Now that Bitcoin’s halving is behind us, when does the real rally start?

Whale accumulation suggests extra upside forward

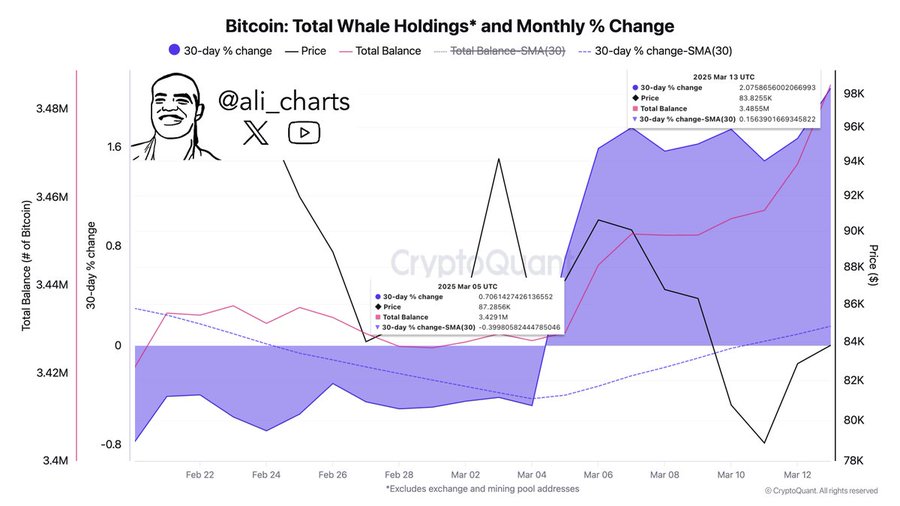

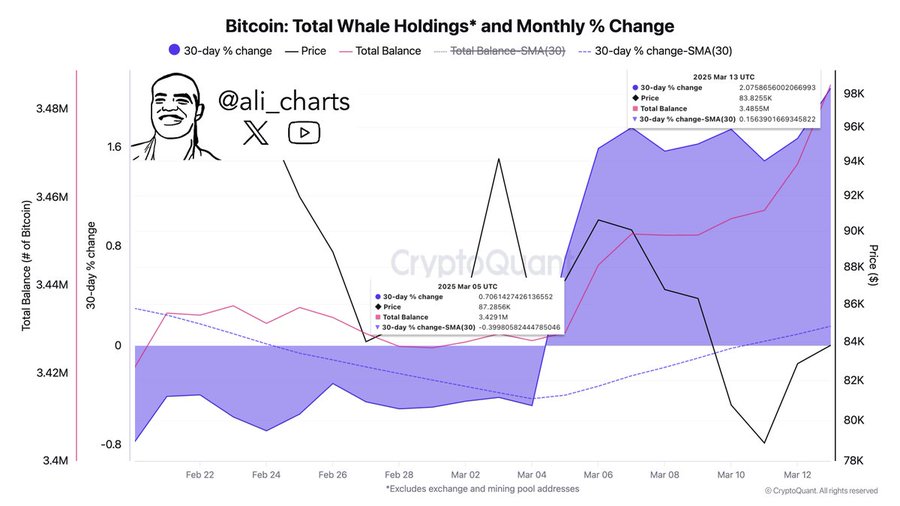

Supporting the case for a continued bull run is the conduct of Bitcoin’s largest holders.

Over the previous week alone, whales have accumulated greater than 60,000 BTC, a robust vote of confidence that aligns with historic post-halving traits.

Newest information reveals a pointy uptick in whole whale holdings — now above 3.45 million BTC — in addition to a notable constructive swing within the 30-day proportion change.

Supply: X

This surge in accumulation sometimes alerts a bullish outlook from long-term buyers, who are inclined to front-run main worth strikes.

When paired with the post-halving historic window that factors to mid-late 2025 for a cycle prime, this renewed whale exercise provides gas to the thesis that Bitcoin’s present rally nonetheless has room to run.

Quick-term consolidation, however momentum might return

Regardless of bullish longer-term alerts, Bitcoin’s short-term outlook remained blended. The each day chart confirmed BTC hovering across the $84,000 stage following a pullback from latest highs.

The RSI was at 44.20, suggesting weak momentum and leaving room for additional draw back earlier than the asset turns into oversold. In the meantime, OBV has been trending downward, reflecting declining shopping for strain.

Supply: TradingView

Nonetheless, worth motion seems to be stabilizing after a stretch of sharp losses, hinting at potential consolidation earlier than the following transfer.

If bulls handle to defend the $83,000-$84,000 help zone, BTC may try a push towards $88,000 within the close to time period. Nonetheless, failure to carry present ranges may open the door for a retest of $80,000.