Odds of Bitcoin, Ethereum starting October on a positive note are…

- BTC and ETH noticed a surge in lengthy liquidation quantity with the value drop within the final buying and selling session.

- The property have began the brand new month with optimistic strikes.

Bitcoin [BTC] and Ethereum [ETH] ended September on a risky observe, with each property experiencing declines. Quick-position merchants dominated the market, driving lengthy liquidation volumes larger.

Regardless of these drops, the absence of a big sell-off signifies a optimistic signal for the market.

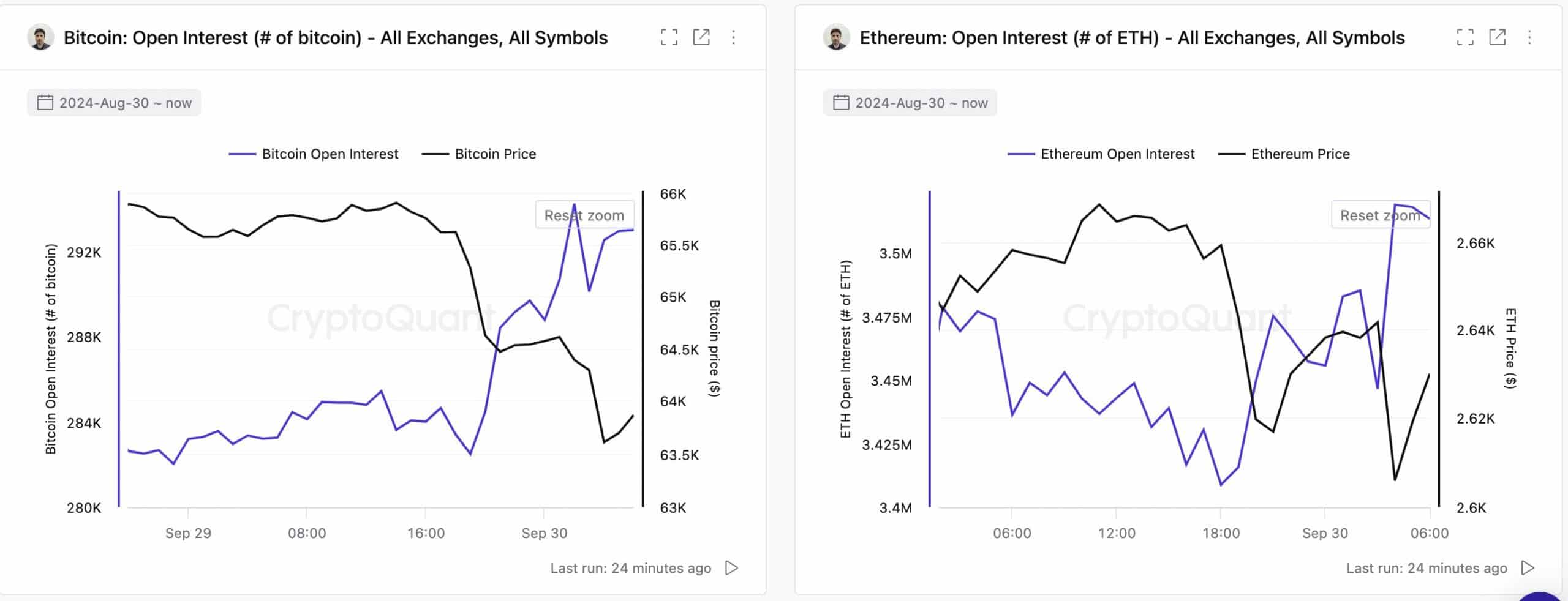

Bitcoin and Ethereum open curiosity declines

In line with CryptoQuant, Bitcoin and Ethereum’s open curiosity (OI) noticed notable declines over the past buying and selling session. Bitcoin’s open curiosity dropped from $18.6 billion to $18.1 billion, indicating that merchants had been closing futures positions.

This lower in OI typically indicators decrease liquidity, volatility, and curiosity in derivatives buying and selling, which might probably result in a protracted/quick squeeze.

Supply: CryptoQuant

Equally, Ethereum’s open curiosity additionally noticed a slight decline, although much less important than Bitcoin’s. As of now, BTC’s open curiosity has bounced again to $18.3 billion, and ETH’s OI has risen to $9.4 billion, reflecting renewed market exercise.

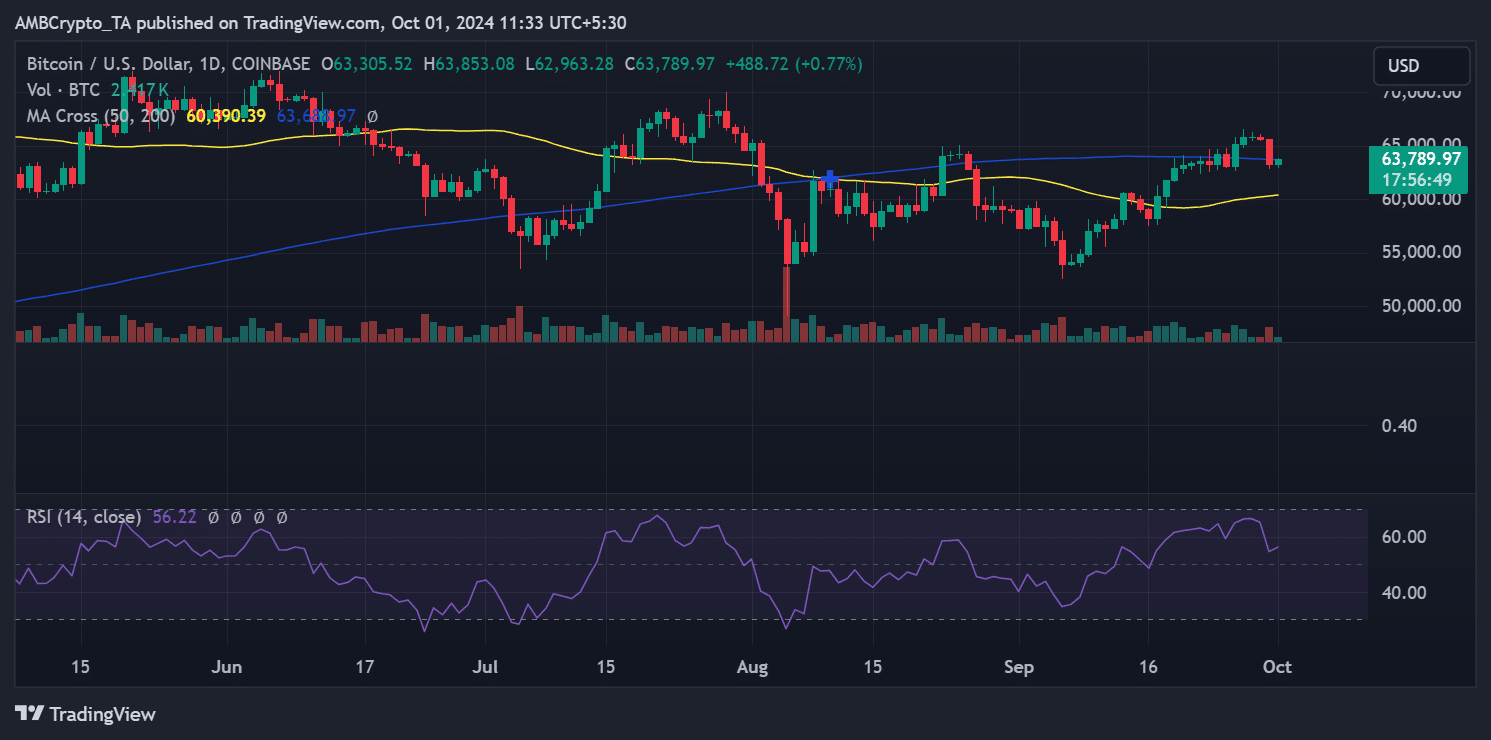

Bitcoin and Ethereum costs observe OI developments

The drop in open curiosity had a direct influence on each Bitcoin and Ethereum costs. Bitcoin skilled a 3.50% decline, falling from $65,600 to $63,301, dipping under its 200-day transferring common.

Supply: TradingView

Equally, Ethereum dropped by 2.13%, from $2,657 to $2,601, staying under its 200-day transferring common however nonetheless above the 50-day transferring common.

Supply: TradingView

As of this writing, each property have proven a slight rebound. Bitcoin was buying and selling at $63,789 with a 0.7% improve, whereas Ethereum gained over 1%, buying and selling round $2,639.

Alternate flows stay steady

Regardless of the current declines, there hasn’t been a big sell-off. Knowledge from CryptoQuant reveals that Bitcoin recorded a detrimental exchange flow, indicating a balanced movement of BTC between exchanges and private wallets.

However, Ethereum noticed a slight improve in exchange inflows, with 14,000 ETH flowing into exchanges over the past buying and selling session.

Nevertheless, this quantity wasn’t sufficient to set off a serious sell-off. Presently, the movement has turned detrimental once more, with over 23,000 ETH being withdrawn from exchanges, signaling lowered promoting strain.

Learn Ethereum (ETH) Value Prediction 2024-25

Conclusion

Whereas Bitcoin and Ethereum confronted notable declines within the closing days of September, the dearth of a serious sell-off and the slight worth rebound counsel a comparatively steady market.

Open curiosity developments and change flows point out that traders will not be dashing to exit their positions, displaying potential for restoration within the close to time period.