NFTs Are Crashing (Again). Here’s Why.

The NFT area isn’t what it was once. This has grow to be painfully apparent to these inside Web3 over the previous few months. From controversial memecoin escapades to overwhelming regulatory initiatives, the magic of the metaverse has been palpably waning all through 2023.

Because it stands, the present state of the non-fungible ecosystem is a far cry from the market highs that helped kick off the yr. But, this spherical of “NFTs are crashing” feels completely different than instances previous. With this bout, the causation behind NFTs slowing down feels extra nuanced. Relatively than concern, uncertainty, and doubt (FUD) main the market down, there might be one thing extra at play.

NFTs by the numbers

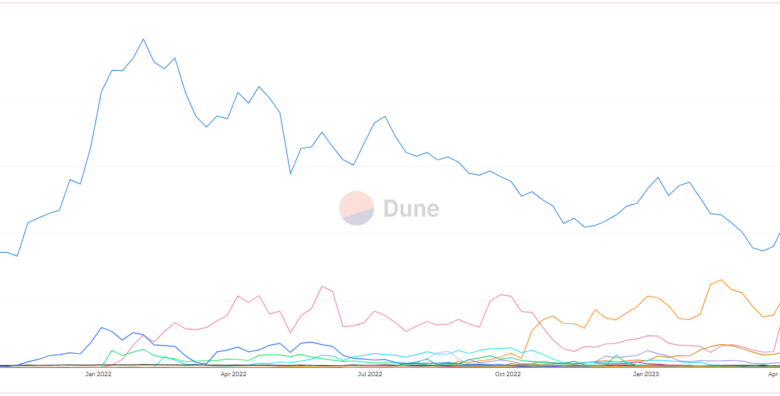

Though neighborhood sentiment is tough to measure quantitatively, market well being can normally be gauged by the charts. These regarded good originally of the yr, with NFT gross sales up 43 p.c. This was a welcome change from the bear market that enveloped the vast majority of 2022.

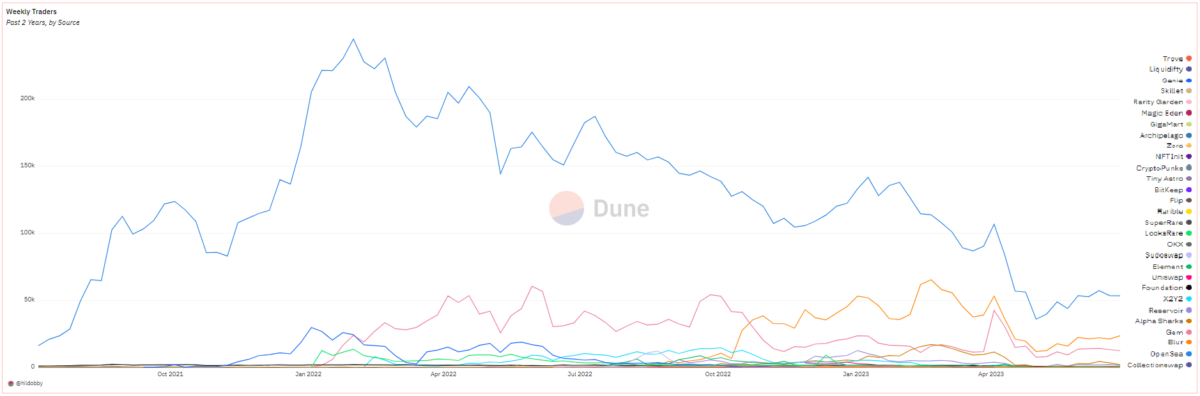

But, in current months it’s grow to be clear that the success we witnessed in Q1 has not continued. So far in 2023, the vast majority of NFT sales volume has been generated on Blur (extra on that later). And whereas quantity was up in a giant manner in the course of the winter, after peaking in February, each quantity and trades dropped and dwindled all through the spring.

It initially didn’t appear all dangerous, although, as a result of, in the beginning of the sunny season (June), the NFT market witnessed a slight uptick in exercise. However upon additional inspection, it turned clear that this uptick may not essentially be indicative of a optimistic development however somewhat a wide range of points at the moment unfolding throughout a spread of outstanding blue-check initiatives.

Bored Apes and Azuki

Most notably, the Bored Ape Yacht Membership and Azuki — which have every respectively grow to be the focus sooner or later in 2023 — have been feeling the warmth. Though, over the previous few months, the majority of NFT sales volume has come from these two initiatives, this newest spherical of buying and selling appears oddly decoupled from the remainder of the NFT ecosystem.

That’s as a result of as an alternative of demand fueling buying and selling and leading to flooring costs rising, as we’ve seen time and time once more with the launch of secondary collections, present buying and selling appears to be the results of flooring costs dropping and merchants subsequently seeking to money in on a great deal.

Whereas this isn’t unusual in Web3, particularly as Blur continues to dominate the market, it’s odd for such an occasion to occur to BAYC. As a silo inside the NFT area, BAYC (and CryptoPunks, for that matter) has anecdotally existed in a world of its personal, unwavering within the face of hypothesis and regulation. However just lately, this has modified.

Within the case of BAYC, flooring costs have been steadily dropping. On the time of writing, the gathering flooring sat around 30 ETH (about $57,000). Notably, that is the bottom we’ve seen Apes fall since 2021. An identical narrative is taking part in out with Azuki, with the model’s core collection having hit a flooring of slightly below 7 ETH ($13,000).

Though there are a selection of causes this value motion could also be taking place, many holders and lovers have pointed to dilutions and fragmentation as the foundation trigger. Extra particularly, BAYC holders have felt disenfranchised by Otherside and HV-MTL, successfully splitting the Yuga NFT ecosystem. Equally, Azuki lovers had been thrown right into a tizzy in mild of the model’s current controversial enlargement, Azuki Elementals.

After all, there are nonetheless issues to be made relating to the impact that BAYC and Azuki are having available on the market. For one, holders from blue chip collections akin to these have really remained somewhat steadfast. But, whereas HODLers be HODLing, value is (and traditionally has been) decided by incremental patrons and sellers. Lengthy story brief, if there are not any new patrons, there’s usually a gradual bleed downwards.

Moreover, whereas Bored Apes and Azuki NFTs waning undoubtedly impacts the NFT ecosystem at massive, they aren’t the only catalysts for NFTs taking place. Azuki Elementals did serve to take away someplace round $38 million from the ecosystem, which suggests even whales are seemingly being conservative with their purchases at the moment.

The Blur impact

One other possible candidate partially chargeable for this newest crash isn’t collectors however somewhat the platforms and marketplaces they function inside. When as soon as OpenSea was the dominant power within the larger NFT market, Blur has unequivocally taken over as the foremost breadwinner of the non-fungible ecosystem. After all, the trail to Blur’s prominence wasn’t devoid of controversy, and even now, the larger NFT neighborhood speculates about how the platform’s infrastructure would possibly push NFT assortment costs down.

Essentially the most main level of rivalry regarding Blur comes from its native token, $BLUR. By means of a number of airdrops, the token sought to reward platform loyalty and person engagement — a system we’ve seen used many instances over with governance and neighborhood tokens ($RARI, $LOOKS).

Nevertheless, the $BLUR token rewards (paired with a royalty-free market) is a serious draw for high-profile collectors. Whereas Blur’s aforementioned monopoly on NFT gross sales quantity is undoubtedly spectacular, it’s just lately come to mild {that a} handful of prominent traders is likely to be utilizing the platform’s incentivization system to wield an affect over NFT costs.

Now, Web3 observers are questioning if {the marketplace}’s successes didn’t come with no doubtlessly bigger price to the broader NFT ecosystem. In response, some have even taken the stance that Blur’s reputation as a chance for token farming might need the facility to tank the NFT market altogether.

A holistic view of the blockchain

Particular instances like BAYC, Azuki, and Blur apart, although, there’s extra to be stated concerning the NFT macroclimate as a contributing issue to the present downward development we’re seeing inside the NFT market itself. And certainly prime of thoughts for many inside the blockchain trade is that ETH is pumping, and the federal government is watching.

At this present stage of maturation in Web3, the unpredictable value motion of crypto paired with mounting regulation of the crypto and NFT area have added a palpable layer of uncertainty to the way forward for the blockchain trade. These components, above many others, are certainly influencing purchaser habits and contributing to market fluctuations.

Particularly, within the case of ETH, important value motion usually poses a risk to the value of NFTs. As ETH rises, many merchants choose to take income or, on the very least, reconfigure their portfolios to make use of ETH as a secure haven for market volatility. In different instances, collectors would possibly try to dump some NFTs at flooring costs or hunt down main sale alternatives (like a sub-30 ETH Ape), additional influencing the market.

If we had been to take a look at an much more macro view of Web3, although, it appears seemingly that advents like Soulbound Tokens, NFT Ticketing, and “phygital” items struggling to really cross over to the mainstream may also be having an impact. General, there’s been a lower in main manufacturers getting into the NFT area, and the acronym itself has gone down in utilization in popular culture in comparison with the place it was on the top of the preliminary increase.

After all, it actually is anybody’s guess the place the NFT area shall be even a yr from now. However with market components in thoughts, creators, collectors, and builders alike would do nicely to be conscious of the altering NFT panorama and keep in mind why the creators of tradition started flocking to the blockchain within the first place.