Ominous Indicator Suggests US Economy Heading Toward Severe Recession: Bloomberg Analyst

Bloomberg analyst Mike McGlone says there are hints {that a} extreme contraction of the American financial system is approaching.

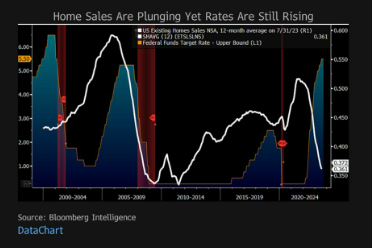

The commodities skilled says on the social media platform X that knowledge is exhibiting a dramatic plunge in house gross sales amid rising rates of interest, a state of affairs much like the 2008 monetary disaster.

McGlone’s chart reveals that the identical divergence between house gross sales and rates of interest beforehand led to an enormous crash within the housing markets earlier than an eventual recession and an rate of interest minimize.

“The Housing Trough Might Be Deeper Than 2011 – Plunging US present house gross sales vs. nonetheless rising rates of interest could also be a transparent signal of what’s modified towards a trajectory for a extreme recession. My graphic reveals the 12-month common of house gross sales falling at a velocity final matched in the course of the Nice Monetary Disaster.”

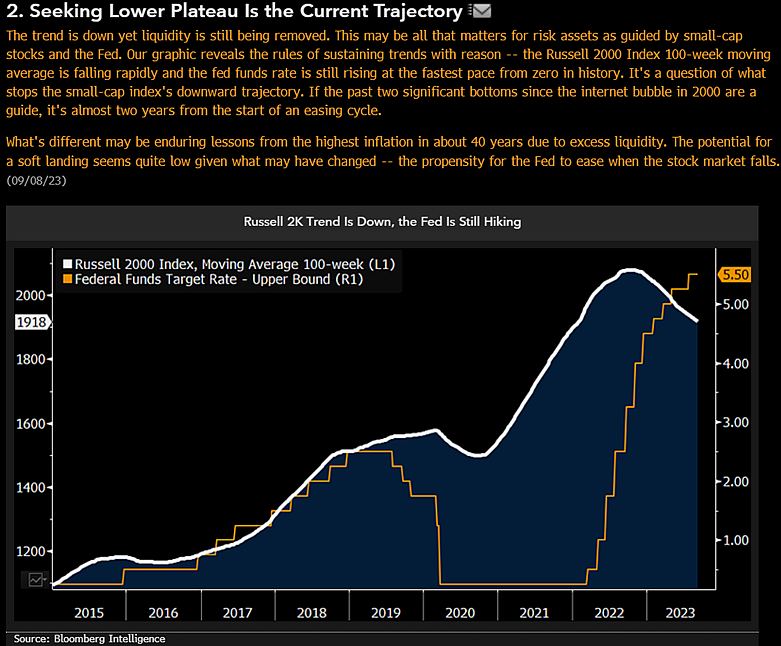

The analyst additionally appears to be like on the Russell 2000, an index of the smallest 2,000 shares within the Russell 3000 Index, which can be utilized to gauge threat urge for food given the risky nature of smaller market cap securities.

McGlone says that the general development is down, whereas liquidity is being diminished, and that primarily based on historical past, markets are nonetheless roughly two years away from an easing cycle that may assist help costs.

“Looking for Decrease Plateau Is the Present Trajectory –

The development is down but liquidity remains to be being eliminated. This can be all that issues for threat belongings as guided by small-cap shares and the Fed.”

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Featured Picture: Shutterstock/Tuso949/Natalia Siiatovskaia