OpenSea Makes Big Moves in Final Sprint to $SEA

Morning Minute is a each day e-newsletter written by Tyler Warner. The evaluation and opinions expressed are his personal and don’t essentially mirror these of Decrypt. Subscribe to the Morning Minute on Substack.

GM!

At present’s high information:

- Crypto majors inexperienced, SOL leads once more; BTC at $112,700

- Tom Lee 30x’s Moonshot wager on OCTO (WLD +75%)

- HYPE hits a brand new ATH at $55 amidst ongoing stablecoin proposals

- MegaETH introduces its mUSD stablecoin, partnering with Ethena

- OpenSea drops new cellular app, Flagship NFT Fund & new rewards program

🌊 OpenSea’s Subsequent Act: Cell, Flagship, and the Last Dash to $SEA

OpenSea is clearly making an attempt to be greater than “simply an NFT market.”

And yesterday’s reveal pushed it towards an on-chain buying and selling superapp with AI on the core, a seven-figure cultural fund, and a gamified closing rewards push forward of the $SEA token occasion.

📌 What Occurred

OpenSea made a sequence of product bulletins yesterday shaping the near-term way forward for the protocol.

The bulletins included:

- A reimagined OpenSea Cell app with AI-native buying and selling

- A brand new Flagship NFT Assortment (a seven-figure treasury for historic and rising NFTs beginning with CryptoPunk #5273)

- Particulars across the closing pre-TGE rewards section by which 50% of platform charges funnel to consumer rewards

The group additionally shared that $SEA particulars are coming in early October.

Maybe most related for customers is the final level – the brand new rewards program.

https://t.co/GhTfWnN7Nt

— Adam Hollander (@HollanderAdam) September 8, 2025

The ultimate pre-TGE rewards begins Sept 15 and can leverage 50% of all platform charges (1% for NFTs, 0.85% for tokens) to energy a “prize vault,” seeded with $1M of OP and ARB.

Customers get a Starter Treasure Chest within the Rewards Portal and may stage up by buying and selling throughout 22 chains, finishing each day Voyages, and accumulating Shipments.

And don’t fear for those who haven’t purchased an NFT in a very long time. Historic customers will obtain their very own SEA allocation from the OpenSea Basis at TGE primarily based on historic quantity and different elements.

🗣️ What They’re Saying

“I have been constructing OpenSea since 2017. I can safely say it is my life’s work, and it comes with the conviction to take huge swings.

With OS2, we determined to rebuild our tech, product, and working tradition from the bottom up. We intentionally “slowed down to hurry up”.

Now we get to speed up. We’re getting into essentially the most thrilling interval in our historical past as an organization, as we evolve OpenSea into the very best place to commerce the whole lot onchain.” – Devin Finzer, OpenSea CEO on X

In This fall, the $SEA TGE could possibly be the largest liquidity occasion in NFT historical past.

OpenSea’s V2 comeback has rebuilt huge goodwill locally – there’s no method they fumble this

— seedphrase (@seedphrase) September 9, 2025

🧠 Why It Issues

That is arguably essentially the most bullish announcement from OpenSea in its existence.

AI-native cellular is the best alternative – the OpenSea cellular app has been lagging for a very long time and due for an improve. An excellent cellular app is desk stakes to put the inspiration for future buying and selling.

The Flagship fund is equally strategic: it reveals that they “get” NFTs and care about them, and can seemingly garner some optimistic sentiment from varied NFT communities of which they purchase.

And routing half of charges is a giant transfer to drive incentivized buying and selling (i.e. farming) and increase these volumes forward of TGE. Some have complained in regards to the doubling of the payment (from 0.5% to 1%), however the actuality is, it’s a toll most shall be prepared to pay for the rewards.

As for impression, count on a pickup in on-platform volumes, a bid for marquee collections (Punks and different Flagship-adjacent units), and renewed airdrop farming as customers stage chests throughout 22 chains.

The $SEA narrative now has a calendar – customers will place into the Sept 15 rewards launch after which maintain for early-October TGE particulars.

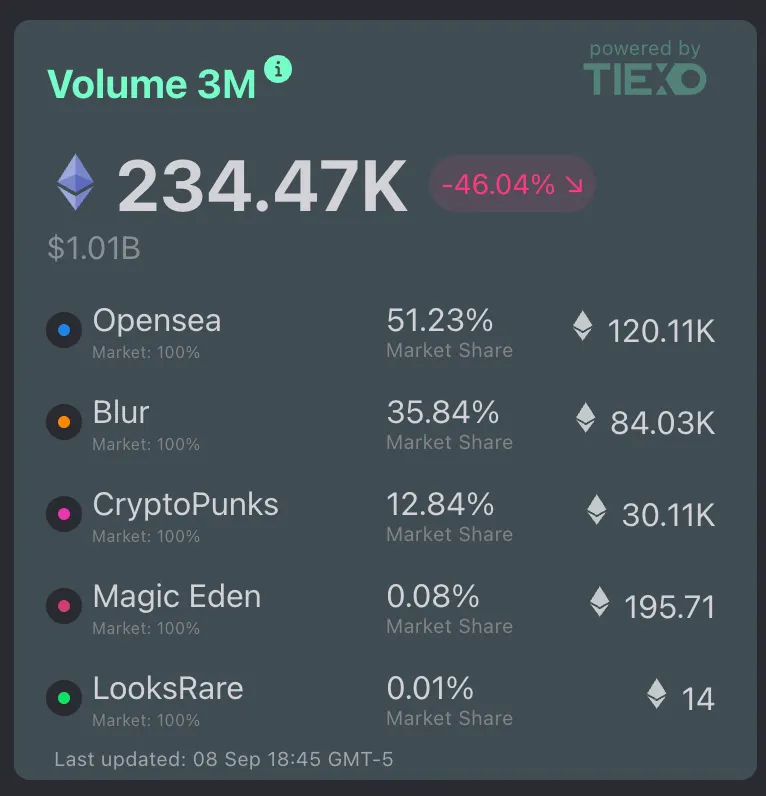

OpenSea has a powerful lead in NFT quantity over the previous few months in line with Tiexo

What I’m watching subsequent:

- The cellular beta waitlist timing and the way rapidly “OpenSea Intelligence” turns into genuinely helpful (alerts, portfolio context, cross-chain routing).

- The cadence and rationale behind Flagship acquisitions, plus committee disclosures and neighborhood reception.

- Rewards portal UX on Sept 15, fee-to-rewards transparency, and the way successfully this system attracts token merchants (not simply NFT collectors).

- The Basis’s $SEA specifics in early October: emissions, utility, governance, and long-term sink/supply design.

However for now, OpenSea has put itself in an excellent place.

Let the dash to SEA start…

🌎 Macro Crypto and Memes

A number of Crypto and Web3 headlines that caught my eye:

- Crypto majors are barely inexperienced with SOL main; BTC +0.5% at $112,700, ETH +0.5% at $4,340, XRP +2% at $3, SOL +2% at $217

- MYX (+185%), WLD (+74%), NEAR (+10%) and MNT (+10%) led high movers

- HYPE hit a smashing new ATH at $55 amidst its ongoing stablecoin public sale

- Odds of a 50 bps minimize in September jumped to 19% on Polymarket, practically doubling on the day

- The BTC ETFs noticed their largest inflows in a month on Monday with $364M in web inflows

- The Nasdaq filed proposals with the SEC to allow tokenized inventory buying and selling and settlement choices

- A senior adviser to Vladimir Putin claimed the U.S. is utilizing crypto and gold to inflate away its debt at international expense

- Tom Lee mentioned Bitcoin may “simply” attain $200K in 2025, citing coverage easing and liquidity

- Cantor Fitzgerald launched a Bitcoin fund that pairs BTC upside with a gold-based insurance coverage hedge

- Safety researchers (and Ledger’s CTO) warned of a giant supply-chain exploit that would have an effect on apps and wallets and suggested customers to pause dangerous transactions (although lower than $100 in exploits have been discovered)

- CoinShares introduced plans to go public within the U.S. through a $1.2B SPAC cope with Vine Hill

- Congress launched a invoice requiring the Treasury to element the way it will custody federally owned Bitcoin, together with cash within the Strategic Bitcoin Reserve

In Company Treasuries

- HashKey launched a $500M Digital Asset Treasury fund to channel conventional capital into on-chain treasuries targeted on BTC and ETH.

- Eightco’s (OCTO) inventory spiked 3,000% after the corporate mentioned it might maintain Worldcoin (WLD) as a major treasury asset and put money into BitMine

- Lion Group introduced a reallocation of its company treasury from SOL & SUI to HYPE

In Memes

- Memecoin leaders are very inexperienced on the day; DOGE +3%, Shiba +3%, PEPE +6%, PENGU +7%, BONK +7%, TRUMP +3%, SPX +8%, and FARTCOIN +7%

- Launchcoin soared 50% to $125M as a $7M brief received liquidated (now again to $90M); PEPECOIN was a high onchain mover, leaping 39x to $3.5M

- SPX is getting listed on Coinbase right now

💰 Token, Airdrop & Protocol Tracker

This is a rundown of main token, protocol and airdrop information from the day:

- Kalshi reported over $440M in sports activities betting quantity throughout NFL week one

- OpenSea unveiled “Flagship,” an NFT treasury that can allocate over $1M to culturally vital NFTs forward of an anticipated SEA token, together with a brand new AI-based cellular app and new rewards

- MegaETH launched its native stablecoin MegaUSD (USDm) in partnership with Ethena

- Pump Enjoyable launched ‘MEXC Mondays’ as a brand new MEXC weekly initiative to record one coin per week, beginning with TBC (TBC +60%)

🤖 AI x Crypto

Part devoted to headlines within the AI sector of crypto:

- General market cap up 5% at $13.7B, leaders have been very inexperienced

- FARTCOIN (+7%), VIRTUAL (+10%), TIBBIR (+5%), aixbt (+11%) & ai16z (+21%)

- ai16z (+21%) and GOAT (+19%) led high movers

- The SEC met with a number of corporations on Monday to debate the convergence of crypto and AI

🚚 What is occurring in NFTs?

Right here is the record of different notable headlines from the day in NFTs:

- ETH NFT leaders have been combined; Punks -0.5% at 48.3 ETH, Pudgy +2% at 10.5, BAYC +3% at 9.25 ETH

- Summary NFTs have been combined, led by RUYUI (+45%)

- Christie’s introduced that they’ve closed their Digital Artwork division, with a number of staffers let go