Analyzing the factors behind Bitcoin’s recent rally

- The smaller-than-expected U.S. Treasury provide estimate for Q1 2024 and Fed’s dovish coverage aided the rise.

- Market contributors had been bullish on Bitcoin on the time of writing.

The crypto market was buzzing with pleasure as Bitcoin [BTC] broke via the $35,000 degree after greater than 17 months. Most market observers and analysts attributed the rip to the optimism over spot ETF approvals.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

Macro components boosted Bitcoin?

Nevertheless, opposite to the favored notion, well-known crypto asset buying and selling agency QCP Capital linked the current rally to macroeconomic components.

The Singapore-based firm said that the lower-than-expected U.S. Treasury provide estimate for Q1 2024 despatched the bond markets decrease whereas favoring dangerous asset lessons.

Certainly, the yield on the 10-year U.S. authorities bond dropped over the week. Usually, larger yields on risk-free authorities debt harms demand for speculative belongings like shares and cryptos.

Furthermore, the current resolution by the U.S. Federal Reserve to not increase the rates of interest utilized important upward strain on shares and cryptos, QCP Capital stated. Traditionally, crypto market has been identified to react positively to such dovish financial insurance policies.

Nevertheless, QCP Capital cautioned that the broader sentiment was upbeat, and that it is likely to be too early to rejoice.

“Whether or not this marks the beginning of a brand new international fairness and bond uptrend stays to be seen, because the macro image primarily stays unchanged, exterior a correction of overly bearish bond sentiment.”

Bitcoin beats different belongings in risk-adjusted returns

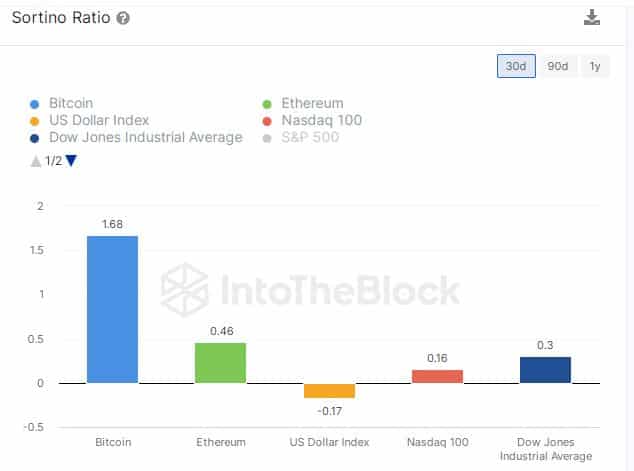

Whatever the causes for the surge, Bitcoin was establishing itself as one of the vital interesting funding automobiles. AMB Crypto scrutinized the Sortino Ratios of a various vary of asset lessons from IntoTheBlock.

It was found that Bitcoin had the best worth at 1.68, outperforming different fairness and greenback indices.

For the uninitiated, the Sortino ratio compares the efficiency of the asset relative to its draw back threat. A better ratio meant that traders had been extra prone to park their cash with the king coin.

Supply: IntoTheBlock

Learn BTC’s Value Prediction 2023-24

Extra features on the way in which?

On the time of writing, BTC was exchanging fingers at $34,262, with spectacular features of 24% over the past month, in response to CoinMarketCap.

The market sentiment was tilted in the direction of greed as per the newest studying from the Bitcoin Concern and Greed Index. This implied that the merchants had been in a temper to purchase extra and the market was trending upwards.

Bitcoin Concern and Greed Index is 65 — Greed

Present worth: $34,235 pic.twitter.com/XdAAmEA6tg— Bitcoin Concern and Greed Index (@BitcoinFear) November 3, 2023