BNB Price Topside Bias Vulnerable If It Continues To Struggle Below $225

BNB worth (Binance coin) didn’t settle above $225 and trimmed positive factors in opposition to the US Greenback. The worth may decline closely if it trades under $210.

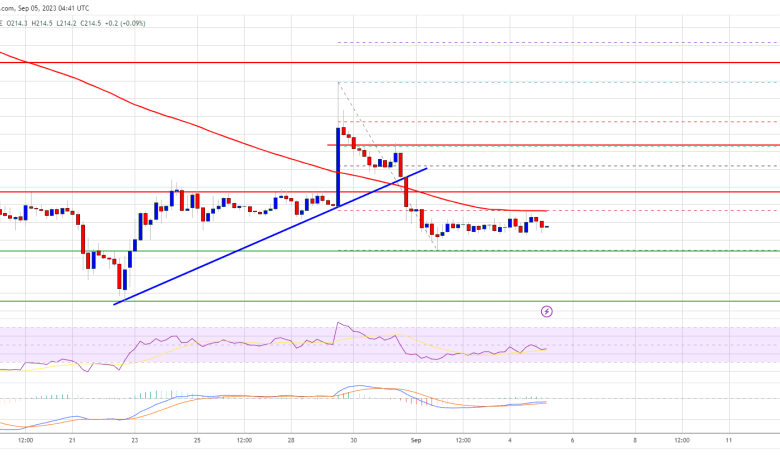

- Binance coin worth examined the $235 resistance earlier than the bears appeared in opposition to the US Greenback.

- The worth is now buying and selling under $220 and the 100 easy shifting common (4 hours).

- There was a break under a key bullish pattern line with assist close to $220 on the 4-hour chart of the BNB/USD pair (information supply from Binance).

- The pair would possibly achieve proceed to maneuver down except there’s a shut above $225.

Binance Coin Worth Fails Once more

Within the final evaluation, we mentioned the possibilities of BNB worth recovering towards the $235 resistance zone. The worth did climb increased towards the $235 resistance however failed to increase positive factors.

It began a contemporary decline from the $235 zone. There was a break under a key bullish pattern line with assist close to $220 on the 4-hour chart of the BNB/USD pair. The pair is now displaying bearish indicators under $220 and the 100 easy shifting common (4 hours), like Bitcoin and Ethereum.

A low is fashioned close to $211.1 and the worth is now consolidating losses. On the upside, it’s going through resistance close to the $216.5 stage and the 100 easy shifting common (4 hours). It’s near the 23.6% Fib retracement stage of the current decline from the $235 swing excessive to the $211 low.

Supply: BNBUSD on TradingView.com

A transparent transfer above the $217 zone may ship the worth additional increased. The following main resistance is close to $225 or the 61.8% Fib retracement stage of the current decline from the $235 swing excessive to the $211 low, above which the worth would possibly rise towards $235. An in depth above the $235 resistance would possibly set the tempo for a bigger enhance towards the $250 resistance.

One other Decline in BNB?

If BNB fails to clear the $217 resistance, it may begin one other decline. Preliminary assist on the draw back is close to the $211 stage.

The following main assist is close to the $210 stage. If there’s a draw back break under the $210 assist, the worth may drop towards the $202 assist. Any extra losses may ship the worth towards the $184 assist.

Technical Indicators

4-Hours MACD – The MACD for BNB/USD is dropping tempo within the bearish zone.

4-Hours RSI (Relative Energy Index) – The RSI for BNB/USD is at present under the 50 stage.

Main Help Ranges – $211, $210, and $202.

Main Resistance Ranges – $217, $225, and $235.