Cardano (ADA) Price Analysis Report – 4 July 2023

Introduction

This report offers a complete evaluation of Cardano (ADA) for 4 July 2023. The info contains real-time worth, quantity, bid/ask, day’s vary, technical indicators, and transferring averages.

Worth and Quantity Overview

As of 5:29:14 p.m. UTC on 4 July 2023, Cardano is buying and selling at $0.2929, down by $0.0013 (-0.44%) from its earlier shut. The buying and selling quantity over the past 24 hours was 96,613,084 ADA. The bid worth is $0.2928, and the ask worth is $0.2929. The day’s vary is between $0.2922 and $0.3016.

Technical Indicators

Technical indicators are used to foretell future worth actions and market traits.

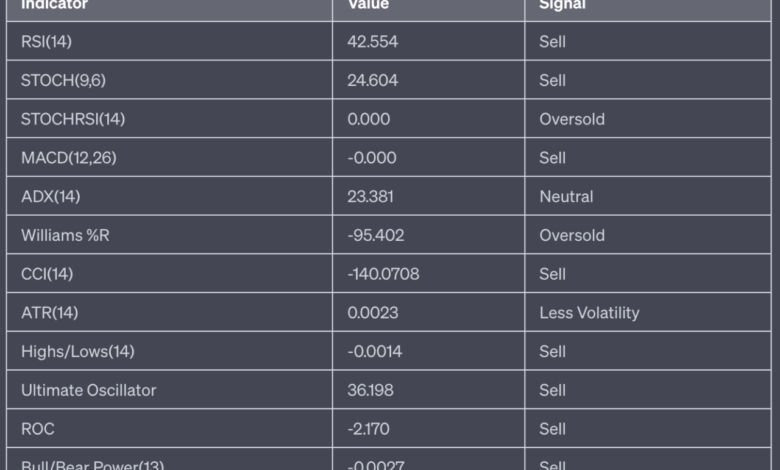

Right here’s an in depth breakdown of the technical indicators for Cardano (ADA):

- RSI(14): The 14-day Relative Power Index is 42.554, indicating a promote place. The RSI measures the velocity and alter of worth actions on a scale of 0 to 100. Historically, the asset is taken into account overbought when the RSI is above 70 and oversold when it’s beneath 30. On this case, ADA is nearer to the oversold vary, suggesting a bearish market situation.

- STOCH(9,6): The Stochastic Oscillator is 24.604, indicating a promote situation. This momentum indicator compares a selected closing worth of the asset to a spread of its costs over a sure time frame. The present worth means that ADA is nearer to its lows than its highs, which is often seen as a bearish sign.

- STOCHRSI(14): The Stochastic RSI is 0.000, indicating an oversold situation. It is a technical momentum indicator that compares the extent of the RSI to its high-low vary over a set time interval. An oversold situation may point out a shopping for alternative as the worth would possibly enhance quickly.

- MACD(12,26): The Shifting Common Convergence Divergence is -0.000, indicating a promote place. The MACD is a trend-following momentum indicator that exhibits the connection between two transferring averages of a safety’s worth. The MACD line crossing beneath the sign line is usually a bearish sign, and when it crosses above, it may be a bullish sign. On this case, the MACD line is beneath the sign line, indicating a bearish sign.

- ADX(14): The Common Directional Index is 23.381, indicating a impartial place. The ADX is used to measure the energy or weak spot of a pattern, not the precise route. Values above 25 could point out a robust pattern.

- Williams %R: The Williams %R is -95.402, indicating an oversold situation. This momentum indicator measures overbought and oversold ranges. Readings above -20 are thought-about overbought, and readings beneath -80 are thought-about oversold. The present studying means that ADA is in an oversold situation.

- CCI(14): The Commodity Channel Index is -140.0708, indicating a promote place. The CCI is a momentum-based oscillator used to assist decide when an funding car is reaching a situation of being overbought or oversold. A CCI above 100 could point out an overbought situation, whereas a CCI beneath -100 could point out an oversold situation.

- ATR(14): The Common True Vary is 0.0023, indicating much less volatility. The ATR is a technical evaluation indicator that

- measures market volatility by decomposing the whole vary of an asset worth for that interval. Decrease values usually characterize much less volatility and smaller worth actions.

- Highs/Lows(14): The worth is -0.0014, indicating a promote place. This indicator is used to establish the best and lowest costs for the asset over a selected interval.

- Final Oscillator: The worth is 36.198, indicating a promote place. It is a technical indicator that’s used to measure momentum throughout a number of timeframes. A worth beneath 30 typically signifies an oversold situation, whereas a worth above 70 signifies an overbought situation.

- ROC: The Price of Change is -2.170, indicating a promote place. The ROC is a momentum oscillator, which measures the proportion change between the present worth and the n-period previous worth. A detrimental ROC signifies a bearish sign, suggesting that the worth is reducing.

- Bull/Bear Energy(13): The worth is -0.0027, indicating a promote place. These indicators measure the steadiness of energy between bulls (patrons) and bears (sellers). A detrimental worth signifies that bears are in management.

In abstract, the overwhelming majority of the technical indicators recommend a “SELL” motion for Cardano (ADA). The oversold situations indicated by the Stochastic RSI and Williams %R may recommend a possible worth correction within the close to future. Nonetheless, the general bearish alerts from different indicators reminiscent of RSI, STOCH, MACD, CCI, ROC, and Bull/Bear Energy recommend that the market sentiment for ADA is at the moment bearish.

Shifting Averages

Shifting averages are a sort of knowledge smoothing approach that analysts use in technical evaluation to establish traits in a set of knowledge, reminiscent of inventory costs. They assist to scale back the noise and fluctuation in worth knowledge to current a smoother line, making it simpler to see the general route or pattern.

Right here’s an in depth breakdown of the transferring averages for Cardano (ADA):

- MA5: The 5-day transferring common is 0.2938 (easy) and 0.2939 (exponential), each indicating a promote place. This implies that the worth is beneath the common of the previous 5 days, which is a bearish sign.

- MA10: The ten-day transferring common is 0.2946 (easy) and 0.2946 (exponential), each indicating a promote place. This implies that the worth is beneath the common of the previous 10 days, which is a bearish sign.

- MA20: The 20-day transferring common is 0.2957 (easy) and 0.2950 (exponential), each indicating a promote place. This implies that the worth is beneath the common of the previous 20 days, which is a bearish sign.

- MA50: The 50-day transferring common is 0.2942 (easy) and 0.2939 (exponential), each indicating a promote place. This implies that the worth is beneath the common of the previous 50 days, which is a bearish sign.

- MA100: The 100-day transferring common is 0.2910 (easy) and 0.2910 (exponential), each indicating a purchase place. This implies that the worth is above the common of the previous 100 days, which is a bullish sign.

- MA200: The 200-day transferring common is 0.2851 (easy) and 0.2875 (exponential), each indicating a purchase place. This implies that the worth is above the common of the previous 200 days, which is a bullish sign.

In abstract, the transferring averages recommend a “SELL” sign for Cardano (ADA), with eight promote alerts and 4 purchase alerts. The short-term pattern, indicated by the 5-day, 10-day, 20-day, and 50-day transferring averages, is bearish. Nonetheless, the medium and long-term traits, indicated by the 100-day and 200-day transferring averages, are bullish. This implies a possible for worth restoration in the long run regardless of the short-term downward pattern.

Conclusion

General, the market sentiment for Cardano (ADA) as of 4 July 2023 leans in the direction of warning. The info suggests a stronger inclination in the direction of promoting quite than shopping for. Nonetheless, there are indications of potential long-term restoration. As at all times, these insights must be used as a part of a broader technique that features different market data and private analysis.