Options Put/Call Ratio suggests cautious optimism among traders

Bitcoin choices are an important a part of the broader cryptocurrency market, because the dynamics inside these derivatives contracts can present worthwhile insights into market traits and potential future actions.

Bitcoin choices are monetary contracts that give traders the fitting however not the duty to purchase or promote Bitcoin at a predetermined worth inside a specified timeframe.

They function important hedging and speculative instruments, permitting market contributors to handle threat and make knowledgeable funding choices. Modifications within the derivatives market can instantly influence Bitcoin’s spot worth, reflecting broader market sentiment and investor conduct.

Places and calls are the 2 main forms of choices contracts. A put possibility offers the holder the fitting to promote an asset at a selected worth, whereas a name possibility grants the fitting to purchase.

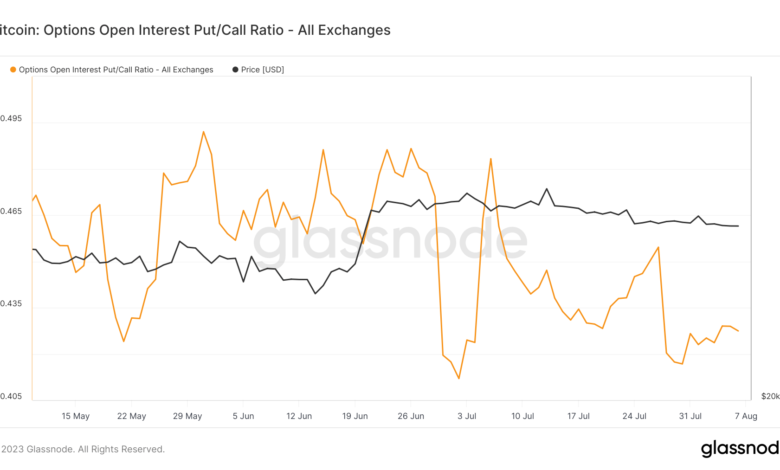

Monitoring the ratio of places to calls is significant as it could sign market sentiment. A excessive put/name ratio could point out bearish sentiment, whereas a low ratio could recommend bullish sentiment.

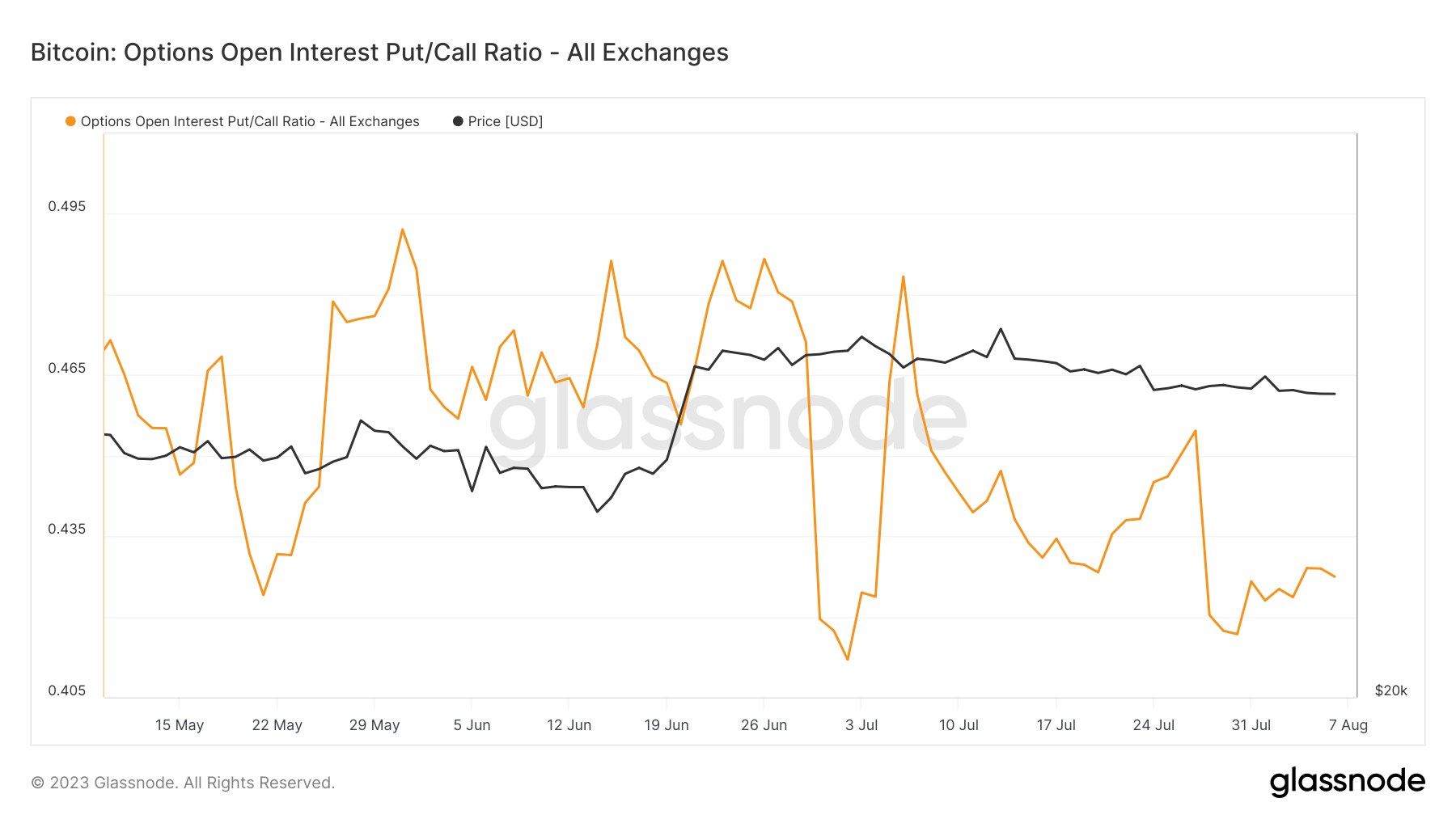

The Bitcoin Choices Open Curiosity Put/Name Ratio is a metric that measures the full variety of open put choices to name choices out there. This ratio dropped sharply on July 27, reaching this 12 months’s lows.

The decline on this ratio could sign a shift in market sentiment, presumably indicating elevated confidence in Bitcoin’s worth rise.

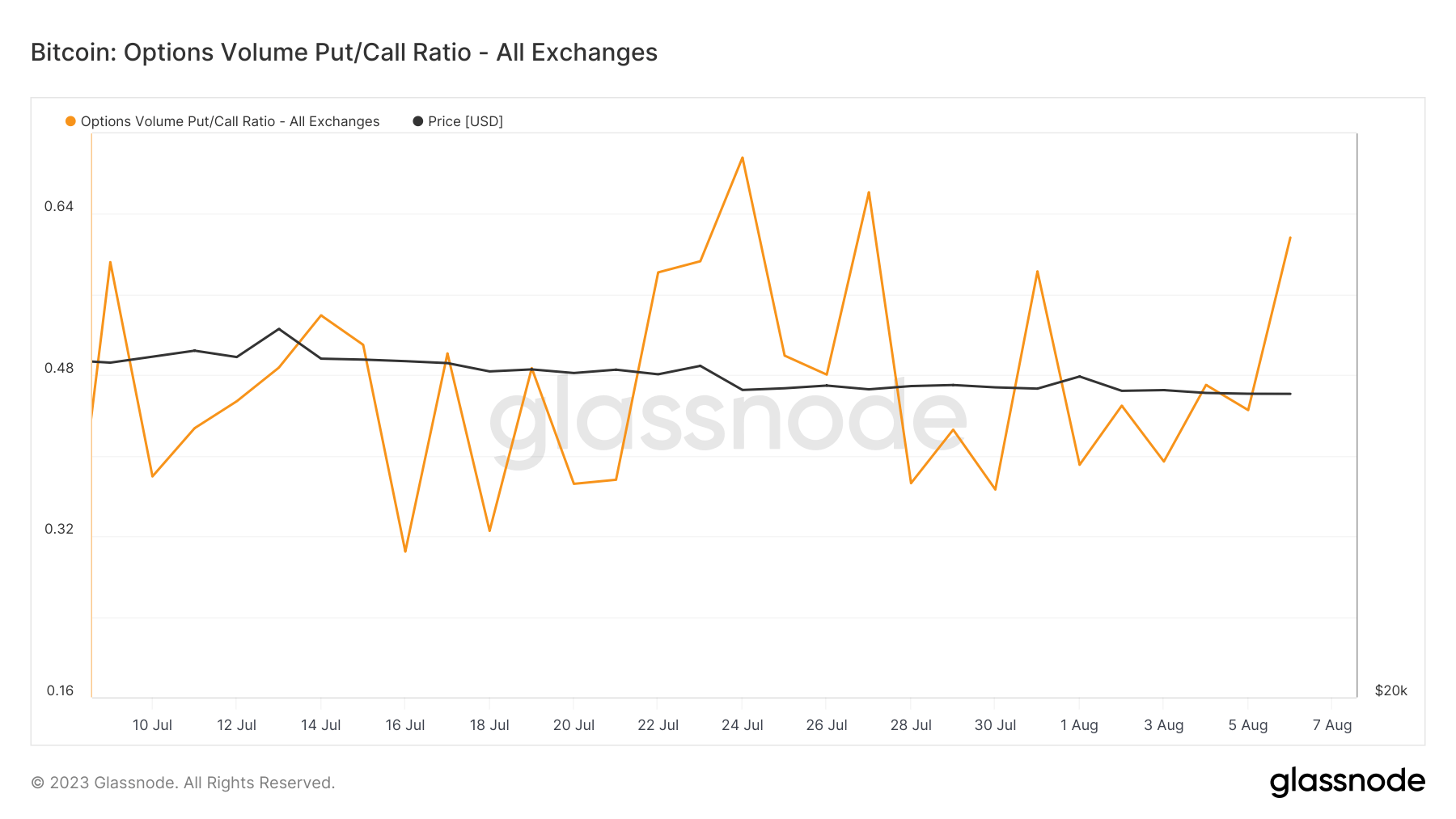

One other important metric is the Bitcoin Choices Quantity Put/Name Ratio, which measures the buying and selling quantity of put choices to name choices. Not like the open put/name ratio, the amount ratio skilled an analogous drop on July 27 however has since recovered, experiencing a 64% improve.

This restoration would possibly point out a extra balanced market sentiment, reflecting each optimism and warning amongst merchants.

The steep decline within the open put/name ratio and the restoration within the quantity ratio would possibly point out a posh market state of affairs.

Whereas the drop within the open ratio could sign bullish sentiment, the following restoration within the quantity ratio means that merchants are additionally hedging towards potential draw back dangers.

When analyzed collectively, these two ratios present a nuanced view of the market, reflecting optimism and warning.

The submit Choices Put/Name Ratio suggests cautious optimism amongst merchants appeared first on CryptoSlate.