fungible token (NFT) market noticed gross sales attain $145 million, reflecting a decline of over 9% from the earlier week.

This downturn continues a pattern of falling gross sales over current weeks, with 4 out of the highest 5 blockchains by gross sales quantity seeing decreases throughout this era.

Final week, as reported by crypto.information, gross sales of digital collectibles dropped by greater than 11%, and this week, they fell by one other 9.68%, totaling $145.01 million, per information from CryptoSlam.

Bitcoin main the pack

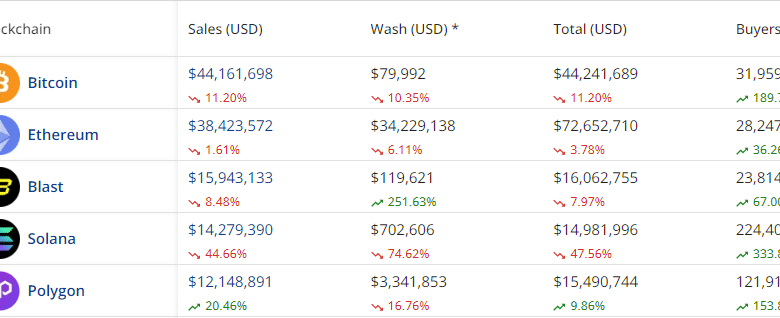

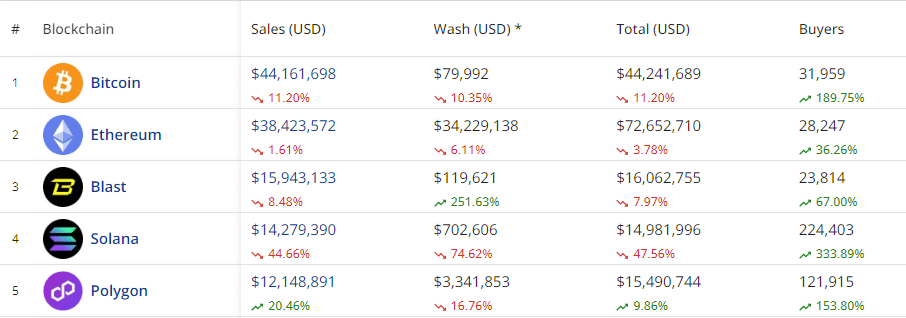

As seen in earlier weeks, Bitcoin (BTC) continued to steer the weekly NFT gross sales, constantly staying forward of main rivals Ethereum (ETH) and Solana (SOL).

Within the final week, the Bitcoin community had the most important NFT gross sales quantity amongst blockchains, managing to rake in about $44.1 million, based on CryptoSlam.

Nevertheless, regardless of the spectacular figures, it nonetheless marked an 11% drop from the earlier week.

High 5 blockchains by NFT gross sales quantity | Supply: CryptoSlam

Ethereum adopted with $38.4 million in gross sales, which was down by 1.59%. Apparently, the blockchain additionally recorded about $34.2 million in wash buying and selling, a observe the place consumers and sellers in a transaction are both the identical individual or people conspiring to create an impression of excessive demand for a specific NFT.

If each the precise and wash buying and selling numbers on Ethereum had been mixed, the community would have the very best NFT gross sales quantity for the week at over $72 million.

Coming in at #3 by way of NFT gross sales was Blast, a newcomer to the highest 5, which recorded $15.943 million, marking an 8.48% decline.

In fourth place was Solana, which reported $14.26 million in gross sales during the last seven days. The determine marked a steep 44.73% drop from the earlier week, a proportion loss solely overwhelmed by Arbitrum (ARB), Tezos (XTZ), and Fantom (FTM), whose gross sales volumes declined by 51.71%, 62.09%, and 69.21%, respectively.

Sitting at #5, Polygon (MATIC) bucked the damaging pattern with $12.14 million in gross sales, which was a 20.37% improve from the earlier week.

You may also like: LayerZero readies sybil ‘bounty searching’ effort, spots 800k addresses in airdrop scheme

Uncategorized Ordinals information highest weekly gross sales quantity

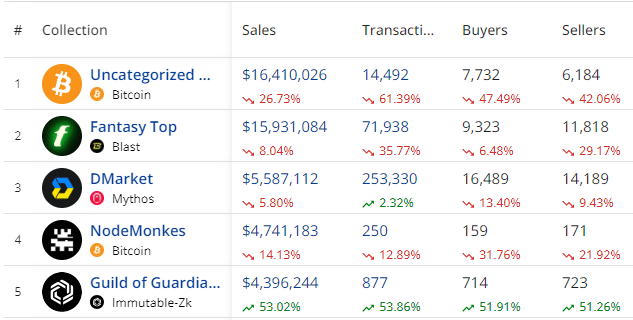

Amongst NFT collections, Uncategorized Ordinals continued to steer in gross sales quantity, with $16.4 million in gross sales, regardless of a 26.73% weekly lower. Blast’s Fantasy High took second place with $15.93 million.

Mythos’ Dmarket got here in third with $5.58 million, adopted by Bitcoin’s Nodemonkes with $4.74 million. Immutable-Zk’s Guild of Guardians overtook Core’s BRC20s to take fifth place with practically $4.4 million in gross sales.

High 5 NFT collections by gross sales quantity | Supply: CryptoSlam

CryptoPunk NFT fetches $792,000

The week’s costliest NFT sale was Cryptopunk #741, which fetched a hefty $792,046. Apparently, an Ordinal inscription was the second-highest at $681,497.

Different notable gross sales included Earthnode #184 from Cardano, which fetched $56,026, a PepperMints NFT from Solana, which fetched $40,384, and a Blast Chain NFT that offered for just below $40,000.

Total, there was a big uptick in consumers and sellers. In line with CryptoSlam, the variety of NFT consumers final week spiked by greater than 166%, whereas that of NFT sellers elevated by 139%. Nonetheless, the 1,583,262 NFT transactions represented a 27.58 dip from the earlier week.

In the meantime, Italian clothier Dolce & Gabbana and digital belongings platform UNXD face a class-action lawsuit after alleged delays in delivering NFT merchandise, based on Bloomberg.

The corporate’s digital belongings plummeted 97% in worth.

Learn extra: Scaramucci: Bitcoin institutional investing ‘occurring now’